Tariff reform is often listed as a high-priority issue in Nigeria. In March 2020, the Nigerian Electricity Regulatory Commission (NERC) issued an order to transition from demand-based to cost-reflective and service-reflective tariffs. Consumers are now supposed to pay based on how long they receive electricity daily, divided into groups commensurate with the quality of services offered. After several delays due to COVID-19, this change finally took effect in September 2020.

Nigeria’s new tariff structure intends to deliver:

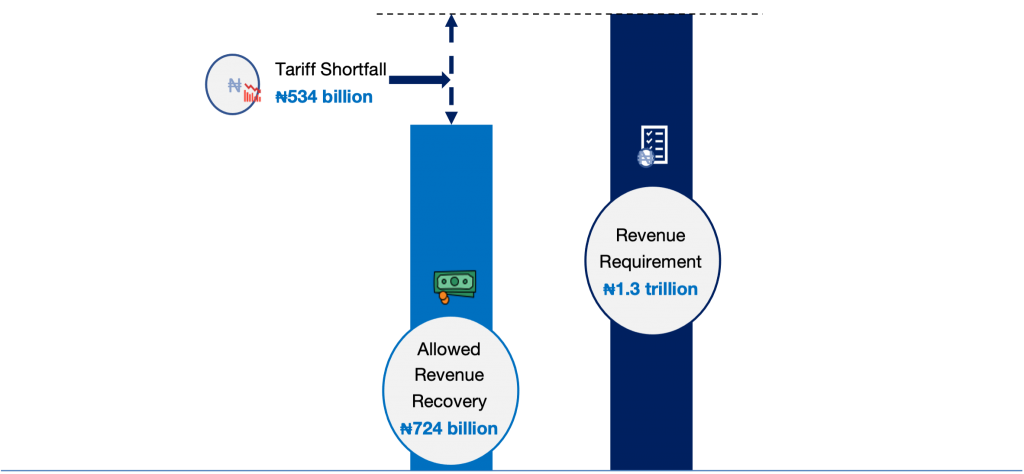

- Financial sustainability. Reduced tariff shortfalls are expected during the transition. In 2020, the Federal Government reportedly spent about ₦380 billion (US$960 million) on electricity subsidies to cover the shortfalls, but aims to reduce this to ₦60 billion in 2021.1

FIGURE 1: Projected Revenue Requirement, Allowed Revenue Recovery and Tariff Shortfall in 2020 (Data was sourced from NERC, 2020).

- Improved service quality. Distribution companies (DisCos) will be assessed on the basis of availability (hours of supply), reliability (frequency and duration of interruptions), and quality (voltage and operating frequency). The re-designed tariffs aim to ensure that consumers who receive fewer than 8 hours of electricity per day do not see tariffs increase until quality improves. The more hours of service provided, the more cost-reflective, meaning DisCos are incentivized to improve service and transition to full cost recovery. DisCos are required to cluster customers with an agreed quality of service and a service-reflective tariff for each tariff band. Any service level agreement will also include compensation to consumers if DisCos fail to meet performance targets.

TABLE 1: The new service-reflective tariff bands (Data sourced from NERC, 2020).

| Sector | Cluster | Product/Process | Major Energy Source |

|---|---|---|---|

| Glass | Firozabad | Glass products | Natural gas |

| Brass | Bhubaneshwar | Utensils | Coke/coal, firewood |

| Brass | Jagadhri | Brass, aluminum | Coke/coal, firewood |

| Brass | Jamnagar | Extrusion, foundry, machining | Coke/coal, firewood |

| Brick | Varanasi | Fired clay bricks | Coal |

| Ceramics & refractories | Morbi | Wall tiles, vitrified tiles, sanitaryware, floor tiles | LNG, coal gasifiers, LPG |

| Ceramics & refractories | East & West Godavari | Refractory bricks, ceramic jars | Coke/coal, firewood |

| Ceramics & refractories | Khurja | Ceramics and potteries | Coke/coal, firewood |

| Chemical | Ahmedabad | Chemicals & dyes | Firewood, coke/coal |

| Chemical | Vapi | Chemicals & dyes | Firewood, coke/coal |

| Dairy | Gujarat | Chilling and pasteurization | Electricity, furnace oil |

| Foundry | Batala, Jalandhar, & Ludhiana | Foundry | Firewood, Coke, Electricity |

| Galvanizing and wire-drawing | Howrah | Galvanizing, wire-drawing | Coal, HSD/LDO |

| Ice-making | Bhimavaram | Ice blocks | Electricity |

| Paper | Muzaffarnagar | Kraft paper | Biomass (various forms) |

| Rice mill | Ganjam | Rice | Rice husk, electricity |

| Rice mill | Vellore | Rice | Rice husk, electricity |

| Rice mill | Warangal | Raw rice | Rice husk, electricity |

| Sponge iron | Orissa | Sponge iron | Coke/coal, electricity |

| Tea | Jorhat | Coal and NG-based | Coal and natural gas |

| Textiles | Solapur | Towels and blankets | Coke/coal, lignite, natural gas, electricity |

| Textiles | Surat | Sarees and dress materials | Coke/coal, lignite, natural gas, electricity |

| Textiles | Tirupur | Compacting, dyeing, knitting | Coke/coal, lignite, natural gas, electricity |

Though some challenges remain:

- The metering gap. Only 38% of Nigeria’s 10 million active electricity consumers have meters to measure actual consumption and quality. The other 62% have been billed on estimations, although they will now receive capped bills to encourage DisCos to install more meters and reduce the risk to consumers of over-billing. NERC is discussing, with DisCos and meter providers, revisions to regulations and service level agreements to reduce the burden of over-estimated capped bills on consumers through more metering. The COVID-19 pandemic has however stalled the metering scheme and impacted the availability of imported components for local assembly of meters.

- The need for stronger transmission and distribution (T&D) infrastructure. Crumbling T&D infrastructure is a perennial issue in Nigeria. Constant faults and outages degrade supply quality and in turn dramatically lower revenues and customer confidence. The Transmission Company of Nigeria (TCN) has been directed to resolve bottlenecks at T&D interfaces, including frequent faults at the 132/33kV substations. DisCos are required to provide smart meters to their 11kV and 33kV feeders to send real-time data to the TCN for monitoring purposes. New tariff-quality linkages aim to provide a push to these measures.

- The COVID-19 pandemic. Nigeria is in recession, while government steps to alleviate the economic impact of the pandemic are further stressing the power sector. The financial strain of COVID-19 has impacted the purchasing power of consumers and decreased electricity demand across the economy. DisCos and other operators in the electricity supply value chain are also feeling the effects of inflation and exchange rate volatility. While service-reflective tariffs are a step in the right direction, the broader macroeconomic crisis will create major headwinds for the sector for the foreseeable future.

Endnotes

- Isaac Anyaogu, Service-reflective tariff for power sector begins July 1. Here’s what it means, Business Day, June 24, 2020.