Source: An artist rendering of the 1.5MW Oklo Aurora powerhouse (Image: Gensler)

Microgrids are increasingly deployed to expand energy access in energy-poor countries, and even in remote areas of high-income countries. While renewable-powered microgrids are growing in market share, microgrids with large loads are still dominated by fossil fuels – especially diesel generators – because of the need for energy density and reliability.

Traditional nuclear power plants have been far too large (over 1,000MW) to make sense for a microgrid. But a new class of very small nuclear reactors – microreactors – could be an attractive option to replace diesel generators and balance renewable energy on microgrids. Nuclear-powered microgrids would eliminate local air pollution, greenhouse gas (GHG) emissions, and vulnerability to fuel supply while providing significant quantities of reliable power. Some microreactor companies are targeting off-grid communities in cold climates, densely populated island communities, hospitals or university campuses, or off-grid industries like mining for first markets.

What are microreactors?

Microreactors are small modular nuclear power plants that have a capacity of fewer than 10 megawatts (MW). For comparison, a large onshore wind turbine is ~2-3 MW. Unlike most other sources of power, microreactors are designed to provide power 24/7 and can do so without refueling for years. Although the technology has not been commercially demonstrated yet, several designs are moving through licensing in North America and Europe, with anticipated demonstrations in the next few years. For example, Oklo, Inc. submitted its license application to build and operate a microreactor in March of 2020, with an expected startup of its first reactor at Idaho National Laboratory by 2025.1

TABLE 1: Examples of microreactors under development in the US and Europe.

| VENDOR | COUNTRY | POWER CAPACITY | CORE LIFETIME (YEARS) |

|---|---|---|---|

| Westinghouse Evinci | USA | .2-15 MWe | >10 |

| Oklo Aurora | USA | 1.5 MWe | <20 |

| LeadCold | Sweden | 3 MWe | 10-30 |

| Urenco U-battery | UK, The Netherlands, Germany | 10 MWth | 5-10 |

| X-energy | USA | 10 MWth | ~10 |

| General Atomics | USA | 14-10 MWe | 30 |

| Ultra Safe | USA, Canada | 5 MWe | 20 |

| HolosGen | USA | 10MWth | 12-20 |

Microreactor designs offer a range of new features that could help with the commercialization of nuclear power in new markets:

- Small Size. Traditional nuclear power projects have extremely high capital costs and produce more power than some countries currently have on-grid. Vastly smaller microreactors are easier to finance and integrate into the grid.

- Factory Fabrication. A central facility will likely construct microreactors which will then be shipped to the owner as a ready-to-use product, similar to how one might buy a diesel generator or gas turbine today. This could make construction significantly cheaper, and simplify logistics, as they can often fit in a few standard shipping containers.

- Reduced maintenance. Some reactors are designed with “lifetime cores”, which allows a fully-fueled reactor to operate for 5-30 years without refueling. This would allow deployment to remote locations where frequent fuel delivery is difficult, and also eliminate the need for fuel handling facilities in new countries, which mitigates proliferation risk. Sealed cores could also reduce the need for on-site security staff, and simplified designs allow some companies to explore minimal staff or even autonomous operation. Ultimately, the local regulatory body will determine required operational staffing, but in theory, this would dramatically lower the barrier to entry by decreasing required on-site expertise.

Challenges for the technology

Almost every country that has commercial nuclear power started by importing nuclear reactors from an established vendor country (e.g. the US, France, or Canada). The International Atomic Energy Agency (IAEA) – the organization responsible for both promoting the peaceful use of nuclear technology and preventing military use – has a process to help countries prepare for hosting a commercial nuclear power plant. Microreactors may lessen the burden for some steps of this process, but will not eliminate the requirements that ensure proper safety and security related to nuclear materials. Some aspects of microreactors, like their distributed nature, could prove more difficult to manage securely.

- Proliferation Concerns – Since nuclear fuel can also be used to produce nuclear weapons – referred to as nuclear proliferation – the IAEA inspects every kind of nuclear facility to ensure there is no material diversion for weapons production. Most proliferation risks come from the fuel cycle, primarily fuel enrichment and reprocessing, not from the actual power generating reactor. Countries with strong nuclear safeguards and IAEA inspections, such as the US, France, or Canada, can produce fuel and process waste, which minimizes the risk of weapons proliferation.

- Transporting Nuclear Materials – Nuclear fuel or waste can still be harmful, so there is concern around transporting nuclear fuels, fully-fueled reactors, or spent nuclear fuel to and from host countries, even in a scenario where a vendor country is taking ultimate possession.

- Physical Security – Microreactor designs have improved physical security, such as sealed cores that make any nuclear materials essentially impossible to access on-site, but there is also concern about whether risks are inherently multiplied when you have many more units deployed. For example, where you may have had one large nuclear power plant producing 1 GW of power, you could instead have one thousand 1 MW microreactors. How the total risk scales is an open question.

