A previous version of this article erroneously referred to “On-Grid” projects in Figure 1, when it should have referred to All Generation projects.

Relevance: At the G7 summit in June, the US and its allies prioritized the growing energy and climate crises, announcing a $600bn initiative for emerging markets infrastructure. The Development Finance Corporation (DFC) is supposed to be the USG’s primary tool for responding to China’s global infrastructure funding and accelerating the clean energy transition – but its actual commitments to utility-scale clean energy pale in comparison to the scale of the challenge, especially in Africa. The US will not be credible on either energy security or climate change without decisively shifting to a more proactive approach and giving DFC the tools it needs to build its own project pipeline.

What’s happening: In September 2022, the DFC announced a $25 million loan for a 20MW solar + storage plant in Malawi. This is the first utility-scale, clean energy project that the DFC has supported in Africa in two years – and the only one approved under the Biden administration.

The BUILD Act that created DFC provided the agency with new authorities and more than doubled its financing capacity, with clear expectations that energy would play a big part in a significantly expanded portfolio. Yet in both FY2021 and FY2022, DFC has approved less than $600m in new utility-scale energy supply projects globally; energy projects in Africa received $267m in 2021 and just $25m in 2022.

Even including all energy-adjacent and off-grid projects, DFC’s investment over the last two years is far less than the average of about $1bn approved each year (2011-2019) by its smaller (and less nimble) predecessor OPIC. What’s going on here?

