Despite significant public expenditure on subsidies, more than 100 million Nigerians still live without reliable access to affordable electricity. Consequently, they also lack prospects for significant income gains, as insufficient and unreliable power continues to hinder productivity and constrain economic growth. It is no coincidence that roughly the same number of Nigerians live in poverty; the causal link between electricity consumption and economic development is well-established for countries across income classifications.

Nigeria is sub-Saharan Africa (SSA)’s largest economy. Yet, its energy consumption pales in comparison to the region’s second-largest economy, South Africa. At less than 200 kWh, electricity consumption per Nigerian is currently 5% of electricity consumption per South African. 200 kWh is well below the “Modern Energy Minimum” of 1,000 kWh per capita, the Energy for Growth Hub’s estimated threshold countries must reach to spur competitive economic growth.

Addressing obstacles to affordability and prioritizing investments that improve reliability for businesses are critical for escaping the vicious cycle currently plaguing Nigeria’s power sector. Improving the performance and competitiveness of Nigerian businesses will support job creation and income growth, which will in turn enable Nigerians to afford electricity without subsidies, and free up a significant portion of the federal budget for catalytic capital expenditure to further improve power quality.

The Vicious Cycle of Inadequate Grid Supply

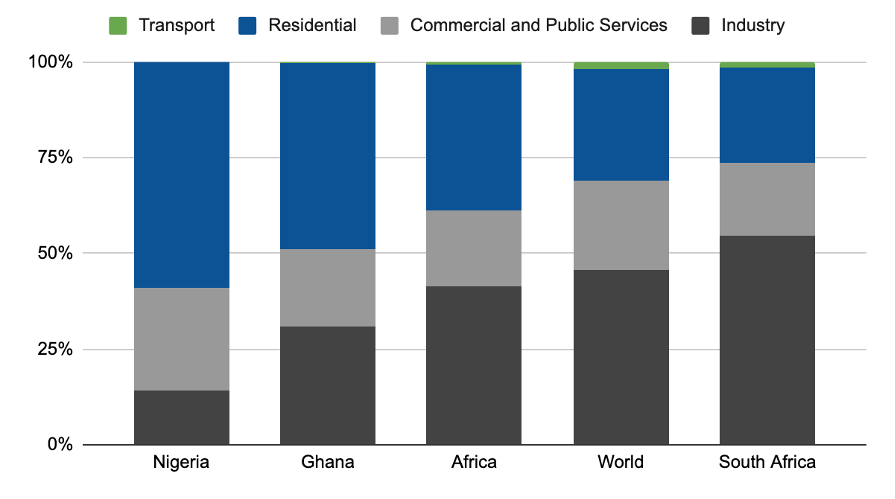

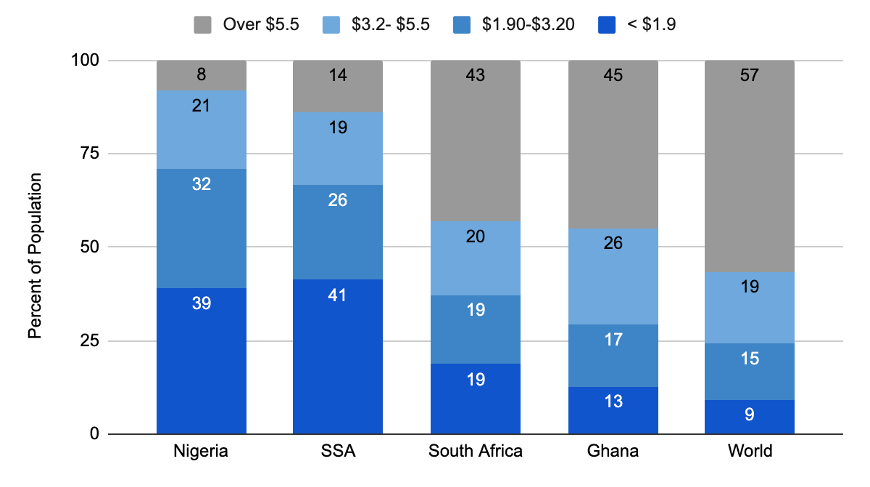

- Low productivity has led to disproportionate consumption by the residential sector. Macro-economic challenges and unreliable power supply have stunted productivity in non-oil Commercial & Industrial sectors over the last few decades. As a result, a disproportionate amount of available power is consumed in the non-productive residential sector. Nigeria’s residential sector accounts for 60% of final electricity consumption — well above the African average (38%) and the global average (30%) (Figure 1), and more than 70% of Nigerians live below the lower middle-income International Line of Poverty ($3.20/day) and cannot afford electricity access (Figure 2). A largely poor, residential customer base means limited revenue for utilities, which compounds reliability and affordability issues, as utilities cannot reinvest in expanding and improving electricity infrastructure.