- Regulations – The export of nuclear materials is one of the most heavily regulated industries. In the US, a variety of agencies evaluate risk based on technology specifics and the country importing. Currently, approval for export is a long and complicated process that is ill-suited for a small, modular technology. Governments will need to develop modernized export regulations with the risks (and opportunities) of microreactors in mind.

- Operating Requirements – Regulators, not plant owners, will ultimately decide whether a microreactor will require on-site operators and on-site security or not, and will significantly affect costs. The requirements will likely differ by country and regulator. Developers are making the case that they can operate microreactors safely with minimal staffing, but like with all aspects of a new technology, this will have to be proven.

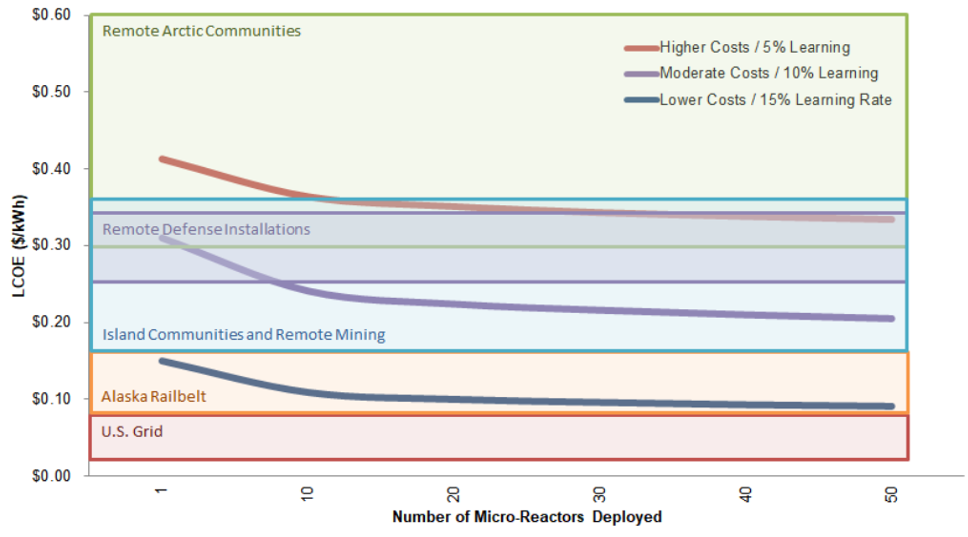

- Cost – Since no commercial microreactor has been built yet, there is significant cost uncertainty. Academic studies that project costs for microreactors based on theoretical engineering scaling functions estimate costs from $4,000/kW to $140,000/kW, while a 2019 report from the Nuclear Energy Institute assumed capital costs would be in the range of $10,000-$20,000/kW and estimated that a first-of-a-kind microreactor would generate electricity at a cost between $0.14/kWh to $0.41/kWh. However, as an industry estimate, this is likely optimistic. In Sub-Saharan Africa, for example, the regional average power tariff is around $0.22/kWh.

FIGURE 1: Micro-reactor cost-competitiveness

Source: Nuclear Energy Institute. Cost Competitiveness of Micro-Reactors for Remote Markets. (2019).

Are they an option for emerging markets?

Microreactors will likely be first demonstrated in remote areas of high-income countries like the US or Canada, but once they demonstrate the technology, energy-poor emerging economies will be the most promising markets for developers. High growth in electricity demand and limited existing grid infrastructure make these ideal markets for this technology. Building a traditional large reactor can cost billions of dollars, which is implausible in many smaller countries, while microreactors are a better fit due to their smaller scale.

Emerging markets present unique challenges, though. They often lack the necessary nuclear infrastructure, especially soft infrastructure like a nuclear regulator, liability protection, and a trained nuclear workforce. The tiny size and portability of microreactors facilitate two novel deployment models that could accelerate their availability to newcomer countries:

- Build-Own-Operate. In this model, a vendor would deliver a prefabricated microreactor and plug it into the grid while retaining ownership and managing operations. Microreactors could also facilitate a Build-Own-Operate-Return model, where vendors ship back the entire reactor to a central facility at the end of its life, mitigating concerns about waste and the decommissioning process. A closed-loop model like this could be very attractive to a country with a nascent nuclear power program.

- Power Purchase Agreements (PPAs). Similarly, some microreactor developers are looking at selling electricity rather than a nuclear reactor. PPAs are standard in the renewable energy sector but would be quite novel for nuclear power. PPAs would eliminate the need for financing and mitigate the justifiable concern about cost overruns that many associate with big nuclear projects.

Endnotes

- In January of 2022, the Nuclear Regulatory Commission announced it was denying Oklo’s license “without prejudice,” meaning they are welcome to reapply. Oklo plans to submit a new application quickly to address purported shortcomings and does not anticipate this will change their deployment timeline significantly. https://morningconsult.com/2022/01/14/oklo-reactor-nuclear-regulatory-commission/