Sub-Saharan African countries urgently need more electricity services to foster economic growth and job creation. While plugging the energy gap is not sufficient to address all the region’s economic woes, it is a fundamental building block to the wider aspirations of these societies. Still, reforming power sector regulations and governance across the region continues to be fraught with problems. Four of the biggest challenges to quality, well-managed service delivery are:

1. Attracting significantly more private investment

In the face of the yawning energy gap the sub-region faces, the level of investment has been paltry.1

- Between 1990 and 2013, $45.6 billion was invested in electric power generation in Sub-Saharan Africa, amounting to less than a paltry $2 billion per year for the continent.

- More than 20% of the investment amount was invested in just one country, South Africa.

- The World Bank estimates that a whopping $800 billion is required for the continent to achieve Sustainable Development Goal (SDG) 7 by 2030.2

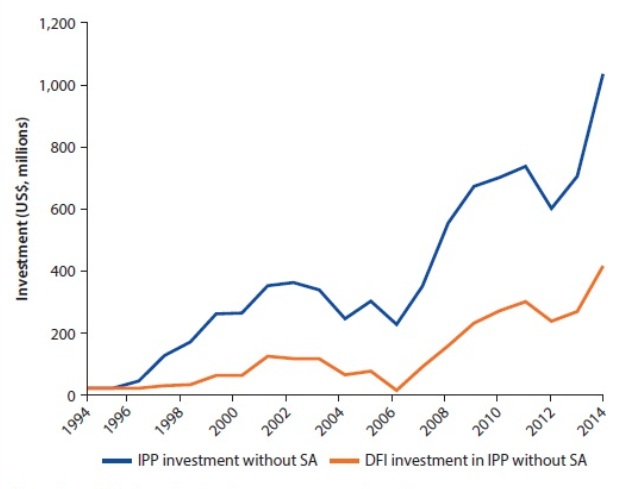

Independent Power Projects (IPPs) are the major source of private investment across the region and are on the rise (see Figure 1). However, to attract a sufficient level of investment, the regulatory framework across the region needs to be dramatically improved, as investors are more likely to gravitate towards countries with lower risk profiles.

2. Reforming bankrupt and non-creditworthy utilities

Power utilities across Sub-Saharan Africa face financial peril, and yet they will need to be leaders in the region’s energy transition.

- In nearly all of these markets, utilities do not recover full costs; only Uganda and Seychelles operate with positive cash flow.3

- Chronic insolvency leads to rising debt and capital shortages, preventing the implementation of new projects and constraining essential maintenance.

Spotlight on Kenya and Mali

- Kenya Power, the country’s sole electricity distribution company, was recently tasked to implement an aggressive access expansion program by the national government. However, the company did not have the required capital to execute the project; instead, the resulting financial crisis required a World Bank debt restructuring.4 The Kenyan utility is still forced to sell power below the full cost and declining service quality is hemorrhaging customers.5

- Similarly, in Mali, a country with less than 30% of the population connected to the grid, the state-owned utility is poorly managed, relying on subsidy from government and multinational banks. Other countries in the region suffer similarly acute financial issues in their power utilities.6

3. Upgrading aging infrastructure

Creaking infrastructure across the power value chain is another disturbing problem.

- Nigeria, with a total installed capacity of 12,522 MW, can only count on 3000-4000 MW on average because of poor performance. Additionally, due to weak transmission lines, power generated often cannot be evacuated to the point of need.

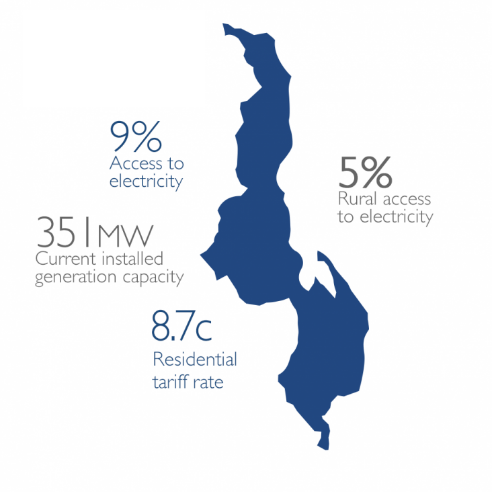

- Malawi has an abysmal 10% rate of electrification (see Figure 2). Power outages are also partly due to aged and faulty transmission infrastructure.7

- Across southern Africa, countries like Zambia, Mozambique, and Zimbabwe remain largely dependent on power facilities built more than half a century ago.7

4. Low institutional capacity

From a political economy perspective, institutional capacity determines the ability of the government to enact and implement coherent, effective, and affordable policies that can eradicate energy poverty over time and manage modern energy systems.8 Moreover, a nexus exists between institutional capacity and attracting private investment. In Tanzania, for example, attracting IPPs is difficult because of opaque deals in the sector coupled with the albatross of a poorly performing state-owned utility.9

Lessons from Brazil? Brazil is a compelling example of high institutional capacity. Today, the Brazilian model is based on a highly-efficient competitive auction system, combined with independent institutions that effectively regulate the power sector and monitor market administration.10

Figure 1: Total Investment by IPPS and by Development Finance Institutions in Sub-Saharan Africa (excluding South Africa), 1994-2014

*Note: DFI = Development Finance Institution; IPP= Independent Power Project

Source: World Bank Group

Figure 2: Malawi Electricity Profile

Endnotes

- Eberhard et al (2017) Independent Power Projects in Sub-Saharan Africa: Investment trends and policy lessons.

- Tomlinson M (2017) The Push and Pull of Power Reform in Sub-Saharan Africa.

- Masami Kojima and Chris Trimble, Making Power Affordable for Africa and Viable for its Utilities, World Bank, 2016.

- Kacaniku T (2018) Breathing new life into power utilities through debt restructuring tools.

- Rose Mutiso and Jay Taneja, Seven Major Threats to Kenya’s Power Sector, Energy for Growth Hub, 2018.

- Embassy Bamako’s Commercial Section, export.gov. www.export.gov/article?id=Mali-Energy

- Ogunleye, K. (2017) The Political Economy of Clean Energy Transitions

- Aklin et al (2018) Escaping The Energy Poverty Trap.

- Eberhard et al (2017)

- Eberhard et al (2017)