The availability and reliability of electricity services is crucial for economic development because of electricity’s role as a powerful engine of social and economic change. No country has ever developed beyond a subsistence economy without having access to energy services.1 Energy is a necessity for operating major industrial machines and contributes to human capital productivity by powering schools, hospitals, and modern communications technology. Because of its importance to economic development and social welfare, chronically poor power supply is one of the biggest challenges facing firms in Africa.

Unreliable power is a first-order obstacle to African Business2

- 78% of firms in Africa experienced power outages in the last year.

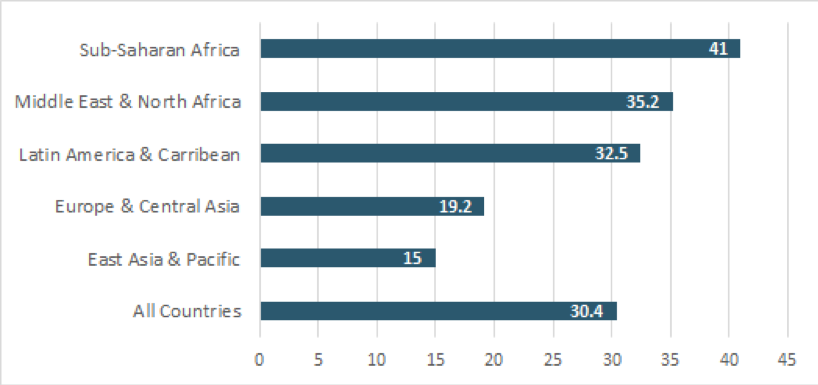

- 41% of firms identified electricity as a major constraint to their business operation, the highest of any region in the world (see Figure 1).

- African enterprises experience power interruptions averaging more than 50 hrs/month, a loss of 25 days of economic activity per year.

- By comparison, firms in East Asia & Pacific average power outages of 20 hrs/mo, while Latin America & Caribbean is only 5 hrs/mo.

Figure 1: Share (%) of firms identifying electricity as a major constraint

The economic cost is enormous

- Lost Opportunity. Beside its contribution to capacity under-utilisation, African firms lose ~5% of the value of total annual sales to electrical outages (see Table 1).

- Indirect Cost. Unmitigated estimated outage costs range from US$2 to US$32 per kWh depending on the level of firms’ vulnerability to power interruptions.3

- Direct Cost. Estimated backup (self-generation) cost in Africa is $0.47/kWh, approximately three times higher than cost-reflective tariffs of grid-supplied energy in countries like Nigeria (~$0.15/kWh) and Uganda ($0.17/kWh).4,5 This implies Willingness-To-Pay for reliable energy should be high.

What should be done in the short-term?

- Countries should rewrite regulations to allow highly vulnerable firms to partner with electricity suppliers in order to receive preferential supply at a premium price but lower than self-generation cost. (The prevalence of expensive self-generation in countries like Nigeria implies that the market would be willing to bear the extra cost for reliability). Even at higher prices, this would be beneficial for firms which are economically vulnerable to outages while also helping suppliers with cost-recovery.

- Utilities should engage their largest customers (which accounts for the largest share of their revenue) to understand their challenges and develop specific solutions to meet the customers’ needs. For example, Kenyan Power has introduced time-of-use tariff targeting the specific needs of their large customers.6

What should be done in the long-term?

- Governments must set higher tariffs to allow for true cost-recovery and incentivize private sector participation in the provision of power and new grid investments.

- Target the expansion and upgrade of critical grid infrastructure by ensuring that utilities develop and implement performance improvement and expansion plans that prioritise investments in network infrastructure. The regulatory and policy environment must incentivize investment in new generation capacity in order to guarantee the security of supply.

| Table 1: Power Outage and Back-Up Cost to Firms in Selected African Countries | |||

|---|---|---|---|

| Country | Share (%) of firms owning a generator | Average Annual Outage times (converted into days) | Average Annual outage loss as a % of annual sales |

| Ghana | 52.1 | 32.8 | 15.8 |

| Kenya | 65.6 | 11 | 5.4 |

| Mali | 66.8 | 10.7 | 8.8 |

| Mozambique | 29 | 4.3 | 3.2 |

| Nigeria | 70.7 | 190 | 15.6 |

| Senegal | 64.2 | 5.4 | 2.8 |

| South Africa | 18.4 | 2 | 1.6 |

| Zambia | 27.3 | 7.3 | 7.5 |

Source: Data from Enterprise Surveys (http://www.enterprisesurveys.org), World Bank.

Endnotes

- The World Bank. (2000). Fuel for Thought: An Environmental Strategy for the Energy Sector.

- Enterprise Surveys (http://www.enterprisesurveys.org), The World Bank

- M.O. Oseni & M. G. Pollitt (2015). A firm-level analysis of outage loss differentials and self-generation: Evidence from African business enterprises. Energy Economics (52).

- M.O. Oseni & M.G. Pollitt (2013). The economic costs of unsupplied electricity: evidence from backup generation among African Firms. Cambridge Working Paper in Economics 1351.

- Uganda Country Commercial Guide: Uganda-Energy. Accessed on April 5, 2019 from https://www.export.gov/article?id=Uganda-Energy

- http://www.kplc.co.ke/content/item/2422/enhancing-supply-quality-to-support-manufacturing-