The challenge of anchoring nascent gas markets in the power sector

Gas-fired power may seem like an attractive option for developing countries trying to expand their electricity supply, especially if they possess domestic gas resources. However, the lack of sufficient gas processing and pipeline infrastructure can be a major barrier to the use of gas for power generation. Gas infrastructure is expensive, and cash-strapped power utilities in developing markets may not be sufficiently creditworthy offtakers to enable its financing.

Should gas even have a role in future power sectors?

Donors and development finance agencies are actively debating whether gas should even have a role in Asian and African countries that are still building power infrastructure. Can gas be a valuable ‘bridge fuel,’ offering a reduction in CO2 emissions and vastly reduced air pollution relative to coal? Or does the magnitude of the climate change problem mean that even fast-growing countries should eschew all new fossil fuel developments in favor of zero-carbon renewable sources?

These power-sector-focused debates tend to ignore an important point:

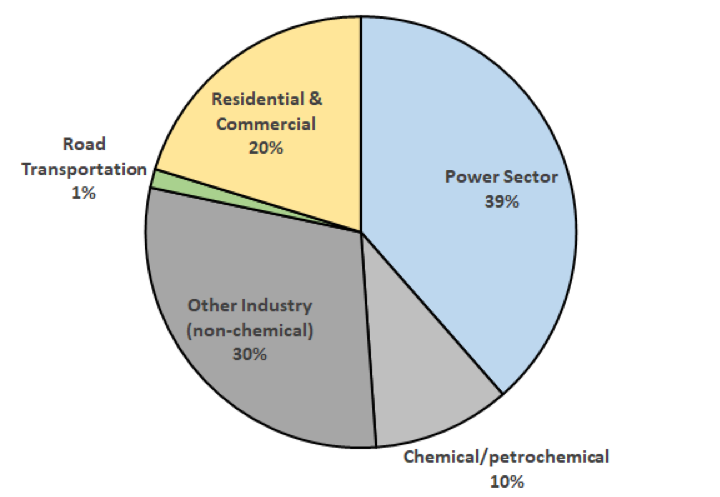

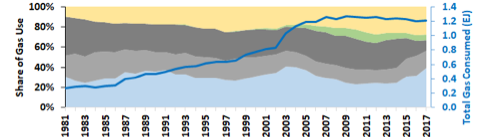

Less than half of natural gas consumption worldwide occurs in the power sector.

FIGURE 1: Global gas consumption by use in 2017. Data source: IEA World Energy Statistics 2020.

Industrial uses of gas

In addition to providing heat for homes and businesses, gas plays significant roles in multiple economically vital industrial processes:

- Chemical and petrochemical production is the largest industrial use of gas, employing gas as both a petroleum feedstock and a source of process heat. Natural gas and products of natural gas processing can be used to produce petrochemical building blocks that are in turn transformed into valuable products like plastics and fertilizers.

- Industrial heat is crucial for the production of products such as steel, cement, and ceramics. Electric heating is not a cost-effective way to achieve the high temperatures needed in many industrial processes, and burning coal for process heat pollutes much more than burning gas.

Industry is an easier starting point for nascent gas markets

The vast majority of country-level gas markets initially developed with industrial uses, rather than the power sector, as their primary focus.

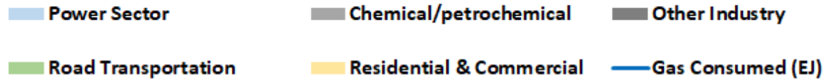

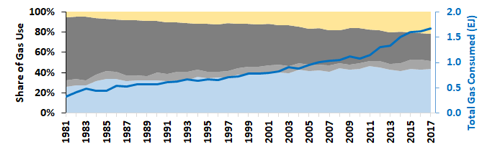

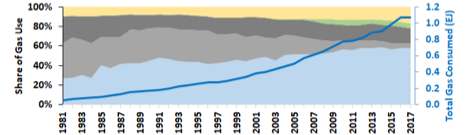

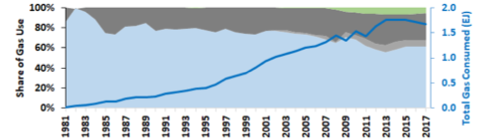

Chemical, petrochemical, and other industrial uses accounted for at least half of initial gas consumption in ten of the twelve lower- and middle-income countries that now consume more than 1 EJ of gas annually (see Figure 2). An industrial starting point for gas market development makes sense for several reasons:

- Gas can be economically attractive relative to alternatives. For example, gas can compete with naphtha as a feedstock for fertilizer production, and gas can compete with coal for industrial process heat, especially if the costs of air pollution control are taken into account.1

- Industries are a dependable end customer to allow financing of gas infrastructure. Power companies in emerging markets are often in dire financial straits due to low electricity tariffs and difficulty collecting fully from ratepayers. Industrial customers for gas do not face these power-sector-specific problems and are more likely to be dependable customers for gas suppliers. They can serve as anchor customers that allow gas processing and distribution infrastructure to be financed and built. For example, India commissioned the Hazira-Vijaipur-Jagdishpur (HVJ) pipeline in 1997 in order to carry gas to fertilizer producers in the state of Uttar Pradesh.

