The Imperative for Small Island Energy Resilience

With over 30 storms named, 2020’s Atlantic hurricane season was the most active on record and the tenth consecutive year with eight or more billion-dollar disasters.1 The 2021 hurricane season is already underway, projected to extend the record to six consecutive seasons with above-normal storm activity.2

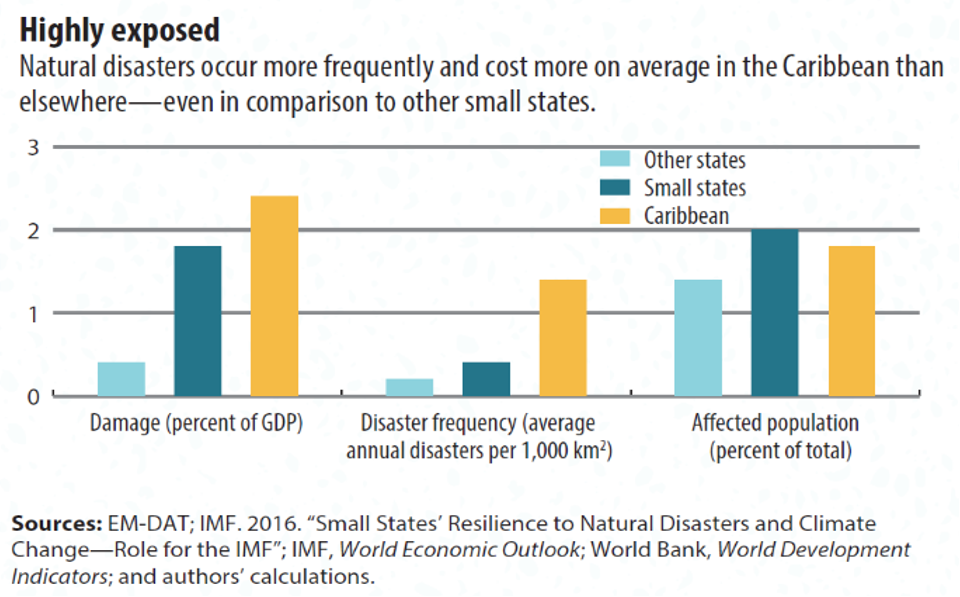

FIGURE 1: Natural disaster impacts to the Caribbean

It is estimated that Caribbean countries suffer annual storm damages equivalent to 17% of GDP on average, with damages often well exceeding the size of the economy – Hurricane Maria is estimated to have cost Dominica 225% of its GDP in 2017.3 Natural disasters occur more frequently and cost more on average in the Caribbean than anywhere else (see Fig 1),4 and are compounded by economic reliance on climate-sensitive industries including agriculture, fisheries, and tourism.

As such, the Caribbean consistently ranks as one of the regions most vulnerable to climate change and is prioritizing adaptation measures and infrastructure that may reduce the costs of climate-related disasters and build resilience to future shocks. Research finds that energy is one of two infrastructure sectors most affected by hurricanes.5 Building resilience in energy systems is essential to reducing the time and cost of post-disaster recovery.6

For power infrastructure, hurricane losses accrue from damages to transmission and distribution networks and widespread transformer and generation unit damage.7 Experience from post-disaster recovery in small island states shows that centralized renewable energy enhances resilience by spatially diversifying generation and reducing reliance on imported fuels. Also, decentralized renewables are less physically vulnerable to storm damage and allow isolation from the grid for faster community-level recovery.8

Despite tremendous political will, ambitious Nationally Determined Contributions (NDCs), and a regionally adopted Caribbean Sustainable Energy Roadmap and Strategy, access to international financing for energy resilience investments remains challenging. Jamaica is one island shedding light on an integrated approach to incentivizing renewable energy development that can also build climate resilience.

The Jamaican Case: An integrated approach to renewable development

Jamaica has one of the longest histories with renewable energy in the region.9 Historically, it had one of the Caribbean’s most expensive electricity rates, which provided the initial incentive for diversification. Jamaica now experiences average annual losses of 0.1%-1.15% of GDP from hurricane damage. Hurricane Ivan for example caused damages of USD 360 million in 2004.10 Heavy fuel oil and subsequently natural gas were originally the bulk of net generation on the island but given the policy environment created for renewables, significant steam generation capacity has since been retired, and renewables now account for approximately 12% of total annual net generation, far above the observed Caribbean average of 5.3%.11,12 Jamaican energy policy prioritizes three key objectives which support this growing diversification: large-scale renewable energy investment; decentralized energy penetration; and grid planning for integration.

