Originally appeared in the Council on Foreign Relations, April 22, 2022.

Russia’s assault on Ukraine has roiled global energy markets and turned the climate policy conversation upside down. To date, most of the attention has focused on European energy security and how the crisis might shape (for good and bad) that region’s decarbonization plans. But the energy sector impacts of this war will reverberate across every corner of the globe. Here are seven ways it could impact Africa’s energy transition.

1. African leaders will increasingly frame energy poverty as an energy security issue deserving the same urgency.

In Europe, disrupted gas exports from Russia, the world’s second-largest producer, threaten economic activity and the ability of people to heat their homes. This threat to energy security has kicked off a flurry of responses, including U.S. efforts to help expand and diversify the region’s liquefied natural gas (LNG) supply. The intensity of the U.S. and European response is well justified: no family deserves to go without heat or electricity. When populations who generally take energy security for granted suddenly find it threatened, they will stop at nothing to protect it. But what about populations who have never had the privilege of energy security? Chronic energy poverty—widespread and worsening across Africa and parts of Asia—is, if nothing else, the most extreme form of energy insecurity. African leaders will rightly argue that this crisis should be tackled with the same degree of urgency and resources.

2. The rush to boost LNG supply to Europe (and sudden shifts in U.S. and European rhetoric) will stoke further African frustration with climate hypocrisy—unless development finance follows through.

Even before the invasion of Ukraine, African leaders had repeatedly voiced deep frustration with lack of support for their energy transitions, including a chronic lack of climate finance and what they see as hypocritical Western restrictions on the use of development funds for natural gas infrastructure in energy-poor countries (see, for example, the president of Malawi, the president of Uganda, and the vice-president of Nigeria). While the United States and others have crafted policies that do include exceptions, the intended flexibility is not yet clear or demonstrated in practice.

Given such restrictions, the U.S. and European rush to secure natural gas supply in the wake of Russia’s invasion has highlighted disparities in both policy and rhetoric. While officials have stressed (and in some cases intensified) their focus on eventual decarbonization, they have also acted with urgency to secure what Europe says it needs in the interim. In contrast, when Africans have articulated their own need for a mix of transitional energy resources (including gas), they have been met with hesitation, denial, and a decided lack of urgency. This is not a productive way to build lasting climate partnerships. U.S. Climate Envoy John Kerry—who previously had been among the most vigorous in calling for an end to overseas gas finance—recently said that “gas is going to be a key component of the [energy] transition, there’s no question about it,” including in Africa. Kerry’s explicit reference to the need for gas in Africa is an important shift in rhetoric if not in policy. But nuanced statements like these will only intensify perceptions of hypocrisy—unless development partners follow through by putting real resources on the table for energy transitions that simultaneously meet urgent needs and accelerate the global path to net-zero. In practice, this requires dramatically scaling up support for clean energy markets and developing clear and consistent ways to evaluate projects that allow development finance to support downstream gas where it’s needed.

