Even a ‘phasedown’, which implies consolidation or reduction in the rate of coal consumption, will transform the country’s labor market and political economy

At COP26, many observers criticized India for driving a supposed ‘last minute’ change to the agreement text from ‘phasing out’ to ‘phasing down’ unabated coal power. For many, this signaled India’s unwillingness to take serious action on climate. But even a ‘phasedown’ of coal will transform India’s economy, political landscape and labor force. It’s important to understand the scope of these impacts in order to help India and other coal-reliant economies meet their net zero goals and manage the associated socioeconomic risks.

The coal industry has deep linkages to India’s socio-political landscape:

Coal dependency in India today mirrors – or even exceeds – that of the UK, Germany, and parts of the US in the early 1900s. The central and eastern coal-bearing regions suffer from the “resource curse”, causing functional, political, and cognitive lock-in. The strong socio-political linkage with the coal economy in these regions is exacerbated by the informal nature of the industry:

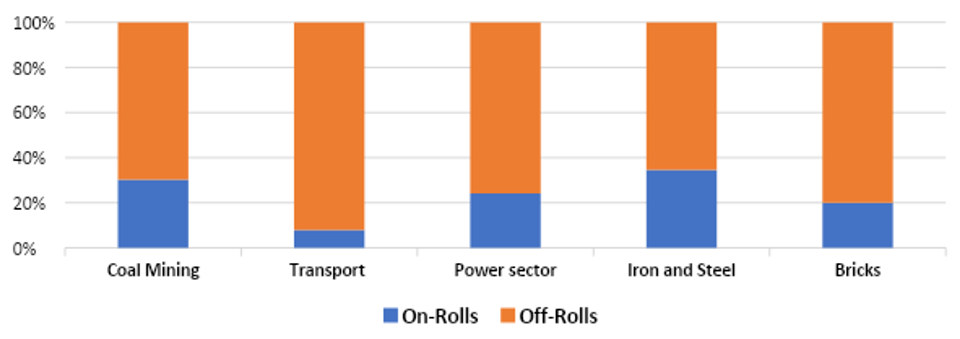

- Official numbers in India understate the population reliant on the coal supply chain: Coal is central to the Indian economy, given its usage across power, sponge iron, steel, cement, and brickmaking. Conservative estimates suggest these sectors employ close to 13 million people, but this likely understates the reality, as more than 70% of jobs in the coal economy go to external contractors and are thus not reported in official coal sector statistics (Fig. 1). In road transport or brickmaking, the share of contractors is as high as 90%. In the coal mining industry and key consuming sectors, the number of contract jobs changes yearly based on production demand. All coal handling (and ash handling in power plants) and transportation activities are outsourced. And there is an informal economy run by local leaders on public land that borders coal mines which enables scavenging of charcoal and low-grade coal. No official estimates exist for the number of workers in this economy, but labor union representatives and local leaders peg it at close to 20 million in just one eastern state (Jharkhand).

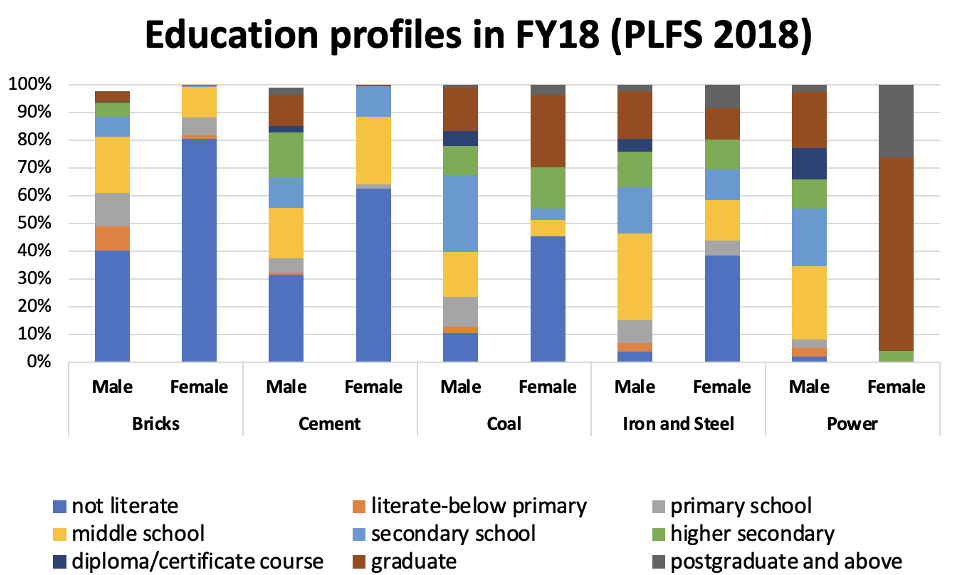

- Poverty and low education levels drive dependency on informal labor markets: The prevalence of the informal economy throughout India has often been attributed to low education and skill levels. The latest national labor survey shows that while 78% of the entire labor force is literate, only 11% hold a university degree (predominantly men in urban areas). This is true in the coal and key consuming industries as well (Fig. 2). Most have not received any formal technical or vocational training.1,2 Formal on-the-job training by companies or unions may not include contract labor and depends on the strength of the union. Women fare worse as many of these jobs are part of the rural economy and socio-cultural practices make it difficult for women to compete alongside men.

- Wages in coal-based industries beat the annual average income: Despite these issues, coal-reliant sectors generally pay higher than average wages. The average monthly household income from agriculture (which employs 42% of the population) is INR 8,337, while part-time wage laborers earn an average of INR 350/day. In comparison, workers in coal-related industries earn almost as much as regular salaried workers in urban India (average monthly income of INR 19,000) and significantly more than salaried employees in rural India (INR 13,000) (Fig. 3). This is despite the fact that, barring coal mining workers, contract labor in other coal-related sectors do not have social security benefits and generally have longer working hours with less pay than formal employees.

