Over the past 30 years, most countries in South Asia have introduced market-oriented reforms geared at addressing structural obstacles to power sector development. Reforms generally centre around five elements, together known as the ‘standard model’ of reform:

- Independent regulation supports the rationalization of tariffs and reduces opportunities for political interference in tariff-setting.

- Commercialization of power utilities allows for the separation of policy, governance, and management functions and introduces corporate governance at power utilities.

- Unbundling power utilities removes conflicts of interest along the value chain and allows for competition in competitive segments (i.e., generation and distribution) to promote least-cost development decisions.

- Opening the sector to private sector participation (PSP) in order to attract alternative forms of finance, expertise and technology transfer, while fostering competition.

- Regionalizing electricity trading as a means to increase energy security and regional integration.

While the relative size, resource mix, and level of development among power systems in South Asia was quite diverse at the start of the 1990s, most countries across the region initiated power sector reforms under similar external, and sometimes internal, pressures and have since followed comparable reform paths and encountered common challenges.1

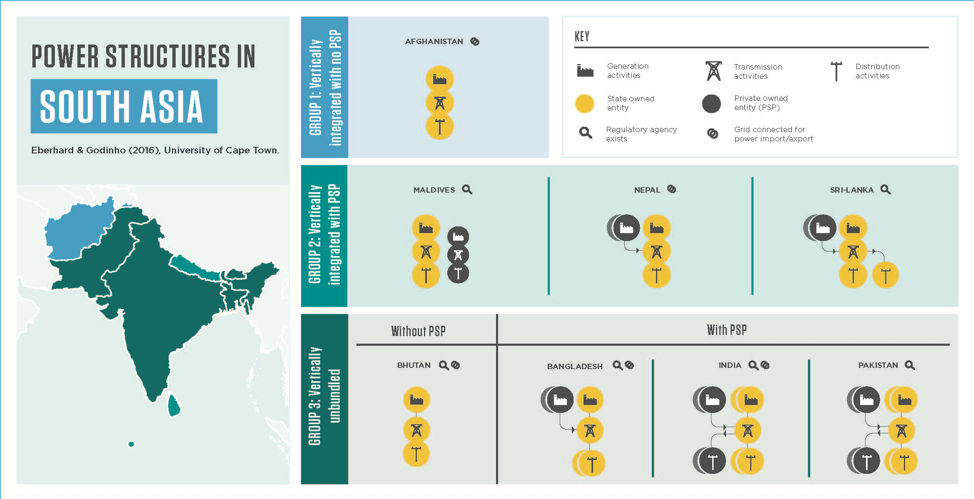

In the figure below, the status of market-oriented power sector reforms in South Asia (as of 2016) is depicted. Countries are divided into three rough groups, according to structure and private sector participation:

- Unreformed – traditional state-owned, vertically integrated utility model persists. Only Afghanistan falls into this group.

- Vertically integrated with PSP – the traditional model remains but allows for some PSP, primarily through Independent Power Producers (IPPs) or small utilities that serve single industrial customers. These are almost always very low market share. The Maldives, Nepal, and Sri Lanka are in this second group.

- Partially or Fully Unbundled – these countries have followed different strategies for unbundling and most allow for private sector participation through IPPs and/or concessions. In Bhutan, only Generation has been unbundled and there is no private participation in the sector. In Bangladesh, India and Pakistan, full vertical unbundling has been implemented and there is private sector participation in generation and/or distribution segments.

Endnotes

- Bhattacharyya, 2007; Jamasb et al., 2014; Sen, Nepal & Jamasb, 2016.