For Large Scale Renewables: Energy Auctions

Jamaica represents the electricity market design popular in Caribbean nations with higher renewable energy penetration: a vertically integrated, single buyer electric utility, with IPP participation.

Since the market opened to IPP competition, there have been two major renewable energy capacity auctions launched by the Office of Utility Regulation (OUR).

- In 2008, OUR announced its first “build own operate” renewable energy auction, awarded to the Jamaica Public Service Company Limited (JPS) for a 6.4 MW hydro plant and a 3 MW wind farm.13

- The National Energy Policy was established in 2009, laying out an aggressive goal of 20% installed renewable energy capacity by 2030. To meet this target, a second round of auctions in 2012 and 2015 resulted in over 115MW of generation licenses awarded through 20-year power purchase agreements (60.3 MW and 57 MW of large-scale wind and solar respectively). 14

Globally, long-term PPA renewable energy auctions are a highly successful mechanism for driving capital into the sector. Jamaica saw $183 million in investments in the year 2015 alone.15 In fact approximately 80% of the current renewable capacity in Latin America and the Caribbean is developed through public tenders and auctions.16 Jamaica is currently the only Caribbean country to employ auction mechanisms – as others focus more on feed-in-tariffs and tax incentive schemes.17

For Distributed Renewables: Net Billing

To incentivize decentralized renewables, the OUR piloted a net billing program in 2012 through JPS, Jamaica’s electric utility company and sole distributor of electricity. The program:

- Made renewable systems of up to 10 kW for residential and 100 kW for commercial installations eligible for net billing.

- Provided consumers with JPS’s short-term variable avoided-cost rate plus 15% for any self-generated electricity delivered to the national grid (averaging US$ 0.18/kWh over the pilot period) in five-year contracts.18

- Ensured that Jamaica collects no value-added tax (VAT) for solar or wind components.

- Launched microcredit products through the Development Bank of Jamaica for residential and small commercial customers for energy efficiency and renewable energy equipment.19

The net billing program was highly successful, receiving over 300 applications by 2015, roughly split between commercial and residential rooftop solar, though with commercial installations (averaging 24.6 kW in size) accounting for almost 10 times the installed capacity of residential solar (averaging 4.2 kW). Program participants reported up to 30% reductions in their electric bills. An improved program, relaunched in 2016, has issued almost 800 net billing licenses accounting for 5.8 MW of new capacity.20 In fact, recent research finds that feed-in-tariffs and net-metering policy have indeed been the most effective policy mechanisms unlocking renewable energy growth in the region thus far. 21