A coal ‘phasedown’ coupled with the 2070 net zero target and 2030 ambitions, implies consolidation or reduced growth in coal consumption across key consuming industries.

A phasedown will pose significant challenges for the labor force and key consuming industries, including:

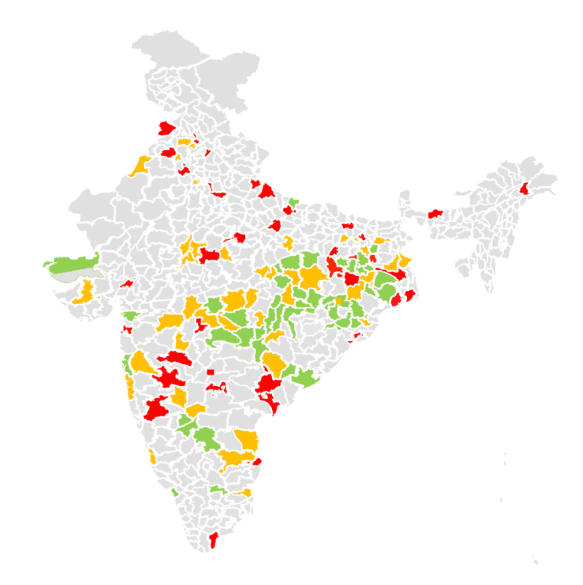

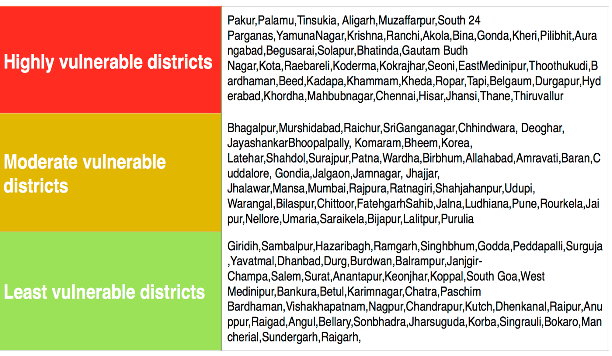

- Re-orientation of industrial strategy. A transition to clean energy for industries necessitates capital investment in technology and supply chains, and financing for reskilling and retraining. This implies consolidation in industries like sponge iron and steel where more than 90% of plants are less than 1 MT in capacity, have thin margins, are family-operated, and may not have the resources to transition. This will also cause mine closures or thermal power plant decommissioning, increasing the scale of local impact. There are currently 135 districts across India with two or more coal-linked assets (Fig. 4).

- Consideration (or lack thereof) for economic diversity. The composition of the labor force is likely to change, particularly if economic regeneration activities do not account for socio-economic differences. The structure of clean energy markets is geared towards the more developed states in western and southern India, with higher urbanization, socio-economic indicators, import dependency, renewable energy resource output, and capital mobilization. By contrast, coal mining industries and jobs are predominantly in the central and eastern regions of India.

- Job mobility and customized transition retraining. It is imperative to establish alternative supply chains in coal-dependent economies – yet, the socio-economic profile of the labor market in coal and allied sectors indicates that not all labor is mobile. Reskilling or retraining programmes will need to be customized to avoid labor being absorbed by the already overburdened agriculture sector (as happened during the COVID-19 pandemic) or other informal industries like construction.

- Jobless growth. In 2018, a World Bank study estimated India would need to create 8 million new jobs every year to sustain current employment levels between 2018-2025. This figure has increased since the start of the Covid 19 pandemic, which pushed about 218 million people, a fifth of the population, back into poverty. Coal-related industries have been major job creators, specifically in regions where other sources of income are sparse.

Thus, contrary to some criticism, a coal phasedown for the Indian economy means both significant progress of the country’s climate goals and serious challenges for the country’s industry and labor force.

FIGURE 1: Share of contract labour across coal and its major consumers

Source: Dsouza S; Singhal K, Socio-economic impacts of coal transition in India: Bottom-up Analysis on coal and its major consumers, National Foundation of India, November 2021.

FIGURE 2: Education profile of workers by gender across all sectors

Source: Dsouza S; Singhal K, Socio-economic impacts of coal transition in India: Bottom-up Analysis on coal and its major consumers, National Foundation of India, November 2021.

TABLE 1: Monthly average wages across coal and key consuming industries by job profiles

| INDUSTRY | WORKERS (INR 0-30K) | SUPERVISORY STAFF (INR 30k-60k) | EXECUTIVE/ MANAGERIAL STAFF (INR >60k) |

|---|---|---|---|

| Iron and Steel | 10946 | 43895 | 88293 |

| Power | 12416 | 40943 | 87143 |

| Bricks | 7969 | 40333 | N/A |

| Coal | 17799 | 41163 | 68300 |

Source: Dsouza S; Singhal K, Socio-economic impacts of coal transition in India: Bottom-up Analysis on coal and its major consumers, National Foundation of India, November 2021 based on PLFS 2021.

FIGURE 4: Mapping closure of coal linked assets in districts in India which have two or more coal linked industries

Source: Dsouza S; Singhal K, Socio-economic impacts of coal transition in India: Bottom-up Analysis on coal and its major consumers, National Foundation of India, November 2021 based on PLFS 2021.

Endnotes

- As defined in the survey, the term technical education means a degree/diploma in medicine, engineering, agriculture etc.

- Vocational training is defined as formal, informal, self-learning or hereditary training.