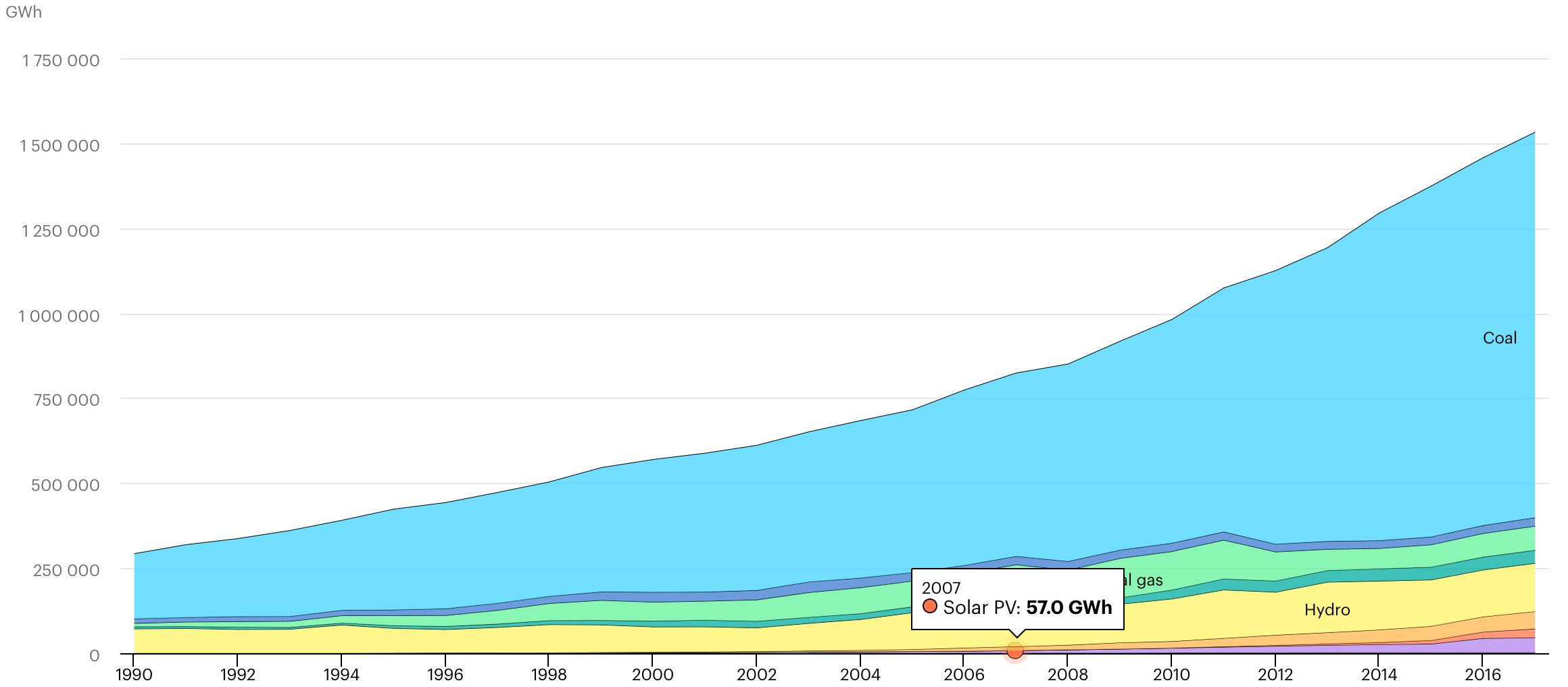

Context: Energy demand in India is forecast to double between now and 2040 as the country strives to improve living standards for its population of over 1.3 billion. The IEA projects that the largest share of new electricity will come from coal, which currently accounts for about 75% of generation.1 India’s reliance on coal contributes to serious air pollution and associated health problems. It’s also part of why the country’s greenhouse gas emissions are expected to grow more in absolute terms than any other country’s between now and 2040.2

Why isn’t gas a bigger part of India’s climate strategy?

Natural gas emits negligible local pollution and only half as much CO2 as coal. It also has lower capital costs and better operational flexibility. Gas has displaced significant amounts of coal in the United States and the United Kingdom, reducing greenhouse gas emissions there. And yet gas is nowhere to be found in India’s announced climate mitigation strategy, which leans heavily on renewable energy and especially solar. Renewable energy will be a crucial contributor to climate mitigation in India and elsewhere, but its intermittent character means it is ill-equipped to displace coal on its own.

It’s not that India is unenthusiastic about the potential of gas, which currently accounts for less than 5% of electricity generation in the country. The government has laid out plans to double domestic gas production by 2022, and to more than double gas consumption. Domestic gas fields in decline are slated to be replaced by deepwater assets and large quantities of imported LNG.3-6

However, there are several possible concerns about relying on gas to knock out coal:

Energy Security

India has much more domestic coal than gas, so it views coal as more “energy secure.” This perspective is understandable, but it isn’t entirely justified, because:

- India already imports large quantities of coal. On an energy basis, India imported about 28% of the coal it consumed in 2016 versus about 45% of gas. Because India’s coal consumption is so much larger than its gas consumption, this translated to substantially more energy imported as coal than imported as gas.7,8

- Energy supply disruptions typically have domestic causes. In India as elsewhere, the worst energy security problems usually result from some combination of severe weather events, regulatory and institutional problems, and underlying infrastructural weakness. For example, India’s 2012 blackouts occurred when drought led to spikes in electricity demand for irrigation, which exposed major deficiencies in grid robustness.