For System Stability: Integrated Planning

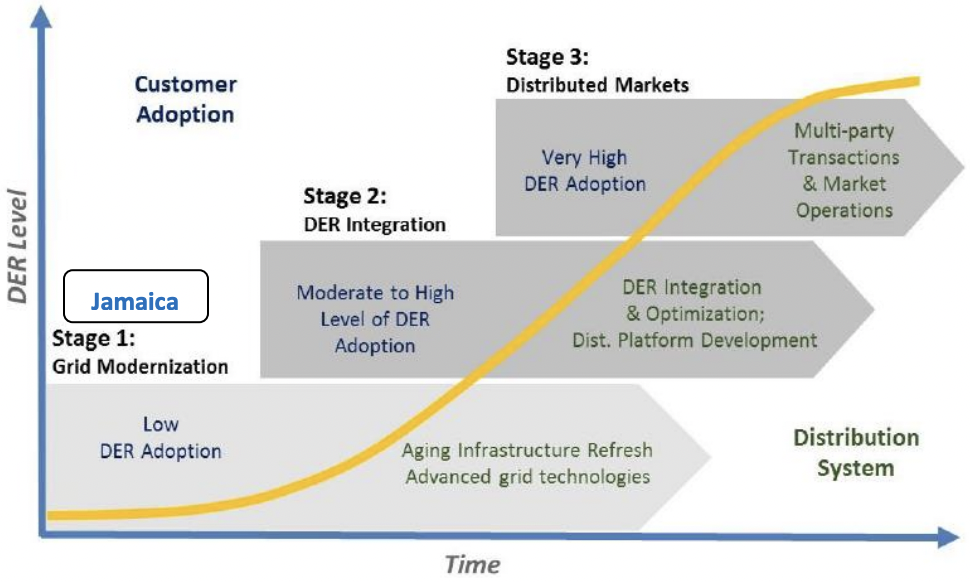

Diversifying the generation mix in these ways changes the amount, shape, and predictability of net loads. An integrated approach to system planning that focuses on reliability, stability, security, and power quality is critical to manage a modernized grid, especially as the OUR aims to reach very high levels of distributed energy adoption (see Figure 2). 21 After 2016, JPS reported stability issues due to the variability of renewable generation. In response, it developed an Integrated Resource Plan (IRP) that included:

- An evolving reserve margin plan.

- Rollout of AMI smart meter technology to improve loss management and detection.

- Upgraded grid control systems to improve reliability and accommodate integration of variable sources like solar and wind.23

- A 24.5MW hybrid energy storage system commissioned in 2019, which has helped improve stability and reliability.24

FIGURE 2: Jamaica’s Distributed Energy Evolution Framework (IRP, 2018)

Lessons Learned: Progressive Policies for Renewables and Resilience in Islands

Jamaica is an example of an island that has identified renewables as a key resilience measure. Today, Jamaica has another 400MW of clean power planned for development (320MW of solar and wind, and 74MW of hydro, waste-to-energy, and biomass).25 The latest auctions in 2018 – 2022 alone will represent 15% of installed capacity, and in recent reports the government has accelerated its ambitions to 50% net generation from renewable energy by 2030.26 According to the IRP, this renewable energy expansion will result in a more flexible national power system capable of withstanding shocks in fuel price and resilient to frequent wide-scale interruptions, with added benefits of marked efficiency gains, reduced transmission losses, avoided costs, and up to 50% emissions reduction.27

Jamaica demonstrates how an “all of the above approach” with specific mechanisms for large-scale generation, and attractive incentives for distributed generation, can drive renewables deployment. Key lessons learned include:

- Opening the market to IPP competition and encouraging access to commercial finance, even at the micro-level, were key to creating the enabling environment for policy interventions.

- Auction design is complex, and for auctions to be successful, there must be enough investor competition for the auction to be oversubscribed to drive down the costs.

- Auctions should provide widespread access to data for bid development, as well as clear guidelines on fines and obligations. 28

- Access to consumer finance at the local level is key for distributed energy adoption, which presents an important opportunity for local and regional banks.

- Careful monitoring of grid performance and an integrated framework for responsive action is important to manage the grid with expanding renewables penetration.

Caribbean islands must work hard to improve the enabling environment for renewable energy given the existing challenges of access to finance. Well-designed incentives schemes, comprehensive national energy policy, and clear regulator roles, mean Jamaica could possibly exceed its renewable energy goals – setting a model for other islands to follow.

Endnotes

- NOAA, 2020.

- NOAA, 2021.

- UNDP, 2019.

- IMF, 2018.

- The other sector is transportation.

- OAS – ECPA, 2019.

- Ibid.

- Weir & Kumar, Natural Hazards Vol. 104, 2020.

- Shirley & Kammen, Energy Policy Vol. 57, 2013.

- World Bank, 2021.

- Office of Utility Regulation, 2020.

- ClimateScope, 2019.

- OUR, 2008.

- ClimateScope, 2019.

- Ibid.

- Viscidi & Yépez-García, 2019; Lopez Soto et al., 2019.

- GWEC, 2019.

- Doris et al., 2015; NREL, 2015.

- DBJ.

- Jamaica Observer, 2019.

- Kersey, Blechinger & Shirley, 2021.

- IRP, 2018.

- Ibid.

- IRP, 2018.

- ClimateScope, 2019.

- Climate Action, 2018.

- IRP, 2018.

- IDB, 2019.