India, already the third largest electricity producer in the world, is rapidly expanding its power sector. In 2017, India alone accounted for a quarter of the rise in global power demand and is projected to more than triple its electricity consumption by 2040. This trend will significantly boost India’s economic and social aspirations, but has implications for global climate-change action.

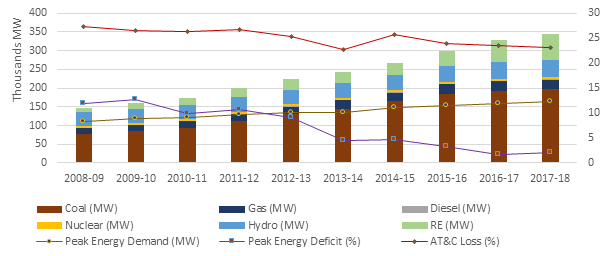

Historically, India’s electrification has prioritized domestic energy security and providing adequate generation for fueling economic growth. The country has made impressive progress, doubling generation capacity in the past decade (Figure 1) and reaching 100% village electrification. Now, the government has two new goals to provide clean, reliable and affordable electricity for all:

- State governments and electricity utilities are to ensure 24×7 uninterrupted electricity supply to all beginning April 2019.1

- Install 175 GW of renewable energy (RE) capacity by 20222 and increase the share of non-fossil electricity generation capacity to 40% by 2030.3

To realize these goals, India will need to:

Take advantage of falling prices for renewable energy

As prices rapidly drop, RE will increasingly provide an alternative source of clean and low-cost electricity. India can meet a large part of its future electricity demand at competitive costs while limiting further environmental damage.

- Improved affordability and the modular nature of RE makes growing penetration attractive.

- Yet a rise in RE also comes with likely disruptions in markets and politics. State-owned banks are heavily invested in coal-fired electricity, while powerful interests and institutions built around the incumbent technology are likely to resist major changes.

- If costs continue to fall, however, RE could keep utilities financially viable while meeting welfare obligations to provide subsidized energy to low income groups.

Assertive planning for the energy transition by promoting markets

- In the past, strong planning for electrification has driven India’s relative success. The coming energy transition will similarly need to be carefully managed for diversification of technology and supply and demand side uncertainties. India also must plan for unwinding the lock-in to conventional energy technologies and managing these transaction costs.

- Coal currently provides significant baseload power supply. Replacing this with intermittent wind and solar will require a more flexible electricity system that can buy and sell power on a far greater scale. An immediate priority is the promotion of a national scale electricity market, establishing linkage between wholesale and retail levels, and fostering flexibility to address future uncertainties

Fixing the financing mechanisms to attract private investment

Meeting the projected future demand will require addition of massive electricity infrastructure for generation, transmission and distribution, which is beyond the limits of public funding.

- A large public capital locked-in to coal-fired electricity is on the verge of becoming non-performing assets (NPAs). In 2018, 34 private coal plants (about 12% of total generation capacity) were declared stressed assets.4 These projects owe Rs 1.74 trillion to banks, amounting to a fifth of the banking sector’s overall NPAs. Public funding to electricity will remain constrained until this capital is salvaged.

- However, penetration of modular RE and their smaller-scale deployment will loosen the linkage between electricity and large capital. The sector should be open to a greater variety of investors, yet India will need to set up financing mechanisms to attract them.

An active role for the federal and state governments

- The central government and each state will need to ensure appropriate regulations and market incentives are in place, while coordinating across a complex web of state-specific political-economy contexts.5

- The government will need to develop mechanisms to unwind the lock-ins, absorb transaction costs, and mitigate the costs to and resistance of market losers.

- Given continued need for state-subsidized electricity to low-income households and distressed farmers, the government will necessarily play an active role even in a market-centric electricity system.

Conclusion: As India moves to the next phase of building its energy future, managing the electricity system will become increasingly complex. While encouraging the market to function, the state must prepare public institutions, utilities, and regulators for a very different future.

Figure 1: Recent Trends in Indian Electricity System

Source: CEA

Endnotes

- 24×7 Power for All: A joint initiative of Central Government with the State Governments, www.powerforall.co.in, accessed on 05 April 2019.

- NITI Aayog, 2015. Report of the Expert Group on 175 GW RE by 2022, New Delhi: NITI Aayog.

- GoI, 2015. Intended Nationally Determined Contribution, New Delhi: Government of India, www.moef.gov.in/sites/default/files/Press_Statement__INDC_English.pdf, accessed on 05 April 2019.

- GoI. 2018. Report of the High Level Empowered Committee to Address the issues of Stressed Thermal Power Projects, New Delhi: Government of India, https://powermin.nic.in/sites/default/files/webform/notices/20_Nov_R1_Draft_Report_HLEC_Final_20_Nov.pdf, accessed on 05 April 2019.

- Navroz K. Dubash, Sunila S. Kale, and Ranjit Bharvirkar, 2018. Mapping Power: The Political Economy of Electricity in India’s States, New Delhi: Oxford University Press.