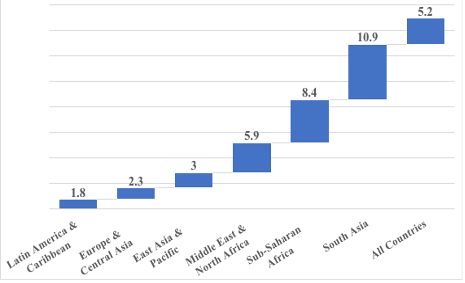

As availability and quality of grid-based electricity services remain abysmal in many parts of Africa, homes and businesses have sought coping strategies to mitigate the adverse economic impacts of service interruptions. Approximately 78% of firms in Sub-Saharan Africa routinely experience power outages, and more than 40% rank poor electricity service as the biggest constraint to their operation. Many firms on the continent resort to self-generation to ensure continuous operation and minimize the impacts of poor reliability. Despite prevalent self-generation, firms in Sub-Saharan Africa still report approximately 8.4% of annual sales lost to power outages relative to the global average of 5.2%.1

FIGURE 1: Losses due to electrical outages (% of annual sales)

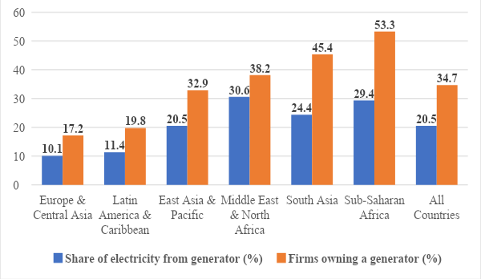

Self-generation is in high demand in Sub-Saharan Africa

- Approximately 53.3% of firms in Sub-Saharan Africa engage in self-generation – the highest in the world.

- Self-generation capacity accounts for over 6% of the installed generation capacity in Sub-Saharan Africa.2

- Approximately 29.4% of electricity used by firms in the region comes from self-generation.

FIGURE 2: Proportion of firms engaging in self-generation and share of electricity generated (%)

Self-generation is a costly second-best survival strategy

- Self-generation guarantees continuous business operation during power outages, lowering the adverse economic impact of grid supply interruptions.

- Outage losses for firms engaging in self-generation would have increased by as much as 183% if those firms depended solely on the grid.

- Firms without self-generation could have avoided an estimated 6-46% of reported losses if they adopted self-generation during grid power outages.

TABLE 1: Estimated economic benefits of Self-generation3

| 2030 Projected Energy Mix | ||

|---|---|---|

| Fuel Type | Installed Capacity (MW) | Likely Generation (TWh) |

| Hydro (includes imports) | 60,977 | 206.6 |

| Pumped Storage | 10,151 | 4.4 |

| Small Hydro and Biomass | 15,000 | 7.2 |

| Coal + Lignite | 266,911 | 1357.7 |

| Gas | 25,080 | 35.4 |

| Nuclear | 18,980 | 113 |

| Solar | 280,155 | 484.2 |

| Wind | 140,000 | 309.1 |

| Battery Storage | 27,000 |

Policy Suggestions

- Increase investment in power projects for additional generation capacity and network rehabilitation and expansion to ensure supply reliability. Adopting a public-private partnership approach can win investors’ confidence and edge against the dwindling government revenue that currently limits the public sector’s ability to finance infrastructure. This investment should be incentivized by implementing cost-reflective tariffs.

- Firms operating in the same neighborhood can jointly invest in self-generation to reduce generation cost owing to economies of scale.

- Introduce policies that allow firms with excess capacity to sell to other firms or the grid, which would encourage a more robust network of supply and ease outages.

Endnotes

- Enterprise Surveys (http://www.enterprisesurveys.org), The World Bank.

- J. Steinbuks, & V. Foster (2010). When do firms generate? Evidence on in-house electricity supply in Africa. Energy Economics 32 (3).

- M.O. Oseni & M. G. Pollitt (2015). A firm-level analysis of outage loss differentials and self-generation: Evidence from African business enterprises. Energy Economics (52).