Electrification in the capital, Dhaka, began over 100 years ago, yet Bangladesh has still not achieved full electrification (~75%) for its population. While the country will likely achieve universal access soon, load-shedding is still a common occurrence and a major obstacle to economic activity. In order to prepare for a population that will be far bigger (200 million or more by 2050) and aspires to be richer (aiming for Developed Country status by 2041), the government plans to build a total of 60 gigawatts (GW) of new generation by 2041.

Principal Challenges

- Insufficient Generation. Installed capacity is around 20 GW, but actual generation is less than 12 GW, which falls short of current demand. The government projects demand to reach at least 52 GW by 2041.1

- Reliability. World Bank surveys indicate outages are a major obstacle to growth, with businesses experiencing several hours of outages per day. Reliable power is therefore a priority for the government.

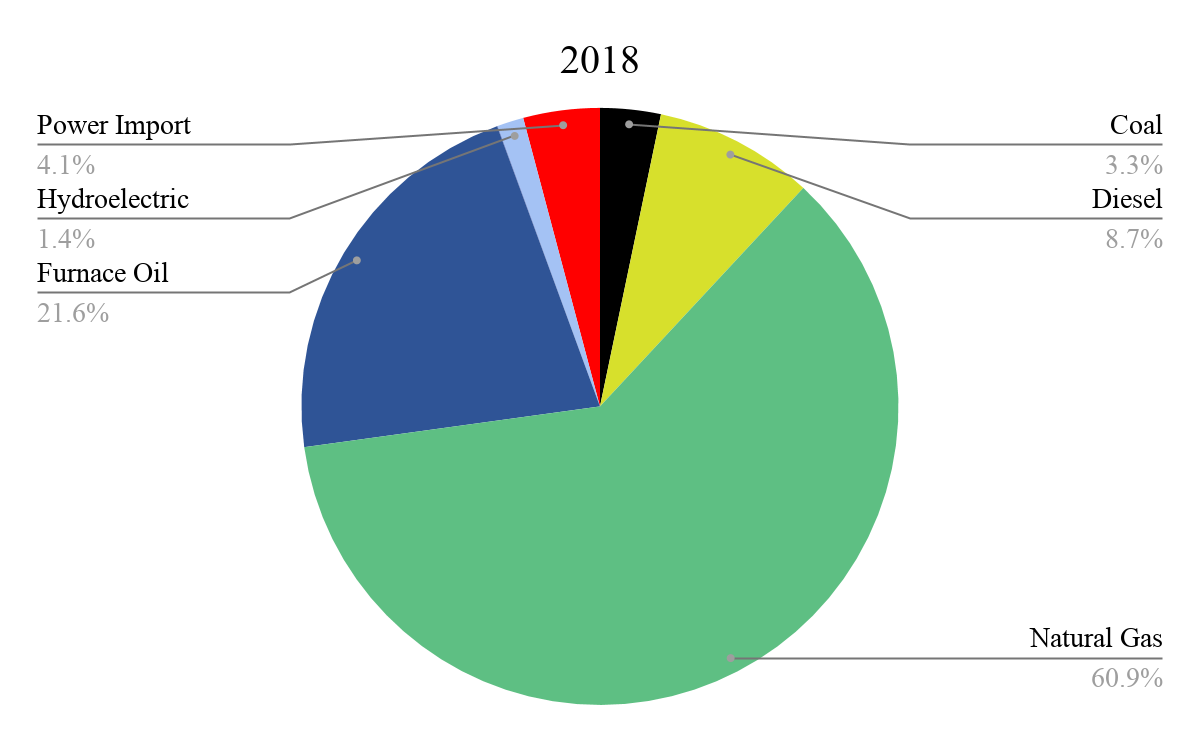

- Domestic gas dependence. Bangladesh is overwhelmingly reliant on heavily-subsidized domestic sources of natural gas (61% of total generation). Domestic gas reserves are slowly being depleted, which means imports of much more expensive LNG will be needed, requiring either significant new subsidies or price increases.