1. The pipeline of investment-ready energy projects in Africa has collapsed

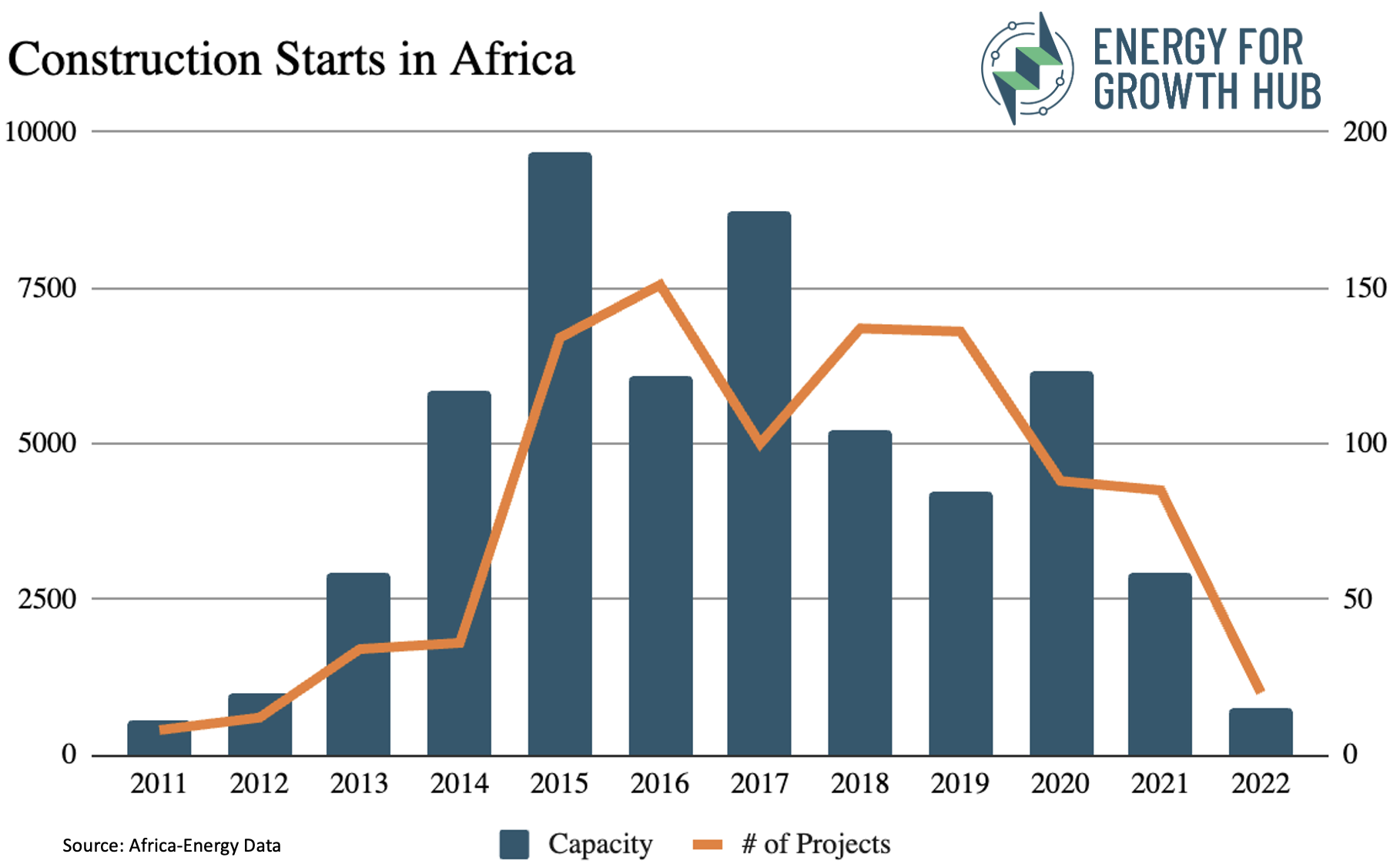

The DFC is designed to mobilize private capital for investment-ready projects looking for financing. The problem in Africa is, there just aren’t very many of them. This isn’t just a DFC issue: Africa is on track to begin construction on less than one-third of the net generation capacity in 2022 as it was in 2021. And 2021 was already a down year – less than half of what started in 2020.

The dual shocks of the pandemic and the Russian invasion of Ukraine have disrupted supply chains, hurt demand, and driven up the cost of capital – all creating massive headwinds for investments of all kinds in emerging economies, but particularly for clean energy (read here for more detail).

FIGURE 1

2. Chronic market gaps are holding back utility-scale projects

- The enabling infrastructure needed to allow large-scale additions of renewable energy is lacking. Many countries still lack the grid infrastructure needed to manage major increases in wind and solar power or distribute the power to paying customers. As a result, renewable projects tend to be small. The average size of DFC-supported solar plants in Africa is just 36 MW.

- Recent overbuilds have outstripped short-term demand. In some countries, including several in East Africa, electricity supply currently exceeds demand – reflecting the need to increase economic activity before adding new generation.

- Investment-ready deals are heavily concentrated in very few markets. In comparatively mature markets like South Africa and Kenya, the private sector has more experience, power systems are more diversified, and local finance ecosystems are relatively robust. Between 2013-2020, DFC/OPIC supported renewable energy generation projects in just 14 of 49 sub-Saharan countries.

- Investment risk is high – and getting worse. Nearly all African utilities (usually the primary power offtakers) are in deep financial trouble. Even with generous subsidies, most fail to cover their costs – driving up risk and shrinking the pool of investors interested in African energy. Some pandemic responses, like halts on customer payments, have deepened their financial hole. And high sovereign debt levels reduce the options for guarantees.

3. DFC doesn’t yet have the tools it needs to builds its own project pipeline

DFC was designed to be able to respond to these types of market challenges, but still lacks what it needs in practice. The BUILD Act was predicated on the bipartisan recognition that DFC’s predecessor agency (the Overseas Private Investment Corporation or OPIC) needed expanded tools and resources if it was going to strengthen US competitiveness and play a meaningful role in global infrastructure finance.

Among other things, the Act gave DFC a new technical assistance fund to support early-stage project development, so that it wouldn’t be forced to wait solely for late-stage projects. But that fund is far too small, and (to date) underutilized for energy projects. And while peer organizations like the World Bank’s International Finance Corporation (IFC) operate with hundreds of business development staff, DFC staffing remains around 400 people in total – almost entirely based in DC, about the same as it was under OPIC, despite expanded authorities and a larger, more ambitious mandate. As a result, DFC is still largely reactive and dependent on finding late-state, investment-ready projects in challenging markets.

