Eskom, South Africa’s state-owned power company, is in an existential crisis. Problems at Eskom have regional reverberations because it is the continent’s largest utility and trades power with seven countries.

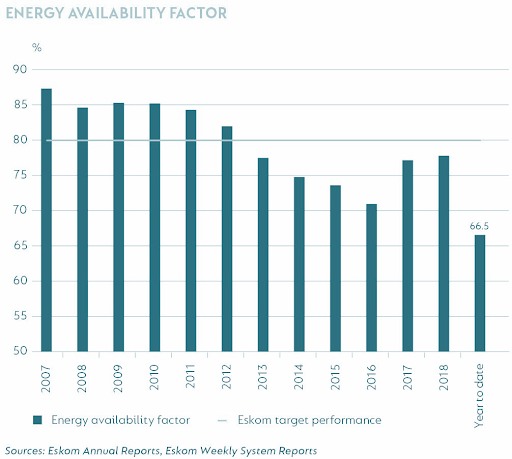

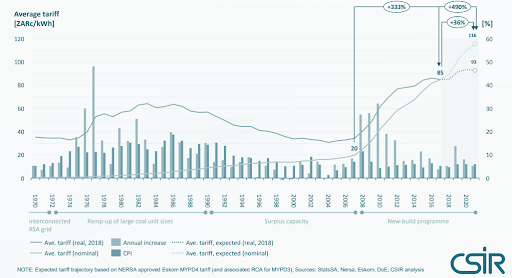

More than a decade of mismanagement, governance failure, spiralling costs, and the accumulation of unmanageable debt has put Eskom into a death spiral. Supply security has deteriorated rapidly, and the utility has resorted to load-shedding and rolling blackouts more frequently, first in 2007/08, then 2014/15, and again in 2018/19. The availability factor of the primarily coal generation now stands at just ~66%.1 This unreliability, paired with 400% price increases over the last decade (the basic tariff is now R1.06/kWh or $0.07/kWh), has cut demand and dramatically increased non-payment rates.2 Eskom, which once enjoyed a higher investment grade than the sovereign, is now chronically indebted, unable to recover OpEx and has been relegated to junk status.3

FIGURE 1: Eskom energy availability factor since 20074

Government Reaction: cash + reforms

The South African government has responded in the short-term via capital injections. Eskom was first bailed out in 2015, but more bailouts are now planned for 2019-22, with costs reaching 2.6% of the total national budget – accounting for more than half the budget deficit in 2019.5

The long-term plan is to restructure the sector.6 Additional measures include:

- Finalising the Integrated Resource Plan (IRP)

- Strengthening the National Energy Regulator (NERSA)

- Amending or applying legislation to increase transparency and accountability in the sector

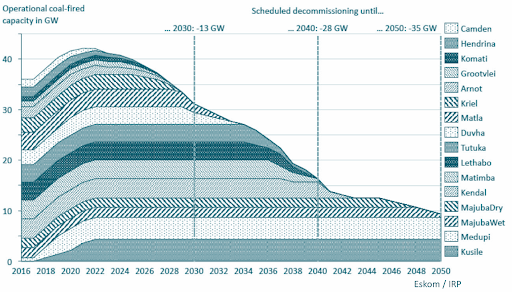

Reviewing universal basic electricity allowances (the first 50 kWh per month to each poor household is free) may also be a necessary intervention, as electricity prices have become unaffordable for many South Africans. With decommissioning of many of Eskom’s coal power plants around the corner, contingency plans for coal workers and communities will also be necessary.7,8

Killing the coal dinosaur: How did we get here?

Historically, Eskom’s coal power plants were linked to privately-owned but publicly-supported mines, geared toward meeting the demand of energy intensive anchor customers.9 This meant supply security, costs, and revenue could be managed effectively for each plant. This low risk arrangement also laid the foundation for a pattern of over-investment in new coal stations, which resulted in a financial emergency in the sector, but growing demand allowed Eskom to weather the 1980s crisis.10 The same will not be true for this current crisis because of:

- Coal Supply Insecurity. Breaking with the past, Eskom has failed to secure long-term coal contracts and has not invested in tied mines. The prevalence of expensive short- and medium-term supply contracts, as well as the breakdown of efficient transportation, has increased the real price paid for coal by around 300% per ton over the last two decades.11

- Expensive New Generation. Eskom’s partly commissioned, huge supercritical power plants, Medupi and Kusile – at 4.8 GW each – have been plagued by extensive delays, engineering faults, and cost overruns.12 This has led to the projects becoming major capital-sinks.

