LCOE = {(overnight capital cost * capital recovery factor + fixed O&M cost)/(8760 * capacity factor)}+(fuel cost * heat rate)+(variable O&M cost)[1]

What is the Levelized Cost of Electricity?

LCOE is the net present value of the unit-cost of electricity over the lifetime of a system.

Pros of LCOE

- Simple. LCOE is a very straightforward analysis. This NREL tool enables easy calculation of LCOE, with ranges for LCOE inputs included for reference.1

- Easily understood. LCOE simplifies the entire project to the most directly relevant data point: how much does the electricity cost.

- Widely used. LCOE data is frequently available or easily computable. It is the most commonly used metric to compare systems around the world.

Cons of LCOE

- Oversimplifies costs. LCOE doesn’t consider all costs associated with an actual financial decision.

- Oversimplifies project context. Ignores project risks, and oversimplifies interest rates within the capital recovery factor, or other elements of the costs of capital.

- Difficult to accurately represent distributed systems. These systems power smaller loads, for instance a building. Efficiency improvements which reduce load in these buildings are not valued because the system cost often does not reduce at the same rate as load. This means the LCOE can be higher for a smaller system powering a more efficient building.2

Practical implications

While it is useful for communicating the basic cost of a project, LCOE:

- Is mostly useful for comparing similar systems in similar contexts (e.g., one natural gas plant vs. another of a similar type).

- Ignores flexibility vs inflexibility.3 Due to the variability of renewables, backup thermal power and/or storage are often needed. This is an additional cost not accounted for in the LCOE of solar or wind. Additionally, in markets with dynamic pricing models, LCOE can obscure competition based on time of day.

