Summary: South Africa’s energy crisis has deepened, but could still get worse. While Eskom’s issues are myriad, closing the growing supply gap is a first-order priority.

Relevance:

- State-owned power company Eskom is technically insolvent and implementing daily rolling blackouts (‘load-shedding’) at a huge cost to the economy and society.

- The Eskom crisis has implications for the entire southern African region. Once a major exporter, South Africa now seeks to import more power from its neighbors.

- Solving the Eskom crisis will also be essential to the success of South Africa’s low-carbon transition, to be supported by international climate finance through the Just Energy Transition Partnership.

Load-shedding is increasing as the supply gap grows

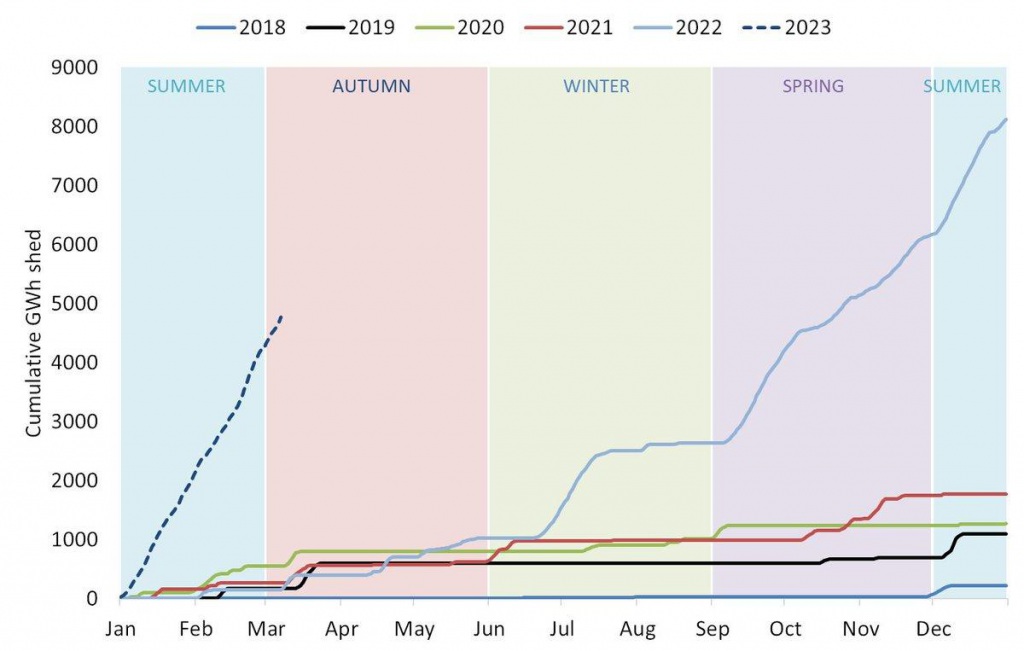

Eskom has indicated that citizens and businesses should prepare for at least four hours of daily power outages for at least the next two years, with 2,000 MW of the demand ‘load’ regularly being ‘shed’ to keep the grid stable (load-shedding). Experts, including the former Eskom CEO, expect eight hours or more of load-shedding to be the norm by July 2023.1 Closing the supply gap would require 6-9,000 MW in the immediate term.

FIGURE 1: Load-shedding per cumulative GWh shed per year 2018-2023

Source: Bureau Economic Research, 2023.

Eskom supply continues to decline and recovery is unlikely

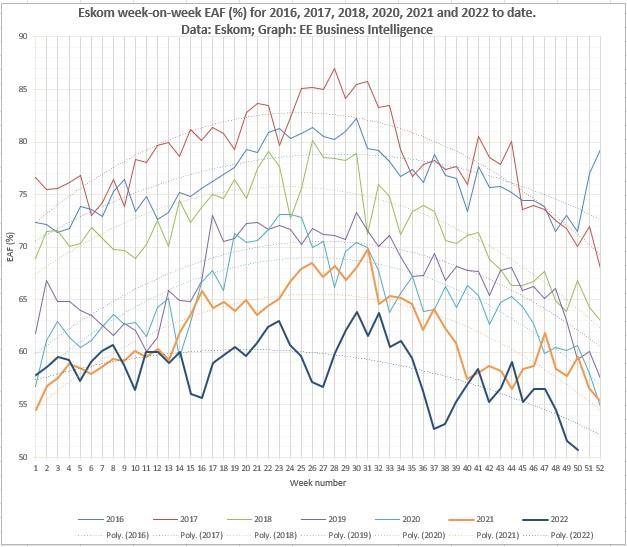

The energy availability factor (EAF2) of Eskom’s plants decreased from 66% to 58% between 2019 and 2022. This trend looks likely to continue. In the first two months of 2023:

- EAF was consistently below 55%, with an average of 52% and low of 49% (Figure 3).

- The unplanned outage factor3 averaged 34% compared to 30% the previous year. 4

FIGURE 2: Eskom availability factor 2016-22

Source: EE Business Intelligence.

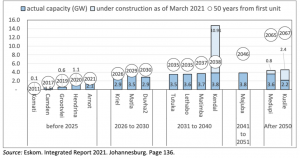

The declining performance of Eskom’s coal fleet – which accounts for 86% of its installed capacity – is the main cause. Most of the fleet is fast approaching or past retirement age (Figure 3).

FIGURE 3: Eskom coal fleet by age

Source: Eskom, 2021.