- Failing Existing Plants. Eskom’s fleet is in a state of disrepair and financial constraints prevent critical maintenance and mandated environmental retrofitting. According to the decommissioning schedule, Eskom will shutter 13 GW by 2030, 28 GW by 2040, and 35 GW by 2050 – around 80% of its fleet.13 Decommissioning may even be accelerated due to costs, poor performance, and the emergence of cheaper alternatives.14

It is clear that Eskom’s coal-driven business model is no longer fit for purpose. Bailouts will not be able to keep up with spiralling costs and boosting revenue through higher tariffs is unrealistic, as higher prices will likely expedite grid defection while suppressing a decreasing base of captive demand.

FIGURE 2: Eskom Decommissioning Schedule15

Root of the Problem: Governance Failures

Eskom is a vertically integrated utility, which holds a near monopoly on the power sector, has always enjoyed special relationships with government, private sector coal, energy intensive users, and organized labour due to centralized employment. This has provided a foundation for rent-seeking, governance failure, political capture of critical policy and planning processes, and poor transparency. While some inquiries have been made, they likely only scratch the surface and may not reveal deeper collusive relationships that have evolved over decades.16 Nevertheless, Eskom’s recent reporting of R19.6 billion in irregular expenditure for the period 2012-18 is one indicator of the costs associated with structural governance failures.17

At the same time, Eskom’s hands are partially tied. Managing costs (of coal and labour) and pursuing sustainable revenue via tariff reform are politically fraught. Despite commitments to market-oriented reforms, the utility has resisted restructuring and actively impeded private sector participation. Simultaneously, the government has been unable to address fundamental issues through reformed policy planning. Even as renewable prices fall, there is significant political inertia to maintaining a coal-based energy mix, especially because of the massive sunk costs for Medupi and Kusile.

What Next for Eskom?

- Refinancing to contain financial contagion. Around 75% of Eskom’s debt is state guaranteed, so a default could trigger cross-defaults on government bonds. There are a number of options on the table, including the establishment of a special purpose vehicle to consolidate and de-risk debt. However, questions remain around the implications for the sovereign’s credit rating. A Chief Restructuring Officer (CRO) was appointed by the Minister of Public Enterprises at the end of July 2019, with a mandate to interrogate the various proposals for debt restructuring and management.

- Structural unbundling. Vertical unbundling — splitting generation, transmission, and distribution into separate entities — has been proposed. This would allow the transmission business, the most financially-viable part of the utility, to secure more affordable debt. Proponents of unbundling argue that it would also facilitate least-cost procurement and dispatch, increase transparency, and improve governance through specialization and recalibration of incentives.

FIGURE 3: Tariff Trajectory based on NERSA approved MYPD4 tariff18

Endnotes

- Longano. (2019). South Africa’s Power Conundrum – A Debt Manager’s View.

- Eberhard & Godinho. (2017). Eskom Inquiry Reference Book.

- Eskom. (2019). Integrated Report.

- Eskom Annual Reports, Eskom Weekly System Reports

- Mboweni. (2019). Special Appropriation Bill.

- Ramaphosa. (2019). State of the Nation Address.

- Strambo, Burton & Atteridge. (2019). The End of Coal? Planning a “Just Transition” in South Africa.

- Cock & Fraser. (2019). Who Will Make the Energy Transition Just?

- Clark. (2019). South Africa’s State-Owned Companies: A Complex History That’s Seldom Told.

- Baker et al. (2015). The Political Economy of Decarbonisation: Exploring the Dynamics of South Africa’s Electricity Sector.

- Burton, Caetano, & McCall. (2018). Coal Transitions in South Africa.

- Donnelly. (2019). Medupi and Kusile: Costly and Faulty

- Ministry of Energy. (2018) Integrated Resource Plan.

- Steyn, Burton & Steenkamp. (2017). Eskom’s Financial Crisis and the Viability of Coal-Fired Power in South Africa.

- South African Department of Energy

- Godinho & Hermanus. (2018). Re-Conceptualising State Capture: With A Case Study of South African Power Company Eskom.

- Khumalo. (2018). Eskom Posts R2.3 bn loss, R19 bn in irregular expenditure.

- The Council for Scientific and Industrial Research (CSIR), 2019

Image Credit:

“President Jacob Zuma visits ESKOM and South African Airways, 6 May 2016” by GovernmentZA is licensed under CC BY-ND 2.0