- Imported gas is becoming more affordable (but maybe not affordable enough). Growing North American supplies should help keep LNG available and (relatively) affordable. It is unlikely we will soon see a repeat of the $15/MMBtu delivered prices that Asia experienced for significant periods between 2011 and 2015. On the other hand, we may not see prices drop as low as the $5/MMBtu observed amid a gas glut in 2016. Indian policymakers are understandably disinclined to build significant new gas-fired generation capacity in the face of significant gas price risk.

Dysfunctional Domestic Gas Market

India’s domestically-produced gas is priced lower than imported gas, but there are often shortages as a result. Subsidized gas is preferentially allocated to favored domestic industries such as fertilizer production and city gas distribution for residential, commercial, and transportation uses. Underpricing of gas shrinks the supply by making it less attractive to domestic gas producers to develop and produce gas in the first place.9-11

Dysfunctional Domestic Electricity Market

The structure of the electricity supply industry in India makes it difficult for power companies to pay high prices for imported natural gas (or imported coal for that matter). The core problem is that India’s state-level electricity distribution entities are mostly loss-making due to electricity tariffs that do not cover costs. (Electricity theft and technical inefficiencies also contribute to their insolvency problems.) As long as this situation persists, it will be difficult to natural gas to play a major role in India’s power sector.12

Climate Politics

Gas tends to be given little “green credit” by environmentalists because it is still a fossil fuel and still emits carbon dioxide. By contrast, ambitious renewable goals in India’s climate INDC (Intended Nationally Determined Contribution) were effective at deflecting international pressure for the country to scale back its planned growth in coal production and use.

Policy measures to make gas more attractive

- Tighter regulation of air pollution and greenhouse gas emissions. Air pollution is already a pressing issue in India, with studies suggesting around 100,000 deaths a year are attributable to coal.13 Tighter regulations would put economic pressure on coal while taking action on a major health issue.

- A price on carbon. Imposing a carbon price that accounts for the negative externalities of CO2 emissions would increase the cost of coal relative to gas. India may be unlikely to impose a carbon price in the near future, but perhaps international funders could pay lower-emitting power plants built instead of new coal plants for the avoided emissions. A carbon price of $30 per tonne of CO2 could be enough to make new gas-fired power competitive, and it would be cheaper than many emissions reduction measures currently being pursued in rich countries.

Conclusion: The status quo in India clearly favors coal over gas. Even if the dysfunctions in gas and power markets are mitigated, gas is likely to remain more expensive than coal. This could be part of why India has not emphasized displacement of coal with gas as part of its climate strategy. At the same time, it is difficult to see how India can contain its CO2 emissions without more and better alternatives to coal. For this reason, India should consider partnering with rich countries concerned about climate change to seek leverage points that could help make gas a more viable option in the power sector.

FIGURE 1: India Generation Mix (source: IEA)

Endnotes

- IEA World Energy Outlook 2018 (Paris: IEA/OECD), 582.

- IEA World Energy Outlook 2018 (Paris: IEA/OECD), 40-41.

- Bilal Abdi, “India’s natural gas production will double in four years: Oil Ministry,” Economic Times, July 31, 2018

- Haley Zaremba, “India looks to double its natural gas usage,” OilPrice.com, November 24, 2018,

- Jessica Jaganathan, “India plans massive natural gas expansion, LNG imports to soar,” Reuters, February 6, 2018,

- IGU, “2018 World LNG Report,” p48,

- IEA Coal Information 2018 (Paris: IEA/OECD), II.10-II.15.

- IEA Natural Gas Information 2018 (Paris: IEA/OECD), II.7-II.11.

- Snam/IGU/BCG, “Global gas report 2018”, p39-40

- Anne-Sophie Corbeau, “Natural Gas in India,” International Energy Agency Working Paper, 2010, 22-23.

- Mark C. Thurber and Joseph Chang (2011), “The policy tightrope in gas-producing countries: Stimulating domestic demand without discouraging supply,” National Bureau of Asian Research paper for Pacific Energy Summit, Jakarta, Indonesia, February 21-23, 2011.

- Jeremy Carl, “The causes and implications of India’s coal production shortfall,” in Mark C. Thurber and Richard K. Morse, editors, The Global Coal Market: Supplying the Major Fuel for Emerging Economies (Cambridge, UK: Cambridge University Press, 2015).

- Sarath K. Guttikunda and Puja Jawahar, “Atmospheric emissions and pollution from the coal-fired thermal power plants in India,” Atmospheric Environment 92 (2014), 449-460.