The US Development Finance Corporation (DFC) works to spur private investment in support of foreign policy and development goals. The DFC opened its doors in January 2020, built on the foundations of the former Overseas Private Investment Corporation (OPIC) and USAID’s Development Credit Authority. Armed with a $60 billion investment cap and new financial tools including equity, hopes are high for DFC’s impact.

DFC, like OPIC before it, is especially important for accelerating energy investments in low-income and emerging markets. Energy is not only essential to job creation and economic growth, but also to reaching global climate goals.

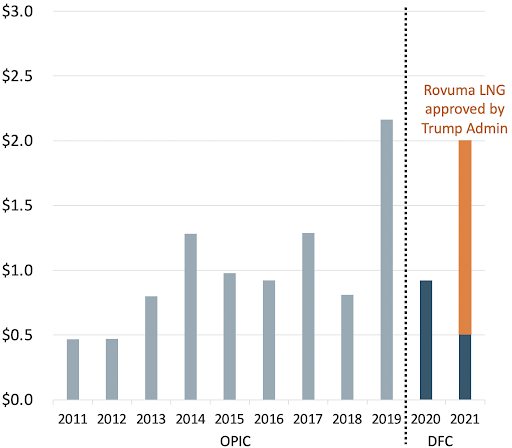

So what can we learn from the DFC’s energy portfolio? In its first two years, DFC has approved ~$3.4 billion for energy supply projects and at least $330M for energy-adjacent projects. Of these, the Biden Administration has approved seven energy supply projects worth about $1 billion (~$500m for 6 projects in FY21 plus $500m for First Solar in FY22 so far).

FIGURE 1: Annual OPIC/DFC exposure to energy supply projects (by FY, US$B)

Source: Author compiled from OPIC/DFC databases; Note: First Solar not included as it was committed in FY2022.

Key takeaways: The DFC is…

- Not yet fully utilizing its expanded capacity in the energy sector. In 2020 the DFC committed just under $1 billion – lower than the annual average spent by OPIC on energy projects between 2011-2019. In 2021, this figure increased to $2 billion, with another $330 million for energy-adjacent projects. However, well over half of this total is part of one large deal, Rovuma LNG in Mozambique. This project is currently on hold due to serious security issues in Cabo Delgado and its future is highly uncertain. Without Rovuma, over its first two years DFC would be committing slightly less than OPIC did on average over the last decade, despite new authorities and greater financing capacity.

- Investing in a wide range of technologies and parts of the value chain. Funding included off-grid and commercial-scale solar, biomass energy production, a natural gas-fired power plant, a gas processing facility, and an investment in the solar supply chain. Energy-adjacent projects included a lighting efficiency and smart city program, as well as loans to institutions that support energy access.

- Providing flexibility for fossil fuel projects in low-income countries (for now). Sierra Leone and Mozambique, both among the world’s poorest nations, received financing for fossil fuel power projects over DFC’s first two years (while the Rovuma megaproject is for export, DFC also approved financing for a related 420MW downstream gas plant to provide power to Mozambicans). In 2021, the Biden Administration approved both a natural gas power plant in Sierra Leone and the expansion of a gas processing plant in Kurdistan, Iraq. These projects originated well before the administration took office, so it’s not yet clear whether they reflect how DFC will approach such projects in the future. But they signal alignment with the Administration’s stated policy to remain open to supporting high-impact carbon-intensive projects in IDA-eligible and vulnerable countries.

- Geographically diversified. The DFC approved investments supporting the development of the private off-grid industry in fairly mature markets (e.g. Kenya, Nigeria, Uganda), critical infrastructure in energy-deficient Sierra Leone, and the diversification of the solar supply chain away from China with its support for solar manufacturing in India. The DFC also used its new equity instrument in Costa Rica and supported an upstream energy project in the Kurdistan region of Iraq. One of the energy-adjacent projects is for security and public lighting in Rio de Janeiro.

Cautious early conclusions: Any analysis of DFC’s energy portfolio must recognize that energy projects are both rare and often large, so year-on-year comparisons provide a limited scope. Considering the first year of an Administration also warrants caution since energy projects have long project development times, so early approvals may not reflect policy shifts or new priorities of the incoming team. Even if the Rovuma LNG project proceeds, DFC energy financing hasn’t yet met expectations given significantly expanded authorities. DFC will need to prioritize cooperation with other agencies and partner DFIs to build out a robust energy project pipeline. We’ll keep watching.

TABLE 1: Energy supply projects approved by DFC in 2021

| PROJECT | HOST COUNTRY | DFC EXPOSURE/TOTAL PROJECT COST (US$m) | DESCRIPTION |

|---|---|---|---|

| Sunfunder Solar Energy Transformation Fund | Jordan | $2.4/ $2.4 | Financing for the construction of solar power plants. |

| Punjab Renewable Energy Systems Private Limited | India | $10/ $13.3 | Guarantee of a loan to finance construction of 7 biomass briquetting plants. |

| Nithio FI BV | Kenya, Nigeria, and Uganda | $10/ $25 | Capitalization to support loans to the off-grid solar industry. |

| GoSolar Energy Efficiency | Costa Rica | $15/ $15 | Debt and equity in a portfolio of small solar projects, and construction of 5MW solar plant. |

| CECA SL Generation Limited | Sierra Leone | $217/ $284 | Loan for an 87MW combined cycle thermal power plant. |

| Pearl Petroleum Company Limited | Iraq | $250/ $625 | Expansion of gas processing facilities in Kurdistan region of Iraq. |

| First Solar | India | $500/ TBD | Construction and operation of a new solar panel manufacturing facility. |

TABLE 2: Energy-adjacent projects approved by DFC in 2021

| PROJECT | HOST COUNTRY | DFC EXPOSURE/TOTAL PROJECT COST (US$m) | DESCRIPTION |

|---|---|---|---|

| 8 Loans to Various Financial Service Firms | Global | $60.7/na | Financing provided to financial services firms and funds, some of which is intended to be used for energy access. |

| Smart RJ Concessionaria | Brazil | $267/$310 | Provision of public lighting services and smart city infrastructure throughout the city of Rio de Janeiro. |