Three waves of electrification in Africa

African countries stand no chance of lifting their people out of poverty and achieving a decent standard of living for all without affordable, reliable, and sustainable electricity. Post-independence efforts to provide electricity access across Africa have played out in three primary waves. The first wave (1960s – 1990s) focused on extending centralized national electricity grids, supported by public sector finance.1 By the mid-1990s, the average national electrification rate in Sub-Saharan Africa was still a mere 28%, requiring a change in approach.2 This led to a second wave (1990s – 2010s) focused on expanding public sector mini-grids to reach rural and remote areas. Several African countries formed Rural Electrification Agencies (REA) and Funds (REF) fashioned after the U.S. rural electrification model of the mid-1930s.3 Over the last decade (2010s – 2020s), a third wave prioritizing decentralized approaches has taken hold. Standalone solar PV systems and mini-private sector grids emerged as viable alternatives – not in competition to the centralized system (although this is starting to happen in some places), but as a cost-effective and often cost-competitive alternative in rural and remote areas.

Now, balancing the urgent need to attain universal access to electricity by 2030 with global efforts to minimize harmful impacts on the climate sets the stage for a fourth wave that must prioritize regional electricity markets in Africa. This wave should not only ensure universal access but sufficient electricity provision that drives economic growth and increases incomes in line with the Modern Energy Minimum.

The need to prioritize regional electricity markets

The benefits of integrating electricity markets go beyond increasing quality, lowering costs, and improving energy security. Crucially, it also provides flexibility to manage higher shares of variable sources of electricity, including wind and solar. Wide networks provide a broader set of options to strengthen contingencies in case of failures, facilitate innovative demand-side management (DSM) techniques, and manage climate-induced generation risks. Hydroelectric power currently accounts for more than 50% of the total installed capacity in at least 12 African countries, making them highly vulnerable to recurrent droughts.4 Those that depend on fossil fuels are exposed to geopolitical risks and price volatility. Interconnected systems provide a hedge against both supply-demand imbalances and supply-side threats.

Although there are efforts to develop functional regional electricity markets such as the Eastern Africa Power Pool (EAPP), Southern Africa Power Pool (SAPP), West African Power Pool (WAPP), Central Africa Power Pool (CAPP), and Comité Maghrébin de l’Electricité (COMELEC), most national electricity markets remain independent in practice.5 Countries carry out their electricity planning at a national level with little regional coordination, and where cross-border trading exists, it’s done on a limited, bilateral basis. Besides the African Union, which focuses on promoting African solidarity and regional integration, there has not been a continent-wide platform suitable for promoting inter-regional power trade. The African Union, with support from the European Union, has proposed the Africa Single Electricity Market (AfSEM).

AfCFTA presents a major opportunity

The Africa Continental Free Trade Area (AfCFTA) now presents an impetus to create a truly interconnected continental electricity market in Africa. AfCFTA aims to “create a single market for goods, services, facilitated by movement of persons in order to deepen the economic integration of the African continent…, among other objectives”.6 Already there are efforts to physically connect these markets including the following interconnectors: 1,010 km Ethiopia-Kenya, 463 km Kenya-Tanzania, 582 km DRC-Uganda, 400 km Mozambique-Zimbabwe, 500 km Angola-Namibia, 350 km Mali-Guinea among others.7 Continent-wide coordination through AfCFTA could strengthen these initiatives and prioritize the most viable actions that will transform power trading on the continent in line with AfSEM’s vision.

