Given pervasively high electricity tariffs across the region and rapidly falling CAPEX costs, utility-scale solar may be a profitable cornerstone solution to Sub-Saharan Africa’s energy needs. But large-scale solar projects face major execution barriers that cause high pipeline attrition.

>50% OF AFRICA’S UTILITY-SCALE SOLAR PROJECT PIPELINE BY CAPACITY IS IN THE PRE-CONTRACT PHASE8

Top 10 Project Execution Barriers:

- Bundled electricity markets. 71 percent of Sub-Saharan countries still have vertically-integrated utility structures.1 Empirical evidence shows that electricity market liberalization improves operational efficiency, reduces price distortions, and increases energy access rates.2

- Regulatory deficiencies. Regulatory gaps and uneven policy, particularly around unclear purchase obligations for non-dispatchable renewables, hurt project bankability and hold back private capital.3

-

Utility fiscal stress. Chronically undercapitalized utilities have historically been unable to recover their operational and capital costs, running an average quasi-fiscal deficit of USD $0.12/kWh and can run as high as $0.49/kWh. Across the region, total generation capacity utilization rates average a paltry 40%. Most utilities are therefore not creditworthy, introducing major counterparty risk into power offtake contracts, particularly with non-baseload generation.4

-

Transmission and distribution insufficiencies. Weak, poorly maintained, and limited footprint T&D networks keep the number of new grid connections low and thereby cap the rate base, limit grid flexibility, and reduce offtaker bankability.

-

Low overall installed grid capacity. Some national utilities have only a few operational generation assets that total a few hundred MWs, placing a low saturation cap on the market for intermittent renewables. This cap has been reached already with NamPower, the state-owned utility in Namibia.5 Currently, Nigeria and South Africa are the only markets in the region that have the grid capacity to host GW-scale PV markets.

-

Long project lead times. Because of slow-moving regulatory bodies, extensive diligence processes, and difficulties in securing financing, project lead times in Sub-Saharan Africa from conception to commercial operation can easily range from 4-6 years.

-

Limited financing.

The small pool of capital with a risk palette suitable for large-scale project finance in difficult markets mean cost of capital can see high risk premiums far above commercial rates. A limited number of sovereign guarantees are available for PPAs in some markets.

-

Unreasonably low price expectations for new tenders.

While the World Bank Group’s Scaling Solar program attempted to send a clear signal to the industry that African markets are open for business, it has contributed to some unrealistic expectations on what kinds of prices can be expected under different procurement schemes. In Nigeria and Kenya, tariffs have been cut from over US $110/MWh to $75 and $55 per MWh respectively, but these are still far above the record low bids seen in Mexico and Saudi Arabia.6

-

Other emerging market risks. Other issues in African markets that raise risk premiums include political, conflict, legal, contract enforcement, and currency risks.7,8

-

Skills gap. Local component and module manufacturing, engineering, procurement, and construction (EPC) work, and ongoing operations and maintenance require technical training and a skilled labor force not yet present in many markets.

These barriers often make it difficult to attract private capital, so many projects moving forward in the subregion (outside of South Africa) are typically funded in part by public agencies. Private investors are more comfortable with smaller investment ticket sizes; 65 percent of the region’s utility-scale project pipeline projects are between 25-100 MWdc in nameplate capacity.9 In terms of power quality, T&D losses, and distribution efficiency, weaker and lower-voltage grids cannot technically support larger utility-scale projects.

Bottom Line: Utility-scale projects in Africa face some significant barriers to project execution, but tender-based procurement can create a semi-insulated environment for private capital to be deployed (e.g. Enel Green Power’s bid for the 100 MW Metehara project in Ethiopia). Regional power pooling (such as the newly launched West African Power Pool) will help lift national grid saturation constraints and improve project bankability, while unbundling electricity markets can improve operational efficiencies, reduce price distortions, and improve access to energy. Given the steep risks in these markets, public and private capital sources can collaborate (blending, de-risking, guarantees, etc) and co-exist in order to be successful.

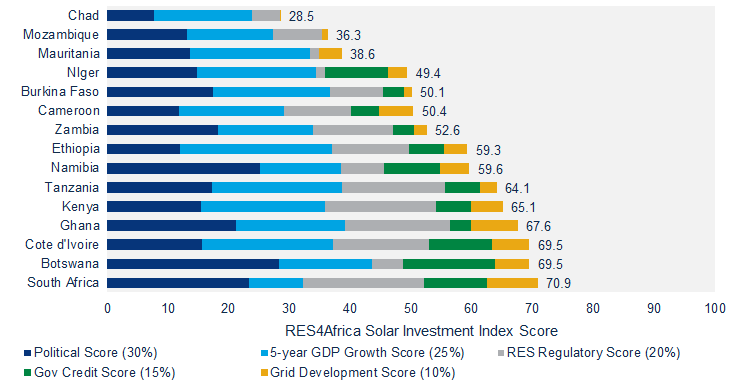

FIGURE 1: Investment Readiness Scores for Utility-Scale Solar in Sub-Saharan Africa10

Endnotes