Nigeria has one of the most rapidly growing tech sectors on the continent, fueled by a robust supply of high-skill workers and venture capitalists looking for new markets. But many of these exciting new Nigerian tech firms are constrained by their business environment, notably the lack of access to a cheap, reliable and continuous source of electricity. A new survey of 93 firms from the ONE Campaign and the Center for Global Development provides evidence of the scale of the problem.1

Power outages

25%

Only about 25% of total capacity is dispatched by the T&D infrastructure

Nigeria’s power sector is notoriously dysfunctional at every level, despite being Africa’s largest oil producer in addition to holding large endowments of coal and gas.2 The country’s installed capacity is extremely low for its population, and only a fraction is delivered by the crumbling T&D system, resulting in many daily outages. Even in Lagos, Africa’s largest city, most businesses rely on diesel generators. For example, MTN is one of the largest mobile network operators in Africa and spends about 70% of its operating expenditures on generator fuel, with average monthly consumption in excess of 10 million liters.3 MTN is not alone — access to affordable, reliable electricity is one of the most serious constraints facing tech firms in Nigeria:

- 57% of tech firms say that it is a major or severe obstacle, another 30% a moderate one

- This is greater than in services, where 48% ranked it as a major or severe obstacle

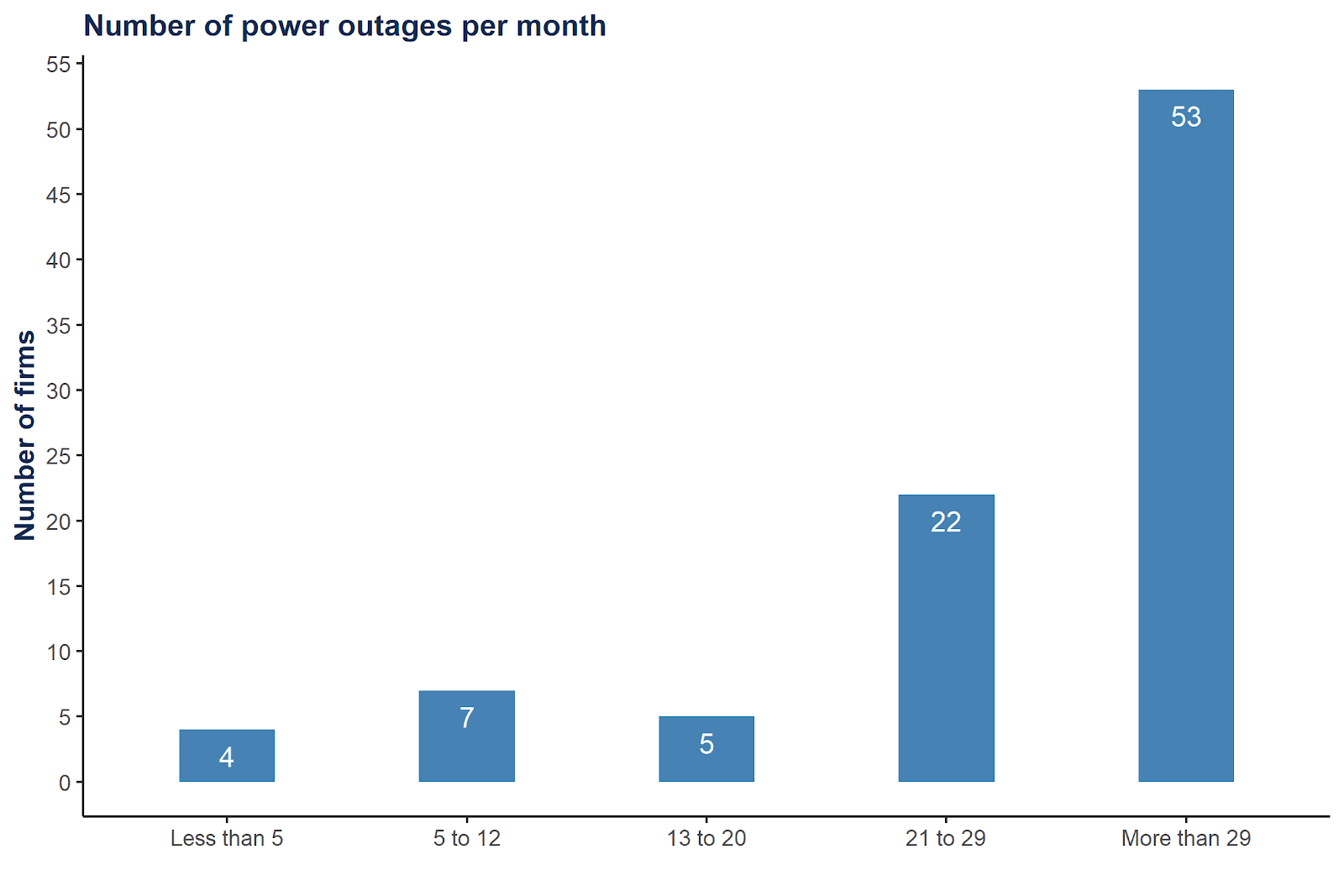

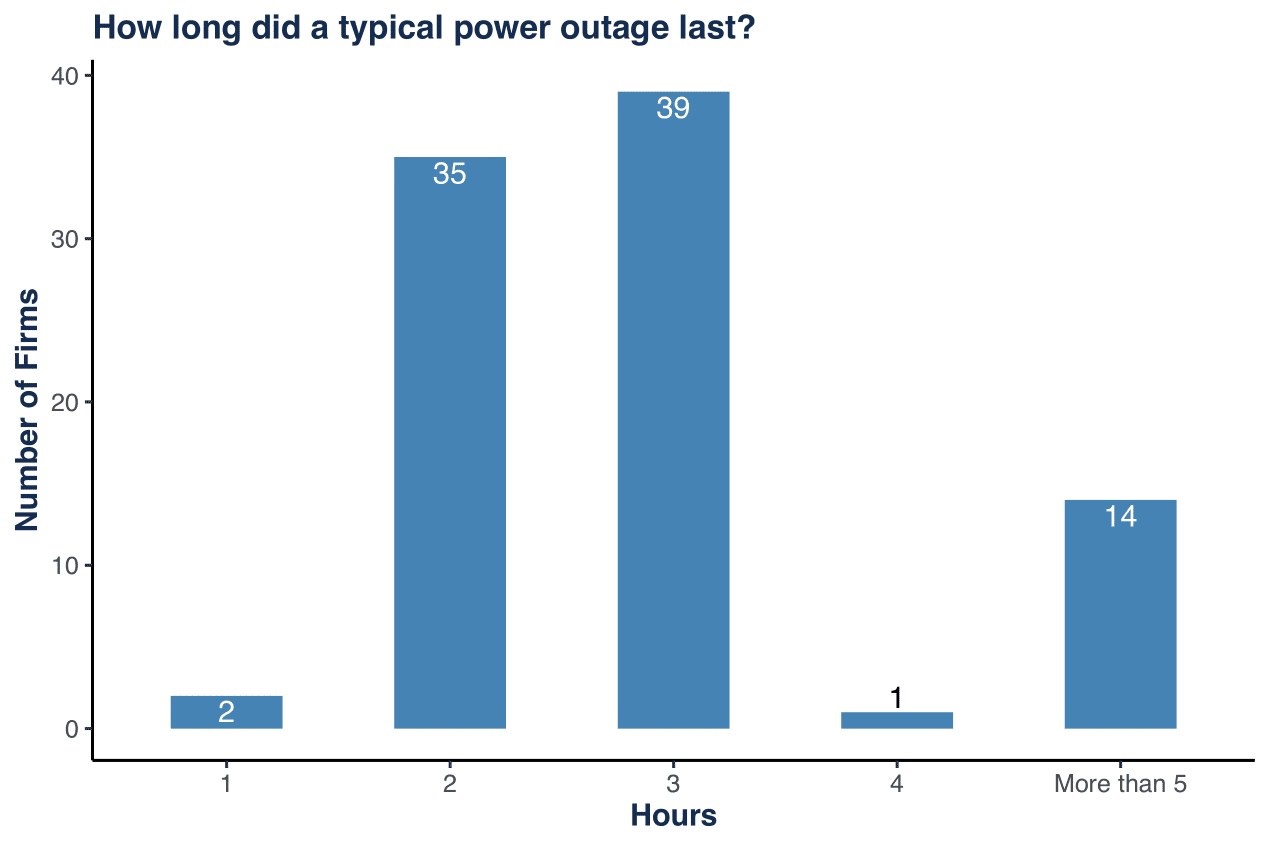

- Tech firms report daily outages of around 3 hours on average (Figures 1 and 2)

The impact on tech firms cannot be understated:

- Over half of surveyed firms report financial losses of up to 20%, some even more

- Almost all surveyed firms either own or share a generator, an expensive and insufficient way to offset losses due to power outages

- Inefficiencies in the power sector in Nigeria are estimated to result in annual losses of 534 billion naira or $1.5 billion4

Conclusion: Nigeria’s blossoming tech sector could provide quality jobs for the country’s burgeoning youth population. However, like most industries in Nigeria, it is hamstrung by consistently poor power supply. This will be a first-order problem to solve if Nigeria is to reach its ambitions in this space.

FIGURE 1: Average number of power outages1

FIGURE 2: Length of power outage1

Endnotes

- Vijaya Ramachandran, Jennifer Obado-Joel, Razaq Fatai, Junaid Sadiq Masood, and Blessing Omakwu. The New Economy of Africa: Opportunities for Nigeria’s Emerging Technology Sector. Washington: Center for Global Development, 2019.

- EIA. Nigeria Country Analysis. https://www.eia.gov/international/analysis/country/NGA

- Bankole Oluwafemi. MTN Nigeria Warns That Diesel Shortage Could Soon Jeopardise Network Services. May 2015.

- Ediri Ejoh. Electricity: Nigeria’s economy losses N534bn to inefficiency in 2016. October 2017.