In energy markets, generation assets get all the attention, and the transmission of that electricity to productive loads that will consume it is unsexy and often overlooked — but is a critical bottleneck to Africa’s high-energy future.

Interconnected grids can unlock a clean energy future

Physical and regulatory interconnectedness is one of the keys to improving the fiscal and operational performance of power systems. Greater interconnection can:

- Create economies of scale in power generation and therefore lower the average cost of supply.

- Improve reliability. Larger, more interconnected transmission networks allow supply in one area to meet load in another and gives system operators the margin they need to balance the grid in aggregate where local capacity shortages may exist. This is especially and increasingly true as variable renewables comprise a larger and larger share of the generation mix.

In Africa, this interconnectedness is partially achieved through Africa’s five power pools, and partially through building and improving domestic and cross-border transmission connections. Even in areas where grid access is far from universal, transmission investment comprises a relatively small and neglected share of the electricity value chain. Investment in transmission must keep proportional pace with investment in generation in order to protect the bankability of generation assets and protect the network’s reserve margin.

Africa’s transmission sector has been chronically underfunded

Historically, private power sector investment in Africa has focused largely on generation (primarily through independent power producer business models), and to some extent on distribution (through public-private partnerships, concessions, and management contracts). However, medium and high-voltage transmission (typically defined as AC lines 100kV or above) is urgently and chronically underfunded.

0.021%

The Amount of Private Sector-Participating Investment That Went Into The African transmission Sector

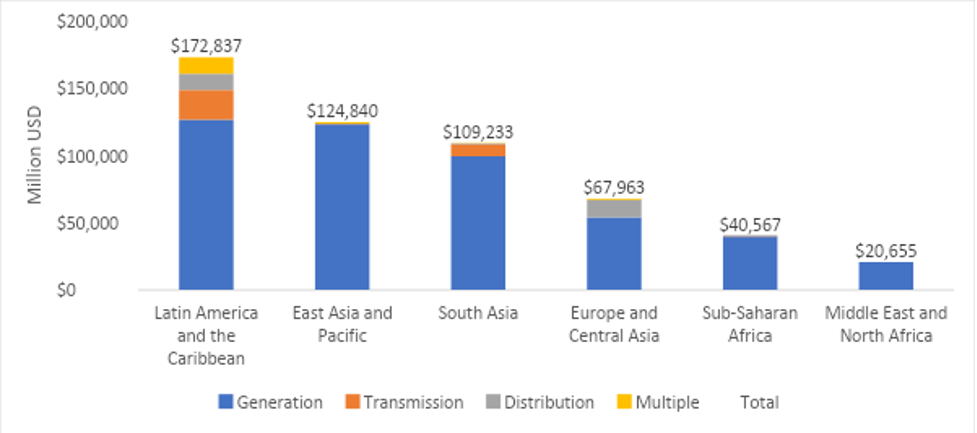

- The World Bank Group’s Private Participation in Infrastructure database tracks infrastructure investment contracts that reach financial close in low and middle income countries that have at least one private counterparty assuming operating risks. Within the scope of the database, from 2010-2020, only 7.5% of electricity infrastructure investment was targeted at sub-Saharan Africa, 98.2% of which funded electricity generation projects, and less than 0.3% of which funded transmission projects. This means the electricity transmission sector in sub-Saharan Africa comprised 0.021% of total electricity infrastructure deals with private participation in the last decade, and private capital’s share of total investment was even less.

FIGURE 1: Contract Value for Electricity Infrastructure Investments with private participation (Million USD)

Source: World Bank Private Participation in Infrastructure Database, 2020

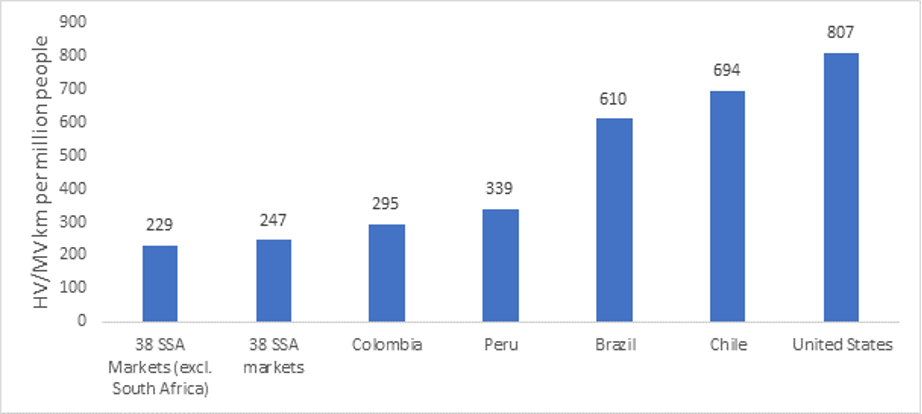

- Existing transmission infrastructure in the region is also limited. A 2017 World Bank Group study found that 38 countries in sub-Saharan Africa had only 112,196 km of transmission lines 100kV and above, which is one of the lowest per capita rates of any region included in the study at 247 km per million people.