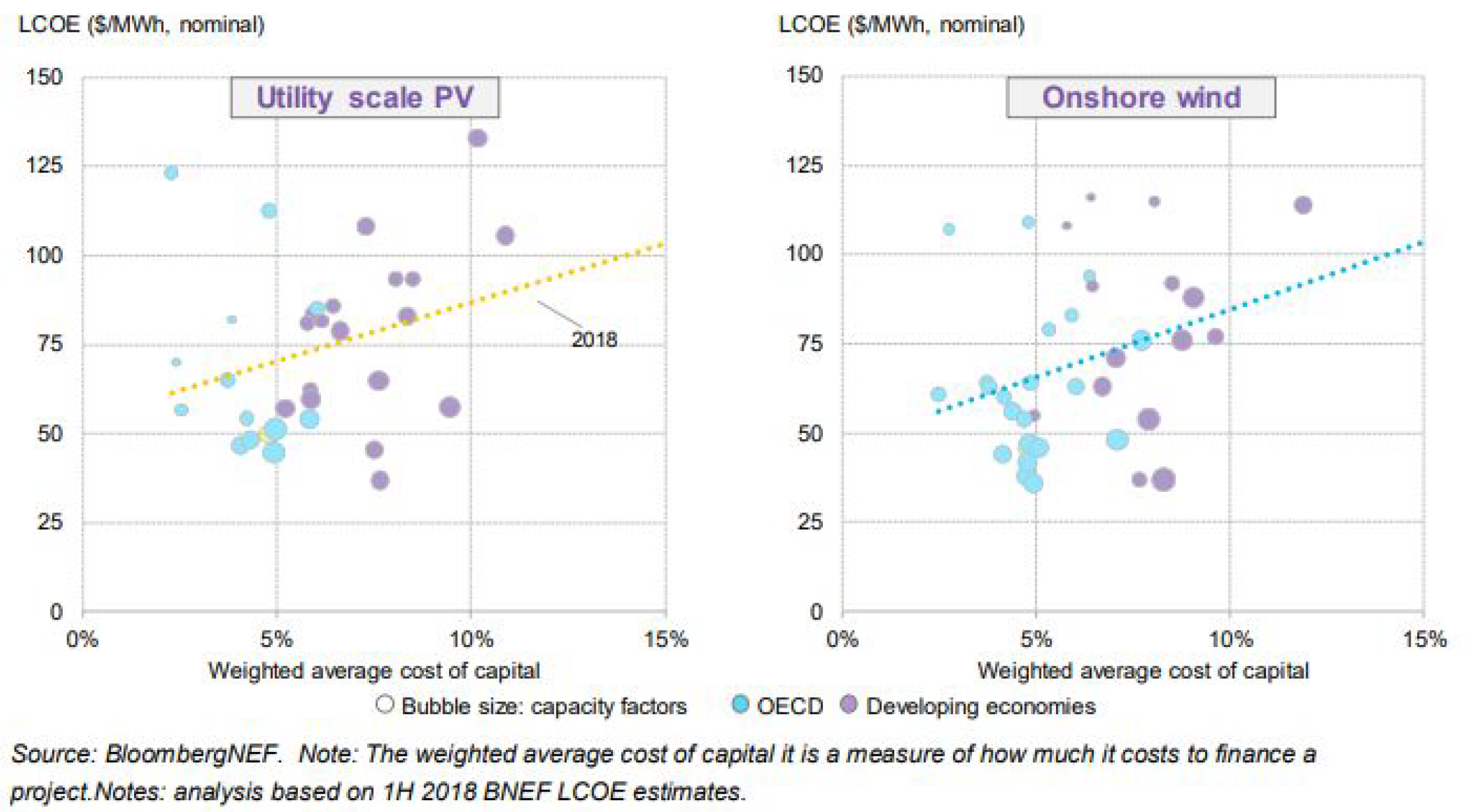

- Misses context.4 Solar, wind and nuclear have higher capital costs but lower operating costs than coal or natural gas, for example. Setting a fixed higher interest rate for an LCOE calculation may favor low capital projects like natural gas plants over high capital solar and wind plants, or vice versa. In emerging markets with higher costs of capital, LCOE can reduce the attractiveness of renewables, shown in Figure 1, or conversely can underestimate the difficulty of financing renewable resources in these markets.

- Masks regional variability when used as average LCOE across different countries. Cost, revenue, and renewables availability all vary greatly among countries. Thus, using an average LCOE value for different locations can be misleading.

- Ignores externalities. Regulatory changes could enforce decreased capacity factors for fossil fuel plants reducing their economic attractiveness and/or increasing their emissions, this is not accounted for with an initial LCOE. Environmental benefits of using renewables are also not valued in a LCOE.

- Does not account for risks.5 For instance fuel supply risks and volatility of oil and gas pricing are not included in an LCOE, nor are regulatory risks. Interest rates reflect financing rates and the weighted cost of capital of an investment. This will also vary based on the risk profile of the entity building the plant, which is not reflected in the LCOE.

How to best use LCOE

LACE = Lifetime cost of project avoided / Lifetime energy generation from avoided project [6]

LCOE is still a powerful screening tool. However, there are unaccounted factors which need to be involved when analysing systems. LCOE works best when combined with other methods to give a more accurate, encompassing comparison of generation systems. These include:

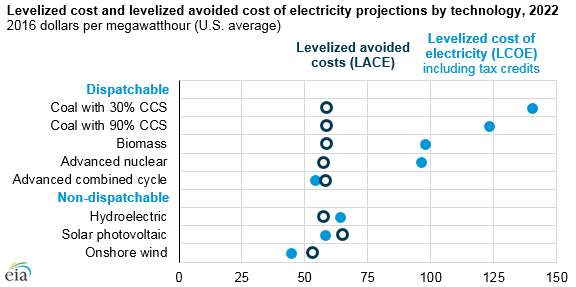

- Using additional tools, such as the Levelized Avoided Cost of Electricity (LACE). LACE assesses a new generation project by measuring the cost for the existing grid to generate electricity which would be displaced by the new project.6 This accounts for marginal production and is more useful for VRE. Figure 2 shows the difference between LCOE and LACE.

- Embedding more contextual information, like adjusting inputs for regional variation. Inputs to the LCOE could be altered for different geographic contexts. Country-specific values for costs, capacity factors and interest rates have been collated by the International Energy Agency and Nuclear Energy Agency,7 The International Renewable Energy Association has more detailed information on inputs for renewables.8

- Avoiding misleading uses, such as direct comparisons between highly variable sources and dispatchable or low-variability sources.

FIGURE 1: Higher financing costs drive up LCOE in Developing economies9

FIGURE 2: LCOE and LACE projections by technology, 202210

Endnote

- NREL. Levelized Cost of Energy Calculator. https://www.nrel.gov/analysis/tech-lcoe.html

- Peter Bronski. Levelized cost of energy: A limited metric. https://www.greenbiz.com/blog/2014/05/21/levelized-cost-energy-metric

- Sklar-Chik, M., Brent, A., & Kock, I. D. (2016). Critical Review Of The Levelised Cost Of Energy Metric. South African Journal of Industrial Engineering, 27(4). doi:10.7166/27-4-1496

- https://www.sparklibrary.com/9-reasons-why-lcoe-can-mislead/

- Aldersey-Williams, J., & Rubert, T. (2019). Levelised cost of energy – A theoretical justification and critical assessment. Energy Policy, 124, 169-179. doi:10.1016/j.enpol.2018.10.004

- https://www.eia.gov/outlooks/aeo/pdf/electricity_generation.pdf

- https://www.oecd-nea.org/ndd/egc/2015/

- https://www.irena.org/costs/Power-Generation-Costs

- http://global-climatescope.org/assets/data/reports/climatescope-2018-report-en.pdf

- http://theamericanenergynews.com/energy-news/power-plants-costs-value-grid-not-easily-reflected-using-simple-metrics