How would the large-scale deployment of off-grid solar technologies affect the future of Africa’s power generation mix? This is a critical question for African governments and investors considering how and where to prioritize energy infrastructure — and what impacts those decisions will have on poverty alleviation, economic growth, and climate.

The US Energy Information Agency’s “Off-Grid Electricity Development in Africa” report lays out two potential pathways to achieve universal electricity access in Sub-Saharan Africa1 by 2030:

- Relying solely on central grid systems results in a doubling of coal generation and a tripling of natural gas generation by 2050. Solar PV generation rises by 12x, but still accounts for only 6% of the total, just a fraction of coal’s 38% share.

- By contrast, relying solely on off-grid solar increases solar generation by 40x, but also expands coal and natural gas by 50% and 150%, respectively. Solar PV accounts for only 20% of the generation mix, still behind both coal and hydro.

On the face of it, these scenarios for 2050 suggest that while solar will rise steeply in both cases, it will max out at one-fifth of the mix while coal will remain dominant. This would be alarming — but a deeper dive into this specific EIA’s methodology model suggests why such an outcome in the real world is highly unlikely:

- South Africa’s size and coal reliance heavily distort the regional aggregate. Any analysis of Sub-Saharan energy really should disaggregate South Africa because it’s such an anomaly. That one market accounts for 55% of the region’s total generation (255 out of 462 TWH in 2017) but only about 5% of the population. South Africa also hosts 94% of the entire region’s 48 GW of coal-fired capacity, which gives it an outsize impact in a region-wide analysis.

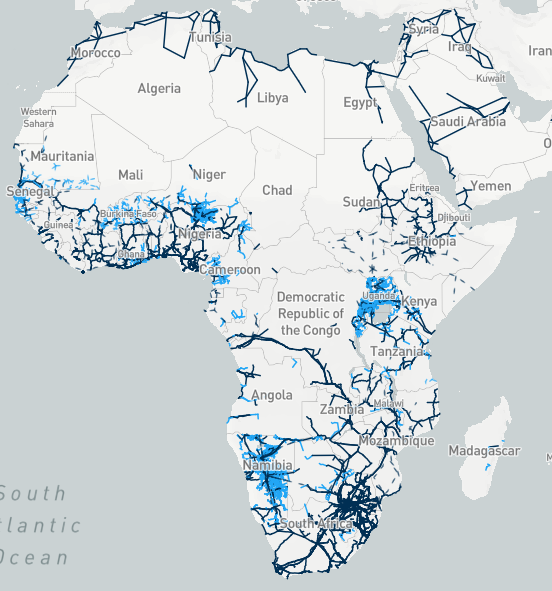

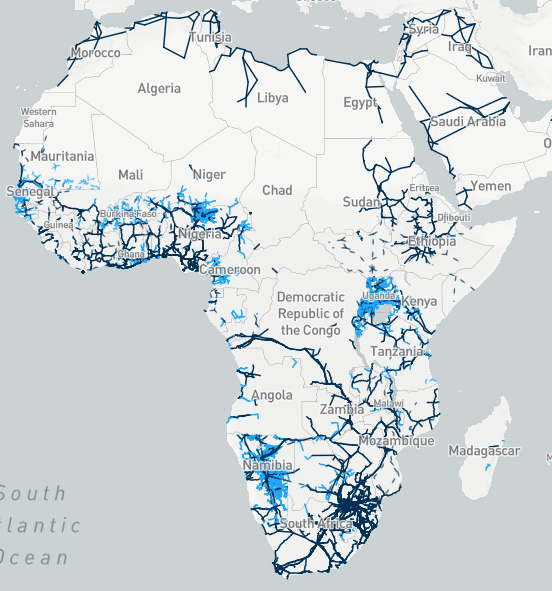

Treating Sub-Saharan Africa as one integrated region skews the scenarios in favor of coal. The model treats the region as if it were one integrated market which allows large-scale cheap energy resources (like coal in South Africa) to meet demand anywhere else. But in reality, regional power pools still conduct only limited (mostly bilateral) trading, and the cross-border transmission infrastructure and regulations to enable a single market pool are highly unlikely in 2050. Coal may function as the least-cost energy option in this model, but isn’t a viable option for many countries that can’t import either electricity or coal from Southern Africa.