3. Rising oil and gas prices will hurt African electricity markets…

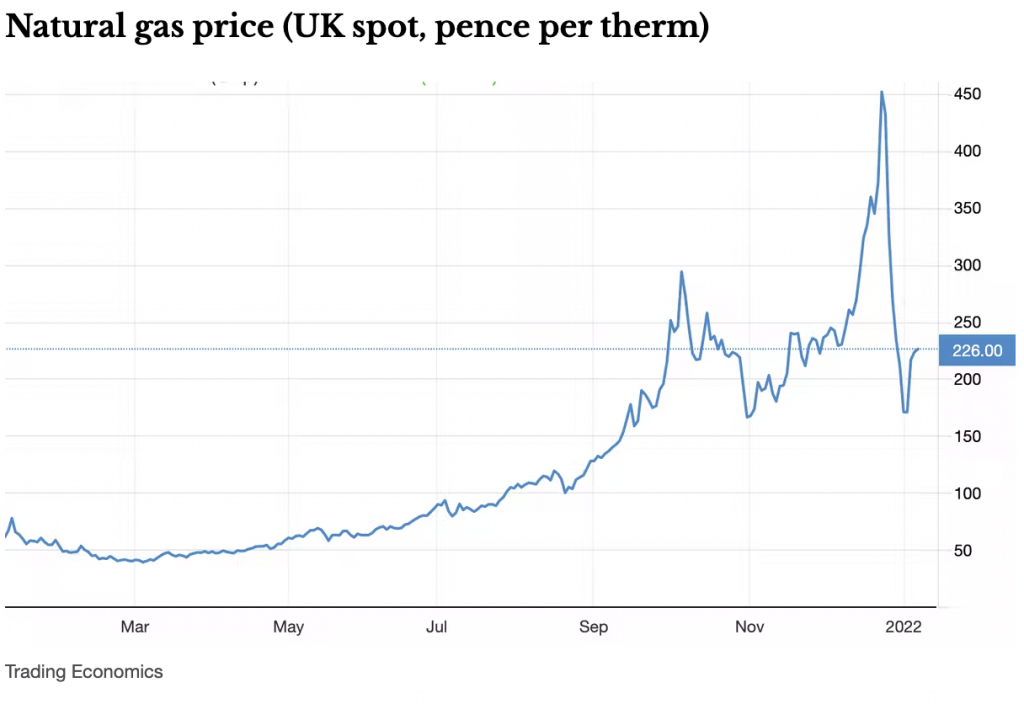

Africa does not import Russian oil, but, like the rest of the world, is facing steep price increases. In the United States, this has mostly meant more expensive gasoline, but in many African countries, the price of oil also has enormous impacts on electricity generation. In West Africa, diesel generators account for more than 40 percent of total electricity consumed; Senegal currently relies on oil for half its electricity generation. This has enormous economic impacts: as fuel prices soar across the continent, businesses in countries like Nigeria—which has seen the cost of diesel increase by more than 200 percent—are struggling to stay afloat. The rising cost of natural gas also makes utility-scale electricity generation much more expensive in markets like Ghana, Côte d’Ivoire, and Nigeria.

Africa does not import Russian oil, but, like the rest of the world, is facing steep price increases. In the United States, this has mostly meant more expensive gasoline, but in many African countries, the price of oil also has enormous impacts on electricity generation. In West Africa, diesel generators account for more than 40 percent of total electricity consumed; Senegal currently relies on oil for half its electricity generation. This has enormous economic impacts: as fuel prices soar across the continent, businesses in countries like Nigeria—which has seen the cost of diesel increase by more than 200 percent—are struggling to stay afloat. The rising cost of natural gas also makes utility-scale electricity generation much more expensive in markets like Ghana, Côte d’Ivoire, and Nigeria.

Source: The Conversation.

4. …But rising interest rates will also create headwinds for renewable projects.

Higher prices for fossil fuels should be a boon for renewables, but adverse market conditions and rising interest rates will hit them hard too—particularly in lower-income, higher-risk markets. Solar, wind, and battery storage are all heavily weighted toward upfront capital expenditures, which means the cost is driven in large part by interest rates (or higher expected returns by private investors). Electricity from a similar solar farm would already cost far more in, say, Ghana than in the United States, because of this risk premium. That gap will widen further with rising interest rates (Ghana’s central bank recently raised its benchmark to 17 percent; the comparable U.S. prime rate is 3.5 percent). This substantial premium adds about 1.5 cents per kilowatt-hour to power from a combined-cycle gas plant, but more than 8 cents to solar PV (and nearly 11 cents to solar PV with storage). Loan guarantees and other de-risking tools will thus become even more essential for clean energy deployment.

5. The need to diversify away from Russia will reinvigorate interest in African oil and gas production for export.

Europe’s urgent need to diversify away from reliance on Russian oil and gas could present new opportunities for some African export markets. A European Commission official confirmed meetings in Brussels with African energy delegations, noting the region’s efforts to secure alternative gas supplies, including from West and North Africa. The Algerian government recently resurrected the proposed Trans-Saharan gas pipeline, which could send up to 30 billion cubic meters a year from Nigeria to Algeria, and then on to Europe. Countries that recently discovered sizable offshore gas, including Mozambique, Tanzania, and Senegal, could see renewed investor interest. The Nigerian vice-president recently confirmed that since the outbreak of the war in Ukraine, his country has been approached to potentially export more gas.

6. As the urgency behind decarbonization intensifies, demand for critical minerals will spur investment in African mining.

Russia holds the world’s fourth-largest supply of rare earth elements and is a major producer of many of the minerals most critical for clean energy technology—including copper, nickel, and platinum. Diversifying global supply chains away from Russia (and China) is already encouraging the United States and others to invest in African mining. The U.S. International Development Finance Corporation (DFC) is considering an investment in Namibia’s lithium mining industry, and President Biden’s proposed FY 2023 budget includes $1 billion for a Global Clean Energy Manufacturing initiative to build more resilient supply chains around the world.

7. Russian actions (and Western financial sanctions) could give countries pause about betting on Russian nuclear technology.

Over the past decade, Russia has made selling nuclear technology part of its broader effort to gain influence in Africa. As of 2020, at least seven states in sub-Saharan Africa had signed agreements to deploy nuclear power with support from Russia—and the state-owned Russian nuclear company Rosatom confirmed it was working with more than fifteen sub-Saharan African markets in all, including on their next generation small modular reactors (SMRs). Russian SMRs likely come with low-cost, state-backed financing and long-term fuel supply and waste disposal agreements. These were considered positive features before the Ukraine war; today they should be a source of concern. Shifting geopolitics also creates an opportunity for advanced nuclear firms in the United States, Britain, and South Korea who have promising models nearing commercialization but lack Rosatom’s aggressive marketing and generous government support. African markets could become a focus.

The current energy crisis underlines in starkest terms the many reasons global decarbonization is crucial—not only to address climate change, but to bolster peace and security. But it also showcases how complicated the energy transition will be and the inevitable tensions between urgent needs and long-term goals. Achieving a global zero-carbon energy system capable of meeting everyone’s needs will require treating energy poverty as the crisis it is, abolishing double standards in development finance, and managing the new geopolitical vulnerabilities created by the shift to a low-carbon economy.