Firms across sub-Saharan Africa (SSA) view power outages as significant obstacles to productivity, and firms in the Maghreb share this concern, despite better infrastructure and greater government capacity. While most countries in the Maghreb have attained universal electrification, power remains expensive and the supply to industry is frequently unreliable.

Take for example…

Morocco has a 100% electrification rate, but a 2019 World Bank Enterprise Survey shows:

- Out of 1,096 firms surveyed, 270 (>20%) reported experiencing outages in the past year (Table 1).1

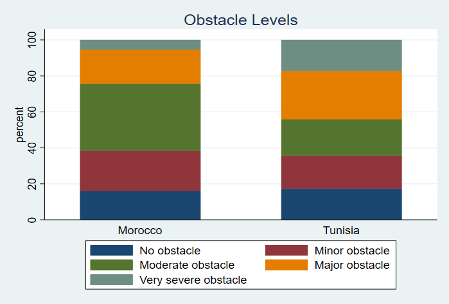

- Most firms claimed that electricity is a significant obstacle to operations (Figure 1).

- 23% reported it as a major or very severe obstacle.

- 57% cited electricity as a minor or moderate obstacle.

- Only 15% claimed it has not been an issue.

- Only 11% of firms are able to invest in self-generation capacity that can fill in during outages (Table 2). Even for firms that can afford it, self-generation is a very expensive alternative.

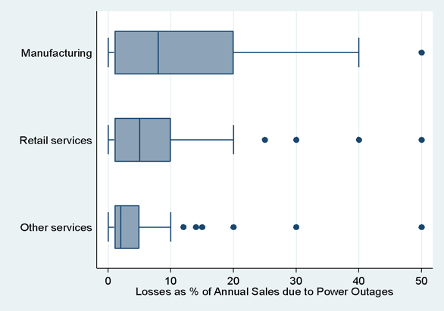

- Responses do not vary significantly across size of firm or sector (whether manufacturing, retail, and other services). Figure 2 shows the distribution of self-reported losses resulting from power outages in Morocco.

And in Tunisia:

- An even higher percentage of firms (42% of the 615 surveyed) reported experiencing outages during the year.2 The frequency of outages is shown in Table 1.

- 44% cited electricity as either a major or very severe obstacle.

- Of these, 74% are in manufacturing (despite that sector making up only 59% of the survey sample).

- 38% considered electricity to be a minor or moderate obstacle. Only 17% reported that electricity is not an obstacle.

From the Maghreb to SSA, firms need better reliability

Firms in Morocco and Tunisia suffer significant losses from the lack of reliable electricity supply. These countries demonstrate the issues that arise when policy goals emphasize the electrification rate but ignore reliability. While outages in countries with universal electrification are perhaps not as pervasive as those elsewhere in sub-Saharan Africa, they still impact firm productivity. In view of this, policymakers across all of Africa must focus on the reliability of electricity supply to industry — not just on the electrification rate — to minimize losses and raise productivity in the private sector.

TABLE 1: Power Outages

| Variable | Obs. | Mean | Std Dev | Min | Max |

|---|---|---|---|---|---|

| Morocco | – | – | – | – | – |

| # power outages per month | 230 | 1.66 | 0.956 | 1 | 6 |

| Duration of outages by hour | 212 | 10.481 | 12.612 | 0 | 50 |

| Tunisia | |||||

| # power outages per month | 190 | 2.652 | 2.086 | 1 | 6 |

| Duration of outages by hour | 181 | 2.447 | 3.270 | 0 | 20 |

Notes: Obs (observation) is the total number of firms for which information on listed variables is provided. Observations for which the value exceeds three standard deviations from the mean are classified as outliers and returned as missing following the recommendations of the Enterprise Analysis unit of the World Bank.

TABLE 2: Generator Ownership

| Country | Compact Status | Investment ($ million) | Description |

|---|---|---|---|

| Indonesia | Closed April 2018 | $70 | (1) Renewable energy investments under the “Green Prosperity Project”; (2) Technical and financial assistance to renewable energy projects. |

| Malawi | Closed Sept 2018 | $283 | (1) Hydropower reliability; (2) Transmission capability & stability; (3) Modernizing management and regulation of the power sector |

| Sierra Leone (threshold) | Closed Mar 2021 | $23 | (1) Sector restructuring; (2) Systems planning |

| Liberia | Closed Jan 2021 | $202 | (1) Generation from Mt. Coffee hydropower plant; (2) Systems planning; (3) Develop independent |

| Ghana | Began Sept 2016 | $450 | (1) DisCo management and planning; (2) Offset demand with efficiency; (3) Planning and sector regulation regulator |

| Benin | Began June 2017 | $333 | (1) Modernize grid infrastructure; (2) 45MW of solar generation via IPP; (3) Support for off-grid and mini-grid; (4) Sector governance |

| Kosovo (threshold) | Signed Sept 2017 | $32 | Reliability & household efficiency |

| Nepal | Signed Sept 2017 | $398 | Expand and strengthen transmission infrastructure |

| Senegal | Signed Dec 2018 | $434 | (1) Strengthen laws, policies, and regulations; (2) Increase connection rates in rural and peri-urban areas; (3) Modernize and strengthen Senelec and transmission network around Dakar |

| Burkina Faso | Signed Aug 2020 | $310 | (1) Solar + Storage Projects; (2) Modernize Grid Infrastructure; (3)Sector governance |

| The Gambia (threshold) | Approved by Board Sept 2021 | TBD | TBD |

| Ethiopia | Eligible, Dec 2020 | TBD | TBD |

| Kosovo | Eligible, Dec 2020 | TBD | TBD |

| Sierra Leone | Eligible, Dec 2020 | TBD | TBD |

Note: This table shows the distribution of generator ownership among the broad categorization of industries in Morocco and Tunisia.

FIGURE 1: Cited obstacle levels of electricity

FIGURE 2: Distribution of self-reported losses among industries in Morocco

Note: Self-reported losses for which the value exceeds three standard deviations from the mean are classified as outliers and returned as missing following the recommendations of the Enterprise Analysis unit of the World Bank.

Endnotes

- World Bank Enterprise Surveys, 2019.

- World Bank Enterprise Surveys, 2020.