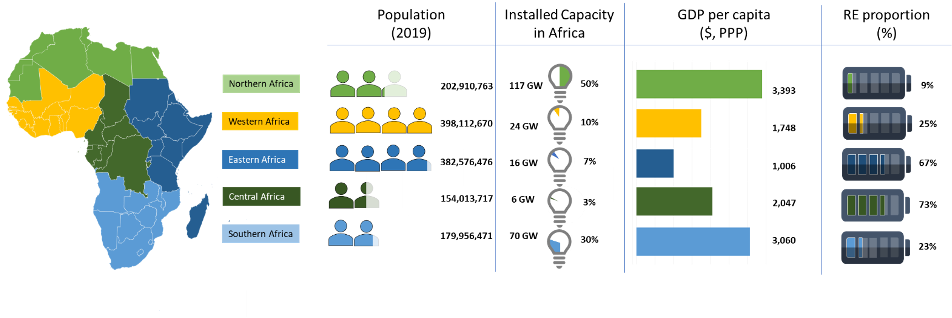

Africa has one of the world’s highest potentials for wind and solar. The IRENA-led Global Atlas for Renewable Energy estimates an economic potential of up to 3,834 GW for wind and 15,334 GW for solar PV in 21 high-potential countries.8 However, the current state of access and contribution of renewable energy is highly varied across regions, as shown in figure 1 below. Additionally, there is significant variance in projected supply and demand. Nigeria, for example, is projected to have a shortage of 3,545 MW in generation by 2025 while Ethiopia, Uganda, Kenya, and Tanzania are expected to have a combined excess of 3,390 MW – mainly from renewable sources.9 Large-scale hydropower could be used to balance variable renewables, but its potential is concentrated in just a few countries, including Ethiopia, Tanzania, Mozambique, and the Democratic Republic of Congo (DRC). Power system interconnectors and advanced regional power pools would unlock this potential to scale clean energy. Inter-regional coordination has been lacking and AfCFTA provides the potential to structure such engagements.

FIGURE 1: Profiles of regional blocks in Africa10

Action points for the AfCFTA secretariat

- Prioritize the development of electricity markets under AfCFTA: Affordable and reliable electricity drives all socio-economic growth. Although AfCFTA has many competing issues to address, promoting regional electricity markets should be a top priority in line with the objectives set out under AfSEM. AfCFTA should convene deliberations between the current regional power pools to create a continental electricity market, with the existing power pools remaining as regional hubs.

- Leverage climate finance to supplement funding for regional electricity markets: Besides utility-scale battery storage options, regional interconnections and regional electricity markets provide the greatest potential to enhance the grid flexibility needed to integrate higher shares of renewable energy. This integration could reduce and eliminate the need for power generation from coal, gas, and heavy fuel oil, which is common across many African countries. Regional electricity markets can offset the use of fossil fuels and therefore have the potential to leverage carbon finance through multi-country programmatic carbon offset projects.

- Assess the business case for establishing Regional Electricity Market Operators: Large power generation projects can provide affordable, clean, and reliable electricity in Africa. This potential is constrained because the countries that can generate clean power at massive scales, e.g., DRC, do not have sufficient domestic demand, and can’t develop those resources unless excess power can be exported. A Regional Electricity Market Operator would provide a basis for private sector investment in very large power generation projects capable of supplying electricity to various countries. Electricity could be purchased from independent power producers (IPPs) or utilities with excess capacity and sold directly to utilities or end-users in other countries.

Endnotes

- Hasenöhrl, U. (2018). Rural electrification in the British Empire. History of Retailing and Consumption, 4(1), 10–27. https://doi.org/10.1080/2373518X.2018.1436220

- Hosier, R., Bazilian, M., Lemondzhava, T., Malik, K., Motohashi, M., and Vilar de Ferrenbach, D. (2017). Rural Electrification Concessions in Africa: What Does Experience Tell Us? World Bank, Washington, DC.

- Lorenzo P., & Luca T. (2013) Rural Electrification Now and Then: Comparing Contemporary Challenges in Developing Countries to the USA’s Experience in Retrospect, Forum for Development Studies, 40:1, 153-176, DOI: 10.1080/08039410.2012.732108

- World Bank. (2020). Electricity production from hydroelectric sources (% of total) available at: https://data.worldbank.org/indicator/EG.ELC.HYRO.ZS?view=chart

- AFREC. (2019). Designing the African Energy Transition: An approach for social and economic transformation in a climate compatible manner. African Energy Commission (AFREC), African Union

- Africa Union. (2012) Agreement establishing the Africa Continental Free Trade Area, African Union. Addis Ababa, Ethiopia.

- USAID (2018). Power Africa Transmission Roadmap to 2030: A practical approach to unlocking electricity trade. USAID Power Africa.

- IRENA. (2020). Scaling up renewable energy deployment in Africa—Detailed overview of IRENA’s engagement and impact. International Renewable Energy Agency.

- Ibid

- Compiled with data from World Bank, IMF, UN Population, and IRENA.