FIGURE 2: km of transmission infrastructure per million people

Source: World Bank Group, Linking Up

- The annual investment requirements for transmission projects in Africa from 2015 to 2040 is estimated to be between $3.2 billion and $4.3 billion USD per year, compared to between $10.6 billion and $14.2 billion per year for distribution and between $33.4 billion and $63 billion per year for the whole power sector, though the region has only spent 19%-36% of annual power sector investment requirements over the past decade.

While the investment gap in transmission in sub-Saharan Africa is staggeringly low, it is not entirely surprising. Plenty of public and private capital is generally quite available for generation projects, particularly renewables, because of investor comfort with revenue models, contract protections like take-or-pay arrangements and sovereign guarantees, and less legal difficulty surrounding land use — in addition to the bankable returns. Alternatively, building transmission infrastructure, especially in rural areas, typically comes with low, infrastructure-grade margins and has historically been limited to public and state entity ownership.

Why it’s time for private investment in transmission in sub-Saharan Africa:

- Most of the region’s ‘zombie’ utilities are fiscally and operationally constrained and cannot invest in new infrastructure – even in projects where good returns can be expected. Mainly because very few state-owned utilities in the region charge cost-reflective tariffs, infrastructure maintenance and system upgrades cannot be rate-based. Rather, these debts are limited by macro-level government borrowing controls, and pandemic relief packages have consumed most of the headroom in public budgets.

- Business models for private investment in transmission are proving out. The World Bank identified four primary business models to facilitate private investment in transmission that have been successful in other geographies – read more about these models here.

- Several key public investment initiatives to crowd-in, de-risk, and catalyze private investment in transmission in sub-Saharan Africa have advanced in recent years:

- The New Deal on Energy for Africa (African Development Bank): Originally launched in 2015, the AfDB-led partnership set a goal to catalyze investment in enough transmission and distribution to add 130 million new grid connections by 2025, in addition to targets for on grid and off grid power generation and access to clean cooking. Last year, Dr. Kevin Kariuki of the AfDB reported that to date the NDEA invested in 6,700 km of transmission lines, 3,200 km of which are for cross-border interconnections.

- Power Africa (USAID): Power Africa is a US government-led partnership launched in 2013 by the Obama Administration aiming to double access to electricity in sub-Saharan Africa by 2030. As of 2020, the partnership has facilitated 2,300 km of transmission projects across the continent to reach financial close and has identified ten key transmission projects to better balance regional supply and demand.

- Desert to Power Initiative (African Development Bank): The Desert to Power Initiative, which just received $150 million in investment from the Green Climate Fund (GCF), aims to deploy 10 GW of on-grid and off-grid solar as well as associated transmission grid, storage, and financial de-risking instruments in the Sahel to electrify 250 million people by 2030, with the particular aim of supporting the efforts to build out the West African Power Pool infrastructure.

- Gridworks Partners (CDC Group): Gridworks Partners is a development and investment platform targeting transmission, distribution, and off-grid electricity in Africa launched in 2019 with a commitment of $325 million of long-term capital from CDC Group. The platform has not yet invested in any MV/HV transmission projects, though it is squarely in the group’s mandate. The new platform has invested in minigrids and distribution networks in the Democratic Republic of the Congo and distributed solar developers across East and Southern Africa.

Final considerations and key takeaways:

- The rate of technical and commercial line losses on the existing network will be a key bankability risk indicator for private transmission investors. Sub-Saharan African power lines lose $5 billion worth of power per year according to a report from the Ghana Institute of Management and Public Administration, and line losses in most regional power markets are typically between 10 and 20 percent.

- Most T&D concessions in the region have been awarded in conjunction with broader unbundling efforts. But a push towards privatization of a state-owned industry may raise justified red flags locally. Policymakers may rightly be reluctant to invite foreign investment and control over their nation’s critical infrastructure.

A reliable, high-capacity transmission network is the backbone of a resilient, flexible, profitable and low-carbon regional power system. Sector unbundling, public sector de-risking instruments, and implementation of privatization business models are the chiropractor to straighten them out.