- Once gas infrastructure is built, end use diversification becomes possible. India’s HVJ pipeline was built with industrial users in mind, but it enabled the development of power plants along the pipeline route, as well as residential & commercial uses of gas and even gas-powered vehicles.2 In China, the development of the West-East Pipeline and LNG import facilities supported industrial consumers but also enabled gas distribution to cities for residential & commercial use, power generation, and gas-powered vehicles.3

Conclusion: Gas can play an important role in electric power supply for emerging economies, including as backup generation for intermittent renewable resources. However, countries with little existing gas infrastructure may find it most effective to focus first on industrial enterprises as anchor consumers for financing and building out a gas pipeline network. This can also create jobs while reducing the temptation to rely on coal as a major industrial fuel.

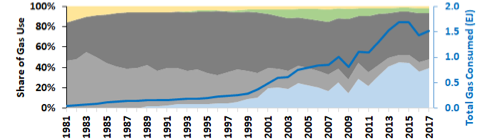

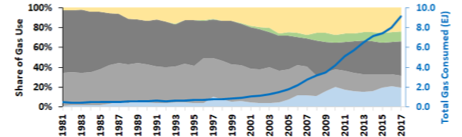

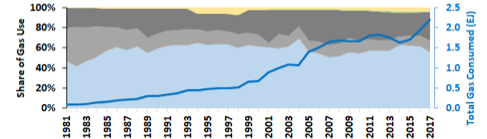

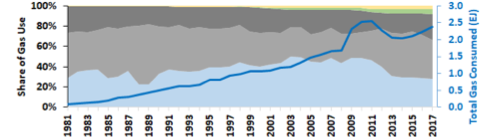

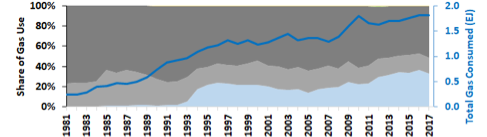

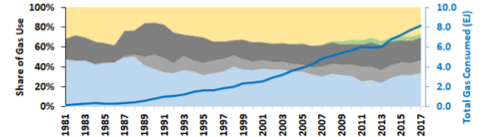

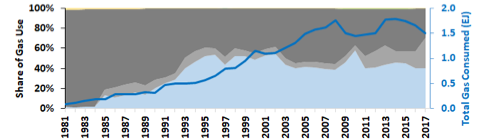

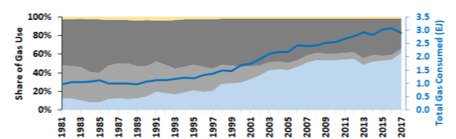

FIGURE 2: Gas usage by sector and total gas consumption for all non-CIS, lower- and middle-income countries with gas consumption greater than 1 EJ in 2019.

Data sources: IEA World Energy Statistics 2020, BP Statistical Review of World Energy 2020.

(a) ALGERIA (b) BANGLADESH

(c) BRAZIL (d) CHINA

(e) EGYPT (f) INDIA

(g) INDONESIA (h) IRAN

(i) MALAYSIA (j) MEXICO

(k) PAKISTAN (l) THAILAND

Endnotes

- M.P. Jackson et al, “The Future of Natural Gas in India: A Study of Major Consuming Sectors,” Stanford University Program on Energy and Sustainable Development, Working Paper #65, 2007, https://fsi-live.s3.us-west-1.amazonaws.com/s3fs-public/Jackson_WP65_India_gas.pdf.

- S. Joshi and N. Jung, “Natural Gas in India,” in Natural Gas in Asia: The Challenges of Growth in China, India, Japan, and Korea, 2nd edition, ed. J. Stern (Oxford: Oxford University Press, 2008), 66-115.

- M.C. Thurber and J. Chang, “The Policy Tightrope in Gas-Producing Countries: Stimulating Domestic Demand Without Discouraging Supply,” Conference Paper, 2011 Pacific Energy Summit, Jakarta, Indonesia, February 21-23, 2011.