Electricity generation in India has risen almost ten-fold since 1985, a dramatic increase leading to a surplus of capacity. Despite this technical surplus, and the claim of “universal village electrification,” 240 million people in the country continue to lack any access to electricity, with the remaining population experiencing regular blackouts, voltage fluctuations and other distribution-related problems.1 Since generation isn’t the issue, what is?

The transmission and distribution (T&D) sectors face massive technical constraints and corruption issues – close to 25% of all power generated in India is lost to theft, corruption, and malfunctioning infrastructure. These losses have contributed to power sector debt equalling 5% of India’s GDP in the last decade. Five steps in the right direction are:

1. Leverage satellite data to expose and address corruption

Evidence shows that line losses in India follow electoral cycles when incumbent politicians work to reduce blackouts by ensuring uninterrupted supply in the lead-up to elections. And at a local distribution level, manipulating billing data to reflect artificially low consumption — effectively an unauthorized subsidy — enables politicians to bypass regulators and covertly reward supporting constituencies, taking advantage of their control over local bureaucracies. This is prevalent in large states such as West Bengal.

Researchers and policy makers can address some of these challenges by:

- Using satellite data to objectively track electricity provision. It is important to use non-manipulable data sources to help citizens draw connections between unreliable supply and the political capture of electricity.

- Communicating the relationship between electricity quality and politics to voters may increase the demand for better monitoring.

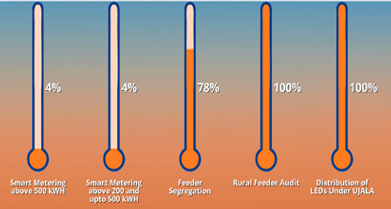

2. Improve measurement of electricity consumption and prevention of losses

It is important to measure and understand the source of losses before tackling them. For example, “distribution losses” could encompass theft, unmetered electricity use, or poor infrastructure. In the state of Bihar, the utility makes only 50% of its projected revenue, effectively being paid for only half of the electricity distributed to consumers.

- Universal metering could help account for some of these leakages. In addition to poor infrastructure, several consumer groups in India, particularly farmers, often receive unmetered electricity. Since there are no meters installed to measure usage, over-consumption is common and misleadingly counts toward large distribution losses.2

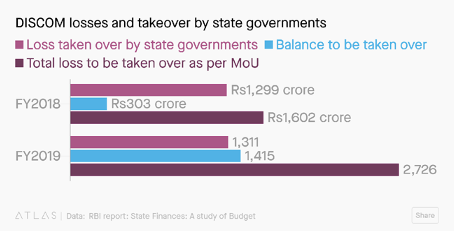

3. Stop bailing out utilities

In November 2015, the government announced a new scheme called UDAY (Ujwal DISCOM Assurance Yojana) to help state electricity distribution companies with historical debt. It functions as a bailout program for utilities and provides no incentives to address system leakages.

- Eliminate this bandage solution and use the resources to improve metering and theft monitoring.

4. Synchronize electricity regulation across states

Until the late 90s, the Indian power sector mostly comprised state-owned, vertically-integrated firms that accrued massive losses. Between 1998 and 2003 reforms under the Electricity Act attempted to make the sector more competitive and efficient, including separating generation, transmission and distribution. However, states enacted these laws differently, resulting in a range of outcomes for customers, particularly manufacturing firms, that comprise the largest consumers of electricity.

- Mimicking the strategies of successful states may help some of the struggling ones. India needs more centralized coordination to avoid old mistakes and adapt to new lessons.

5. Invest in greater transmission capacity

The Electricity Act of 2003 introduced a new power market in India. However, transmission constraints are a major obstacle to trade between regions. This is one reason that despite having surplus generation capacity, the country continues to face severe electricity shortages.

- Investments need to include this intermediate sector to facilitate new generation as well as more efficient distribution.

- Expanding transmission lines could increase market surplus by as much as 17%, justifying the costs of the investment.

FIGURE 1: Utilities are behind their goals in terms of installing better meters and other measurement tools at feeder level (Source: UDAY India)

FIGURE 2: Utility losses have gone up over time (Source: Quartz India and RBI)

Endnotes

- https://money.cnn.com/2018/04/30/news/india/india-electricity-villages-modi/index.html

- Any shortfall between electricity provided, and the amount billed for counts as a commercial or technical loss.