What can the Administration (and Congress) do about it?

The USG needs a far more proactive agenda that intervenes earlier in the project pipeline, invests in complementary enabling infrastructure, and harnesses simple transparency to change how power is procured. Three ideas for DFC:

- Provide a larger technical assistance fund to allow investment in feasibility studies, project preparation, and other upstream activities to bring more projects to application stage. Beyond DFC, scale up USG resources devoted to tackling chronic energy sector risks via USAID, USTDA, MCC and others.

- Expand project-development staff, including more based overseas, who can dedicate time and attention to identifying early-stage opportunities and work directly with the US Trade and Development Agency (USTDA) to understand that agency’s pipeline of early-stage projects, align priorities, and ensure that a greater share of USTDA-supported projects are primed for later-stage DFC investment.

- Fix DFC’s equity scoring problem to allow it to invest directly in earlier-stage projects, companies, and venture capital funds targeting emerging market clean tech. Equity was a core feature of the BUILD Act, but the interpretation of current budget rules are preventing it from being used as Congress intended.

TABLE 1: DFC energy supply projects approved, Oct 2020 – Sept 2022

| PROJECT | HOST COUNTRY/TECHNOLOGY | DFC EXPOSURE/TOTAL PROJECT COST ($m) | DESCRIPTION |

|---|---|---|---|

| FY2021 APPROVALS | (Oct 2020 – Sept 2021) | – | – |

| Sunfunder Solar Energy Transformation Fund | Jordan/Solar | $2.4/ $2.4 | Financing for the construction of solar power plants. |

| Punjab Renewable Energy Systems Private Ltd | India/Biomass | $10/ $13.3 | Loan guarantee for 7 biomass briquetting plants. |

| GoSolar Energy Efficiency | Costa Rica/Solar | $15/ $15 | Debt & equity in a portfolio of small solar projects + construction of a 5 MW solar plant. |

| CECA SL Generation | Sierra Leone/Natural Gas | $217 (2021 finance) / $50 (2022 insurance) | Loan & insurance for an 87 MW combined cycle thermal plant. |

| Pearl Petroleum Company Limited | Iraq/Natural Gas | $250/ $625 | Expansion of gas processing facilities in Kurdistan region. |

| FY2022 APPROVALS | (Oct 2021 – Sept 2022) | – | – |

| FS India Solar Ventures Private Limited | India/Solar | $500/ $720 | Construction & operation of a new solar panel manufacturing facility. |

| Orb Energy II | India/Solar | $20/ $30.8 | Financing for SME solar installations. |

| Golomoti Solar project | Malawi/Solar | $25/Unknown | Support for solar + storage facility opened in 2022. |

Note: Table includes all projects in the DFC database plus those cited in recent board announcements, such as September 2022. We exclude insurance renewals for already-approved projects or refinancing of existing projects.

TABLE 2: DFC off-grid or energy-adjacent projects approved, Oct 2020 – Sept 2022

| PROJECT | HOST COUNTRY/TECHNOLOGY | DFC EXPOSURE/TOTAL PROJECT COST ($m) | DESCRIPTION |

|---|---|---|---|

| 14 Loans to Various Financial Service Firms | Global | $193.2/na | Financing provided to firms and funds, some of which is intended for energy access. |

| Smart RJ Concessionaria | Brazil | $267/$310 | Provision of public lighting services and smart city infrastructure throughout the city of Rio de Janeiro. |

| Taiba Wind Farm Expansion | Senegal/Wind | Technical Development: $0.6/ $1.2 | Partial funding for feasibility studies to expand a previous wind project. |

| Evergreen Viento Tamil Nadu Windfarm | India/Wind | Technical Development: $0.6/ $1.2 | Partial funding for TA and feasibility studies for a 150 MW wind farm. |