Treating Sub-Saharan Africa as one integrated region skews the scenarios in favor of coal. The model treats the region as if it were one integrated market which allows large-scale cheap energy resources (like coal in South Africa) to meet demand anywhere else. But in reality, regional power pools still conduct only limited (mostly bilateral) trading, and the cross-border transmission infrastructure and regulations to enable a single market pool are highly unlikely in 2050. Coal may function as the least-cost energy option in this model, but isn’t a viable option for many countries that can’t import either electricity or coal from Southern Africa.- Demand growth and urbanization are excluded from the model. It’s important to remember that this model only considers new demand associated with achieving universal access at basic service levels. The demand growth underlying these scenarios would be a major achievement – but still not nearly enough to drive expanded economic activity or raise large numbers of people out of poverty. Nor, crucially, does this model account for rapid urbanization, which will have huge impacts on where and in what quantities energy is consumed, or the increased demand expected to stem from electrification itself.

A closer look suggests the future energy mix for the continent will depend on market prices, technology trends, resource endowments of each country, and infrastructure decisions. That’s why we draw a few very different conclusions:

- Coal doesn’t have much of a future: In contrast to the EIA’s projected sizable increases in coal generation, we don’t expect much (if any) new coal capacity to come online. A project-by-project analysis suggests that of all proposed coal plants in Africa, just one small (100 MW) plant is likely to be built, with nine further projects (combined capacity 3,410 MW) possible but unlikely. Even within South Africa’s existing fleet, a combination of circumstances (flat demand, a bankrupt Eskom, and the burden of multiple low-performing mega-projects) suggests that coal’s future is grim. This all points to either flat coal generation or, more likely, steady declines.

- Growing demand and urbanization, not just last-mile access, will drive energy policy decisions: Unlike Europe — where demand is flat and policy aims to replace coal or gas with lower-carbon options — the principal challenge in Africa is building new infrastructure to meet expanding demand. While reaching universal access is one critical objective, most governments are also focused on ensuring they have the energy needed for industrialization and to meet long-term growing consumer demand as incomes rise. Our country-by-country projection with Third Way suggests that Africa’s total electricity demand will grow by more than 300% by 2050.

- Each country will determine its own energy future: As African countries strive to meet new demand and balance political, economic, and climate goals, their respective generation mixes will (and should) vary widely. The critical factors of cost and reliability will drive decisions, alongside other considerations. Scenarios that consider the generation mix continent-wide are only so helpful in understanding this diversity of endowments and objectives.

- Africa’s solar potential is massive, but penetration will ultimately depend on supportive technology and a range of unknowns. As prices for solar PV continue to decline, variable renewable generation is expected to increase dramatically worldwide. How much solar contributes to the mix three decades from now will likely be driven, not by PV costs alone, but rather storage costs, transmission infrastructure, and innovations in technology and business models. This is especially hard to predict in emerging markets where cost of capital, political risk, and other factors will matter more than the prices for PV panels. Yet, solar is likely to win a far larger share of Africa’s energy mix than either of EIA’s access scenarios project.

The EIA’s decision this year (for the very first time) to disaggregate Africa into two regions and include consideration of off-grid technologies is a welcome improvement. This report provides a useful thought exercise of two extreme pathways to universal access. But, as the EIA itself acknowledges, it should not be taken as a prediction of what’s really to come across a diverse and fast-changing continent at the very early stages of accelerating up a steep energy curve.

Endnotes

- The EIA uses ‘Africa-South’ as shorthand for all of Sub-Saharan Africa minus a handful of Sahelian countries. See https://www.eia.gov/outlooks/ieo/pdf/IEO2020_IIF_Africa.pdf.

- Cover image taken from Africa Electricity Grids Explorer (World Bank Group, 2017).