- Current policies place the losses at the feet of the government. In an attempt to bridge the sector’s affordability and financial liquidity gaps, the government subsidizes consumption by regulating the electricity tariffs charged to end-users. The government then funds the tariff shortfall — the difference between regulated tariffs to end-users and cost-reflective tariffs required by Electricity Distribution Companies (DisCos). However, this policy is largely regressive: most residential electricity is consumed by higher-income households (8% of the population in Figure 2) who have greater access to grid supply and do not require subsidies. In 2019, the electricity tariff shortfall was estimated at $1.7 billion, or 11% of government revenue, exacerbating financial pressures on an already overburdened government budget. Consequently, government expenditure on these poorly targeted subsidies continues to grow to unsustainable levels without achieving its main objective of facilitating access for a growing share of the population who cannot afford access.

- Underinvestment in the grid leads to continued insufficient and unreliable access. The government rarely pays these regressive subsidies in a timely fashion, leading to poor liquidity in the electricity sector. Without reliable cash flows and a guarantee of reasonable returns, investors shy away from financing grid expansion and improvements. This further constrains productivity and economic growth and decreases prospects for job creation and income growth.

- Nigerian households and businesses supplement unreliable grid supply with expensive off-grid solutions that cannot support long-term economic growth. Despite the government’s significant recurrent expenditure on subsidies, Nigerian businesses and households with higher ability to pay cost-reflective tariffs supplement their unreliable grid supply with off-grid solutions. The defection of credit-worthy customers further aggravates the liquidity challenge utilities face. Also, these off-grid solutions (such as mini-grids) cost as much as four times the price of cost-reflective grid electricity, making them even less affordable for customers. Without technical innovations to improve efficiency and further reduce cost, renewable off-grid micro-solutions cannot competitively provide the level of electricity consumption companies need to thrive, offer higher incomes, and increase purchasing power for Nigerians.

FIGURE 1: Electricity end-use by sector

Source: IEA, 2019.

FIGURE 2: Income Distribution

Source: World Bank Development Indicators.

Recommendations to Break the Cycle

Rather than allocate significant resources to business models innovating to access a share of poor people’s incomes, the government should prioritize electrification solutions that create more high-paying jobs for millions of Nigerians. With more income, Nigerians would be able to afford modern levels of energy consumption and other key services which would sustainably raise their standards of living. Recommendations for resolving the affordability challenge include:

- Redirect subsidies to capital expenditure aimed at lowering the long-term cost of electricity. In light of increasingly limited sovereign balance sheet capacity, current investors and the government must reconsider the high reliance on sovereign guarantees and subsidies which facilitate liquidity in the sector. The government’s recent approval of an increased electricity tariff for customers with access to more than 12 hours/day of grid electricity supply is a step in the right direction. Customers with this relatively high level of service tend to live in higher-income residential areas. These customers have demonstrated the capacity to pay higher tariffs based on service levels or higher costs of supplementing with off-grid sources, hence they do not require subsidies. Reducing these regressive subsidies will enable the government to devote more resources to much-needed catalytic capital expenditure on programs such as the $2 billion Presidential Power Initiative (PPI) in partnership with Siemens aimed at addressing transmission and distribution infrastructure gaps that will reduce system losses, increase wheeling capacity and unlock stranded generation capacity. This targeted investment is critical to attracting additional private sector capital needed to scale grid capacity and lower the cost of expanding access to electricity.

- Grow productive use of electricity to improve the creditworthiness of market participants. Investments must focus on expanding access and improving reliability to Nigeria’s commercial and industrial sectors, which have higher capacity to pay cost-reflective tariffs. Powering these sectors’ productivity and competitiveness will consequently stimulate job creation and income growth. Successful businesses create higher-paying jobs which improve the purchasing power and creditworthiness of end-users. Where off-grid technology is determined to be competitive against supply from the central grid (e.g. in rural areas with no central grid infrastructure and low levels of electricity consumption), policies should stipulate that these off-grid technologies must target applications that appreciably raise productivity and incomes to levels that move people out of poverty.

- Create a competitive, attractive environment for investors. Implementation of regulatory reforms that lower macroeconomic risks will improve investment climate and attract private capital. Transparent implementation of Multi-Year Tariff Orders (MYTOs) is critical for predictability of cash flows. Exchange rate volatility is another critical risk to mitigate because of the mismatch between dollar investment obligations and local currency revenues. Efforts aimed at providing long-term local currency financing, unifying exchange rates to improve convertibility and growing foreign exchange earnings from non-oil sectors will improve bankability of projects.

If Nigerians’ purchasing power continues to diminish, the transition to cost-reflective tariffs for all customers will be hindered by political considerations to keep voters happy by keeping prices artificially low. However, Nigerian policymakers must recognize that investors will not address Nigeria’s electricity shortfall if they are uncomfortable with pricing mechanisms and regulatory risks.

Conclusion

Nigeria aspires to achieve the level of poverty reduction witnessed in Asia over the past two decades. But it cannot achieve this aspiration unless the government demonstrates the political will required to trade short-term political gains for long-term prosperity for all Nigerians. Execution of energy and climate policies must align with the overall goal of enabling the scale and pace of economic development that will lift millions of Nigerians out of poverty within the next decade. Measures that merely alleviate poverty for a growing share of the population are no longer sufficient. The goal must be elimination or at very least a significant reduction in the number of people living in poverty.