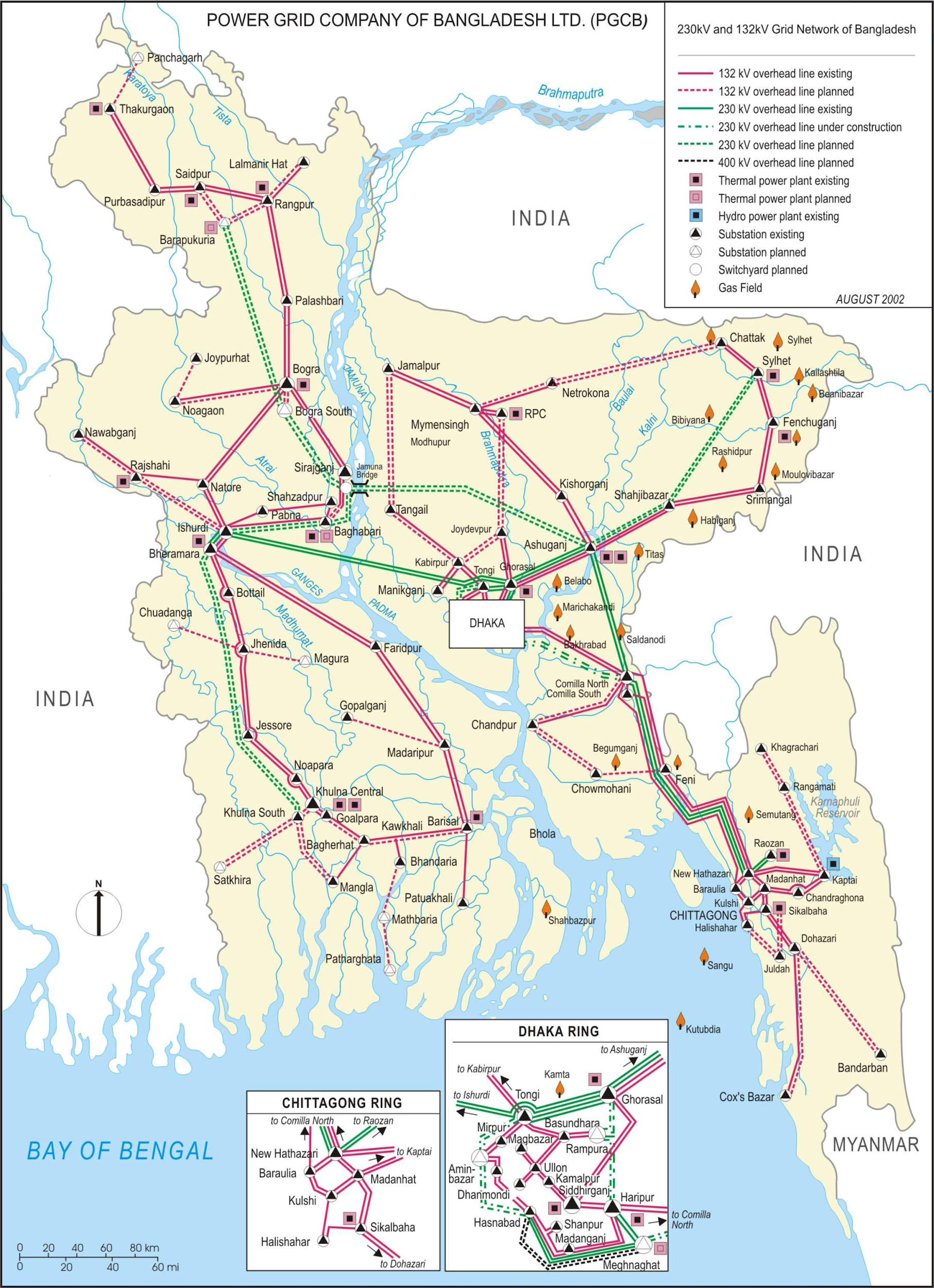

- Poor Transmission Capacity. While transmission losses of 14% compare favorably to other South Asian markets, transmission capacity has not kept up with generation growth.2

