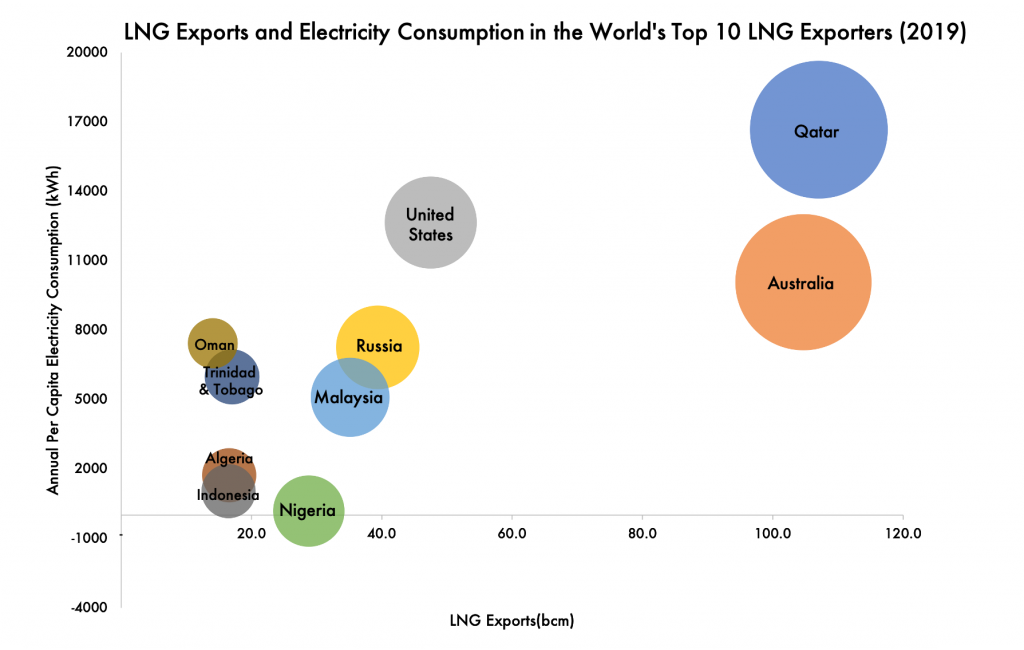

Nigeria holds Africa’s largest proven natural gas reserves. Yet despite its enormous domestic energy needs (Nigeria’s annual per capita electricity consumption is one of the lowest in the world), the country consumes only 25% of its commercialized gas supply and less than 1% of the global total. The remaining 75% is exported, making Nigeria the world’s 6th largest exporter of liquefied natural gas (LNG).

Nigeria’s vast natural resources and human capital make it an insightful case study of the opportunities and challenges associated with harnessing natural gas for industrialization and economic diversification, and offers potential lessons for countries like Algeria, Libya, Mozambique and Senegal. Expanding Nigeria’s domestic gas market could increase its rate of gas consumption, and generate economic opportunity and job creation.

Obstacles to growing Nigeria’s domestic natural gas market

Two major factors explain why Nigeria exports 75% of its commercialized gas:

- Global demand for natural gas has grown significantly — including in Nigeria’s major LNG destination markets (Europe, China and India). This has been largely driven by technology improvements that unlocked supply and increased gas cost competitiveness, and by some countries’ efforts to increase natural gas consumption to reduce carbon emissions. Natural gas accounted for almost one-third of total energy demand growth over the last decade — more than any other fuel.

- Investors have limited confidence in Nigeria’s domestic value chain. First, the size of the existing domestic gas market does not support the necessary economies of scale to make investments in gas infrastructure bankable. Second, the electricity sector — which accounts for a majority of Nigeria’s domestic gas sales — is not commercially viable. Economic and political constraints prevent electricity utilities from charging cost-reflective tariffs, which adversely impacts their capacity to pay for gas supply. Potential investors avoid exposure to any market that lacks a structured and sustainable process for addressing poor payment performance and enhancing credit. Finally, efforts by policymakers to stimulate domestic demand by regulating gas prices and imposing requirements for how supply is distributed may prohibit the revenue growth necessary to cover costs and generate enough return to attract capital.

A Multipronged Approach to Industrialization and Economic Diversification

To attract investment in the domestic commercial gas market, Nigeria and other African countries could adopt several measures, each of which requires leadership and collaboration between African governments, private sector, and the international community.

- Invest in gas supply projects for credit-worthy industries that require high volumes of gas. This would enable gas producers to diversify their customer base, reduce exposure to a dominant sector’s financial liquidity challenges (e.g., the electricity sector in Nigeria), and increase domestic demand to achieve the economies of scale required to attract investment. Investment in projects for high-volume industries can also have a multiplier effect. For example, companies can use natural gas to produce petrochemicals including fertilizer, which is necessary to enhance food security. At present, Sub-Saharan Africa uses an average of just 19kg of fertilizer per hectare — ~7 times less than the global average — and has only four nitrogen-based fertilizer manufacturing plants. Because the agriculture sector employs ~54% of Africa’s workforce and constitutes 23% of sub-Saharan Africa’s GDP, increased fertilizer supply could have a significant impact on economic growth and job creation.

- Earmark portions of the government’s LNG export proceeds to catalyze investment in gas and ancillary infrastructure. These initial investments should be concentrated in special economic zones (SEZs) that offer incentives to attract private sector capital. SEZs allow governments to concentrate limited resources in specific geographic areas and sectors with the highest potential for impact; and then scale these investments to the vast gas transmission, storage, and distribution networks that exist in more developed gas markets over time.

- Deliver a framework to address investors’ needs for political, commercial, and fiscal stability. This includes mutually beneficial contract terms for investors and governments; a clearly timed transition to set gas prices at levels that incentivize investment and support domestic gas demand growth; and an elimination of legal and regulatory barriers to improve the viability of long-term, capital-intensive projects. This will enable countries to secure long-term, large scale investments.

Conclusion

These measures could address current barriers and unlock opportunities to secure much-needed financing. Policymakers must deliver a multi-pronged approach that sustains needed revenue from exports; enables greater domestic consumption in offtake industries; and builds toward future industrialization, diversification, and growth. This requires a reorientation from using gas to maximize government revenue to using it as a tool to develop the economy and expand job opportunities — an approach that would benefit not only Nigeria, but also similarly positioned countries across Africa.

FIGURE 1: LNG Exports and Electricity Consumption in the World’s Top 10 LNG Exporters (2019)