After decades of poor upkeep and insufficient investment, it is unreasonable to expect improvements without massive and costly maintenance works (which would also take power offline). But analysts suggest this approach would be more expensive than procuring new power and is unlikely to lead to a significant recovery in capacity due to the extent of damage at many plants.5

Old and damaged plants aren’t the only issue; newer plants have also significantly underperformed. Many – including Eskom – attribute related delays, spiraling costs, design defects, and poor performance to corruption and sabotage.6,7,8

- Tutuka: With an EAF of around 33% in January 2023, the 3,650 MW Tutuka coal plant is the worst performing of Eskom’s fleet despite being one of the ‘younger’ plants.9

- Medupi & Kusile: The biggest and newest plants are designed to run with an EAF above 80%, but Medupi’s EAF for January 2023 was 58% and Kusile 25%. The two 4,800 MW plants are planned to be completed over a decade late (in 2023 and 2026, respectively) and the units currently in operation are already underperforming.

The pipeline of new power outside Eskom is growing

Recent amendments to the Electricity Regulation Act (ERA) allow for:

- More private power. Legal changes increased licensing thresholds from 1 MW to 100 MW. (Previously, any new generation capacity above 1 MW could only be procured by the Minister of Minerals and Energy.) The private sector response has been immediate. At the end of February 2023, renewable private projects at ‘budget quote’ phase (a key step before financial close) increased to 13.4 GW, overshadowing the ~3.8 GW in private power procured by the Ministry of Minerals and Energy through the REI4P.

- Municipal power. Municipalities can now procure power directly instead of going through Eskom. Some of South Africa’s biggest (and richest) municipalities have already begun to do so. For example, eThekwini plans to procure 400 MW from gas and solar IPPs, Ekurhuleni has awarded tenders to 46 IPPs for 680 MW from renewables, and the City of Cape Town has tendered 300 MW, also from renewables.10 Municipalities also plan to increase solar rooftop. A 25% national rebate for solar PV was announced in early 2023.11

It should be noted that structural inequalities mean that not all municipalities or citizens can contribute to or benefit from the increased scope for private participation in the sector – government support and interventions will be essential to advancing energy justice. Nevertheless, these trends indicate that municipalities, the private sector, and individuals can be highly responsive to government actions that create opportunities for their involvement in the power sector.

Attracting sufficient new power hinges on updated power plans and reforms

The response from private power producers offers a lifeline and some hope for South Africa. But crisis responses do not address underlying structural issues. To create an enabling environment for new power investment, the government will need to:

1. Set realistic targets for Eskom’s plants and update the power plan

The South African government’s current power plans and targets are out of touch with the reality of Eskom’s declining fleet performance:

- Power targets: The Minister of Public Enterprises has charged the Eskom board with increasing the EAF to 75% and the government intends to set EAF targets for all coal plants. Efforts to maintain existing capacity make sense but should not be pursued at any cost or where they are unlikely to succeed, especially if there are cheaper alternatives.

- Power plan: The 2019 Integrated Resource Plan (IRP, the primary power and procurement planning document) assumes Eskom will have an EAF of 70% or more, which is obviously no longer realistic. Government aims to update the IRP in 2023 – the integrity of the plan will depend on realistic assumptions.

2. Implement reforms that increase competition and reduce political influence

Government has long promised but failed to implement the market-oriented reforms laid out in the 1998 White Paper on Energy Policy, including: opening the grid to private producers, ending Eskom’s monopoly, and reducing political control over power procurement. Reform plans were revived in 2019 with some progress:

- A draft Electricity Regulation Act Amendment Bill was published in February 2022. A revised version was finalized (but not released publicly) in January 2023 for submission to Cabinet, and the President has said that it will be tabled in Parliament later in the year.12

- An independent state-owned transmission system operator is supposed to be established. Key reforms in the bill include a “competitive multi-market” structure and transmission expansion plans.

- However, discretionary ministerial powers might increase. The draft bill leaves the door open for political interference, undermining principles of competition and the independence of the transmission system operator by giving additional discretionary powers to the Minister of Minerals and Energy.

Conclusion: Government cannot afford to delay reforms again, nor should it expand the Minister of Minerals and Energy’s stranglehold over the sector. To close the supply gap and keep it closed, the South African government needs to ensure reforms not only get implemented but also that they increase competition, transparency, and institutional independence.

Endnotes

- Carmen Mileder, Experts warn of decade-long load-shedding crisis in South Africa, BizNews, Mar. 2023.

- Ratio of the available energy generation over a given time period to the maximum amount of energy which could be produced over the same time period.

- Ratio of energy losses over a given time period to the maximum amount of energy that could be produced over the same time period.

- System status reports, Eskom, 2023.

- Terence Creamer, Accelerating replacement generation rather than 75% EAF should be main Eskom performance measure, Creamer Media’s Engineering News, Nov. 2022.

- Search Results for: sabotage, Eskom, 2023.

- Denene Erasmus, Eskom fraud: exorbitant prices paid at Tutuka power plant, Business Day, Mar. 2023.

- SIU welcomes the arrest of former Eskom executive and seven others, Special Investigating Unit, Oct. 2022.

- Denene Erasmus, Eskom fraud: exorbitant prices paid at Tutuka power plant, Business Day, Mar. 2023.

- Graeme Raubenheimer, How far are SA’s metros from taking advantage of the IPP 100MW waiver? Not very, Eyewitness News, Aug. 2022.

- Rooftop solar in South Africa still faces these major challenges, Business Tech, Feb. 2023.

- Cyril Ramaphosa, President Cyril Ramaphosa: 2023 State of the Nation Address, South African Government, Feb. 2023.