Goals and Future Trends

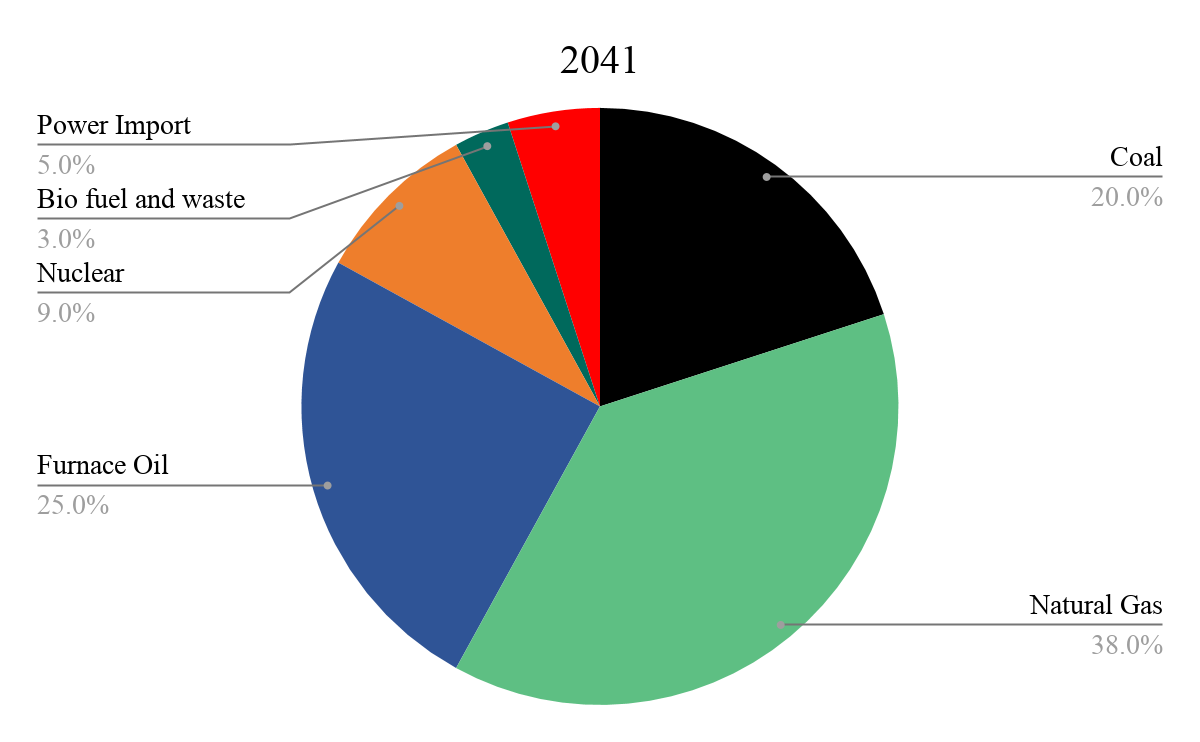

- Diversify. The majority of new power supplies coming online include coal, imported LNG, nuclear, and regional trading (see Figure 1 and below). Due to seasonal water flows and limited land area, renewables are not seen as a primary contributor.

- Continue Privatization. Bangladesh will need an estimated $35 billion in power sector investment by 2041 to meet its goals. While gas production is still government-controlled, independent power producers began investing in smaller generation modules (200-300 MW), but the government has put several incentives in place to attract more.3

- Modernize Grid Infrastructure. Inadequate transmission and distribution systems, particularly in the southern and western regions of the country, create bottlenecks. There are plans to build 8,000km of new transmission and 120,000km of new distribution lines by 2021. Very high population densities challenge new developments, especially in the megacity of Dhaka where public services are already overloaded.4

- Boost cross-border interconnectivity. Bangladesh intends to import power from India, Bhutan, Nepal, and Thailand (via Myanmar). Progress on this front is already underway: Bangladesh is doubling the capacity of its interconnection with India to 1 GW, and the government has begun exploring with neighbors potential co-investments in hydroelectric power plants.

FIGURE 1: Transmission Infrastructure of Bangladesh

Source: PGCB

FIGURE 2: Bangladesh’s electricity mix, 2018 vs. 2041

Source: Power System Master Plan 2016, Energy and Mineral Resources Government of Bangladesh

Endnotes

- Power System Master Plan 2016, Energy and Mineral Resources Government of Bangladesh.

- Taskin Jamal and Weerakorn Ongsakul. (2012). Smart Grid in Bangladesh power distribution system: Progress & prospects. 10.1109/SCES.2012.6199096.

- Mamun Rashid, Yogesh Daruka, Amit Kumar. Transforming the power sector in Bangladesh. PWC. 2018.

- Poppy Mcpherson. “The dysfunctional megacity: why Dhaka is bursting at the sewers.” March 2018. The Guardian.